Litecoin price fell 8% within the weekly timeframe, reaching its lowest of $75.7 on Tuesday June 11, but recent trends observed among whale investors could spark an early rebound phase.

Litecoin price holds $75 Support Amid Intense Crypto Market Volatility

The crypto market has witnessed significant turbulence this week, amid hawkish macro economic indices reported by US authorities. But notably, Proof of Work (PoW) projects like Litecoin (LTC) and Bitcoin (BTC) have shown greater resilience this week, while the likes of Solana (SOL), and Ethereum (ETH) are battling double-digit losses.

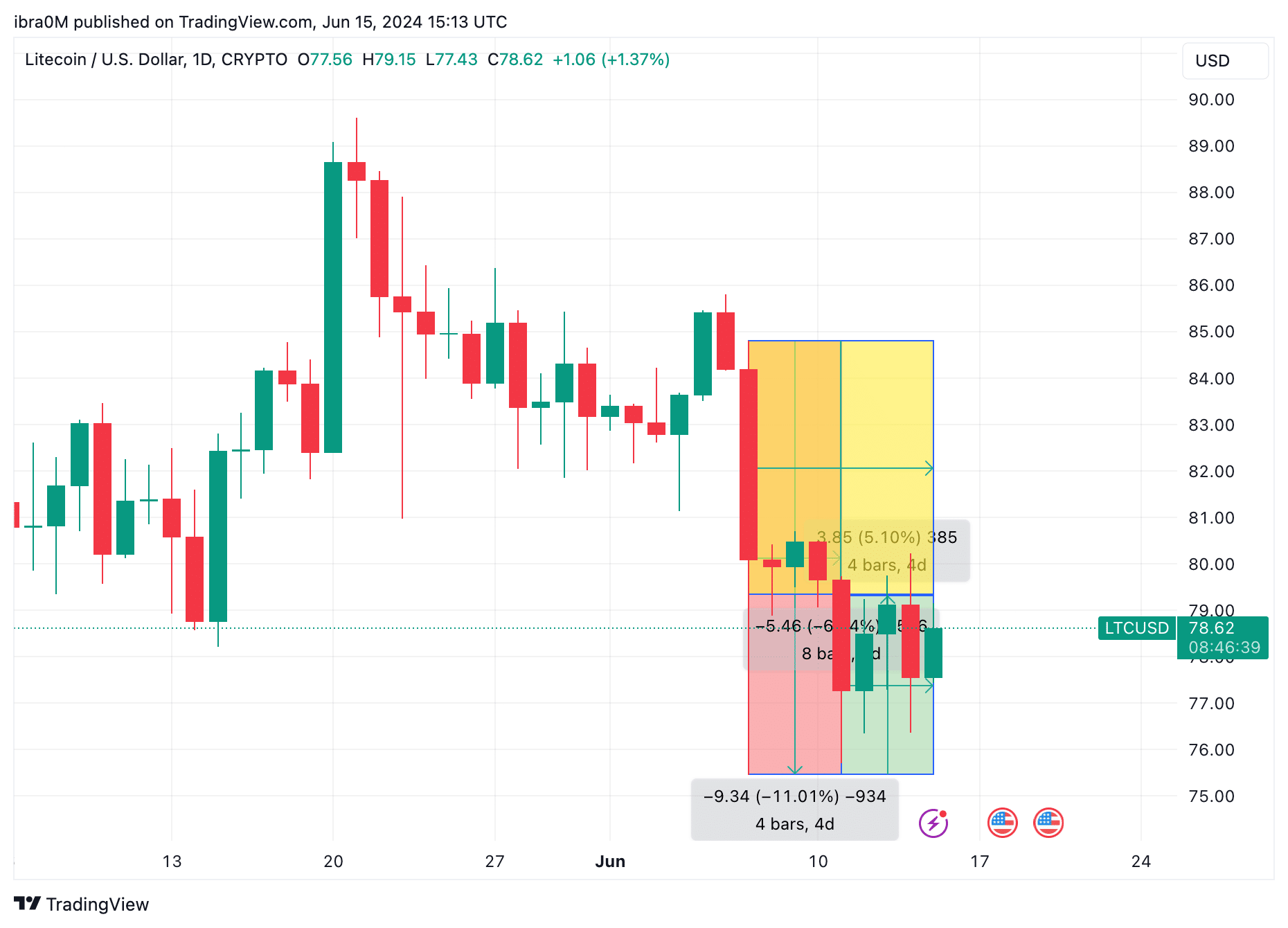

Looking at the weekly price chart, LTC price had plunged into an 11% downswing by Tuesday June 11. But since then, bull traders have regained foothold, reversing more than half of those loses, by the end of trading on Friday, June 14.

