Ethereum price witnesses a 24-hour drop of up to 5.78%, as its Relative Strength Index (RSI) hits lowest level since August 2023, suggesting oversold conditions.

Market veteran Michael van de Poppe, disclosed this in a recent report. This sharp decline indicates significant bearish momentum, suggesting Ethereum might be oversold. Furthermore, altcoins have reached their lowest RSI levels, either historically or for this cycle, indicating a widespread market capitulation.

#Ethereum reaches the lowest RSI (Daily) since the collapse in August '23.#Altcoins have reached their lowest RSI (Daily) ever or of this cycle.

Clear capitulation. pic.twitter.com/9eehaITkQI

— Michaël van de Poppe (@CryptoMichNL) July 5, 2024

Potential Downward Targets for Ethereum Price

Ethereum price currently hovers around $2,956, marking a 5.78% decline over the past 24 hours. Key resistance is identified between $3,800 and $4,200, where Ethereum struggled to break through, leading to its recent decline. The price now faces crucial support at $2,480. A breach below this level could trigger further declines towards $2,145.

Despite the decline, trading volume remains stable, indicating the absence of panic selling. This stability suggests that while the market sentiment is bearish, a potential rebound or consolidation phase could be on the horizon.

Price Impact on Holder Profitability

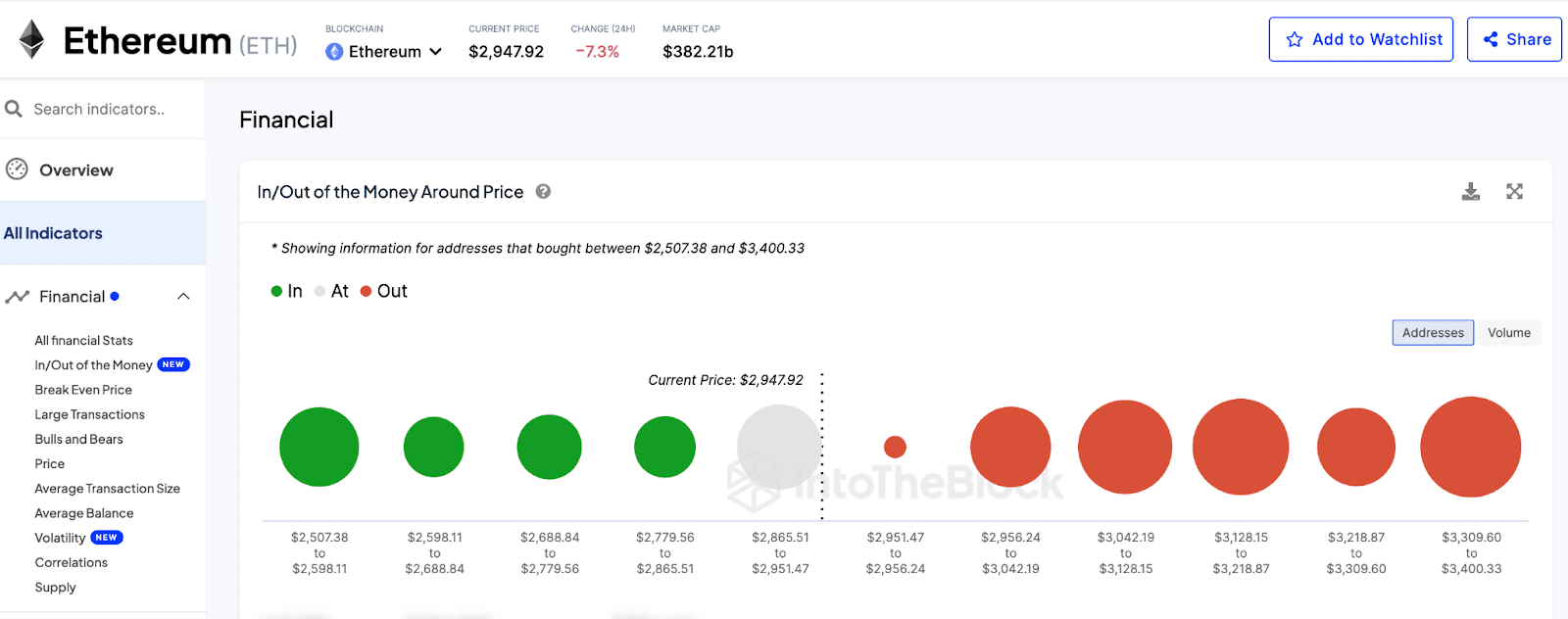

Analyzing Ethereum addresses, varying positions are seen based on the current price of $2,956. Notably, a significant number of addresses are “Out of the Money,” having purchased ETH at prices ranging from $2,951.47 to $3,400.33, thus currently incurring losses.

Market Sentiment and Investment Flows

Meanwhile, a previous report from CoinShares highlighted continued outflow from crypto investment products, totaling $30 million over the past three weeks, according to The Crypto Basic.

Ethereum alone saw an outflow of $61 million. Despite this, Bitcoin-related exchange-traded products (ETPs) experienced an inflow of $10 million, bringing the total assets across all Bitcoin ETPs to $67.57 billion.

Interestingly, other digital assets also saw positive net inflows. Multi-asset ETPs attracted $18 million, while Solana, Litecoin, Chainlink, and XRP recorded inflows of $1.6 million, $1.4 million, $600,000, and $300,000 respectively. Ethereum’s unique outflow data suggests increased bearish sentiments surrounding the asset.

Disclaimer: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic’s opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

-Advertisement-