At the time of writing on June 15, Litecoin is exchanging hands around $78.9, reflecting a 5.10% increase within the last 3 days which have been riddled with several bearish macro market catalysts.

Whale Investors Pushing for LTC Rebound Against all Odds

Over the last 3-days, the US Federal Reserve opted to hold interest rates unchanged, after the Bureau of Labor statistics published CPI reports showing slowing inflation. This event has triggered negative reaction among crypto investors. But despite these strong bearish headwinds, LTC price has managed to advance from the $75 resistance.

On-chain data analysis identifies Litecoin whale investors as the main drivers behind this resilient LTC price performance amid the intense market volatility.

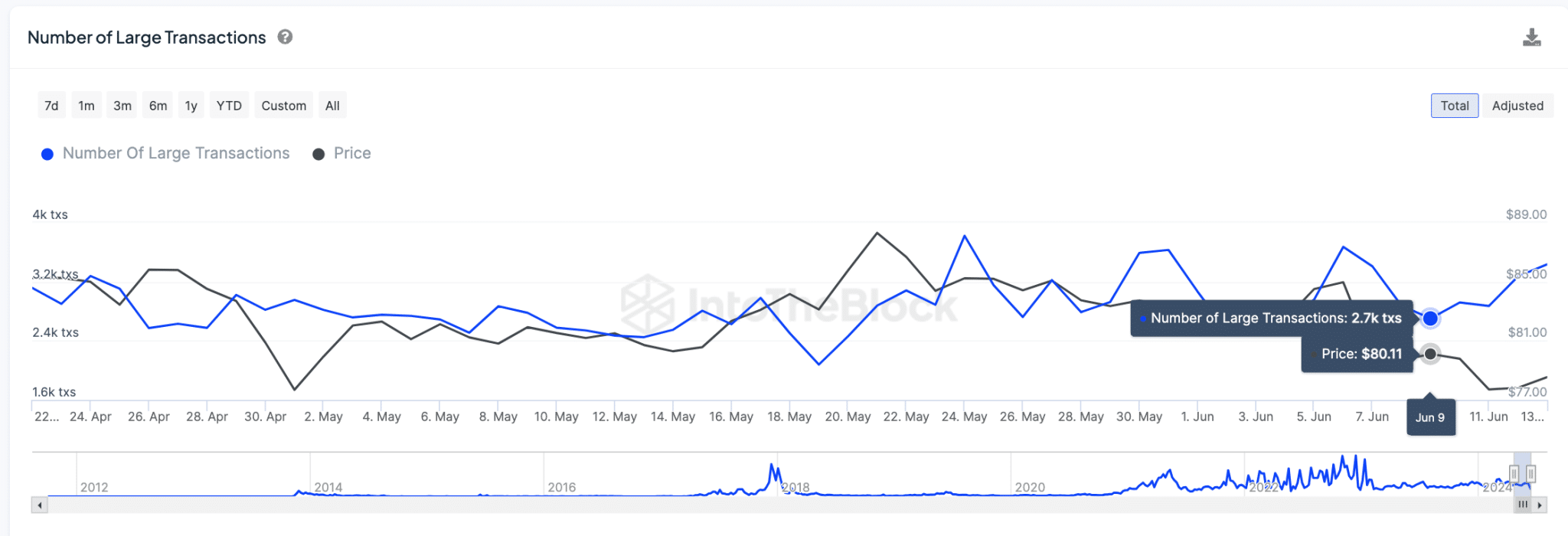

IntoTheBlock’s Large Transactions chart below tracks whale investors’ activity by counting daily number of transactions that exceed $100,000 in nominal value.

The spate of whale activity on the litecoin network has increased considerably over the past week. The chart above shows that as of June 9, LTC investors conducted only 2,700 transactions exceeding $100,000.

Interestingly, the figure has now skyrocketed to 3,430 large transactions recorded on at the close of June 14. This shows that there has been a 27% increase in whale demand for Litecoin over the past week.

Increased whale activity during market downtrends is often interpreted as a bullish price signal for a few reasons.

Firstly, the whales’ large volume purchases provides much needed market liquidity which helps panic sellers to exit without major price impact. More so, the whales buying trends also increases confidence among other investors.

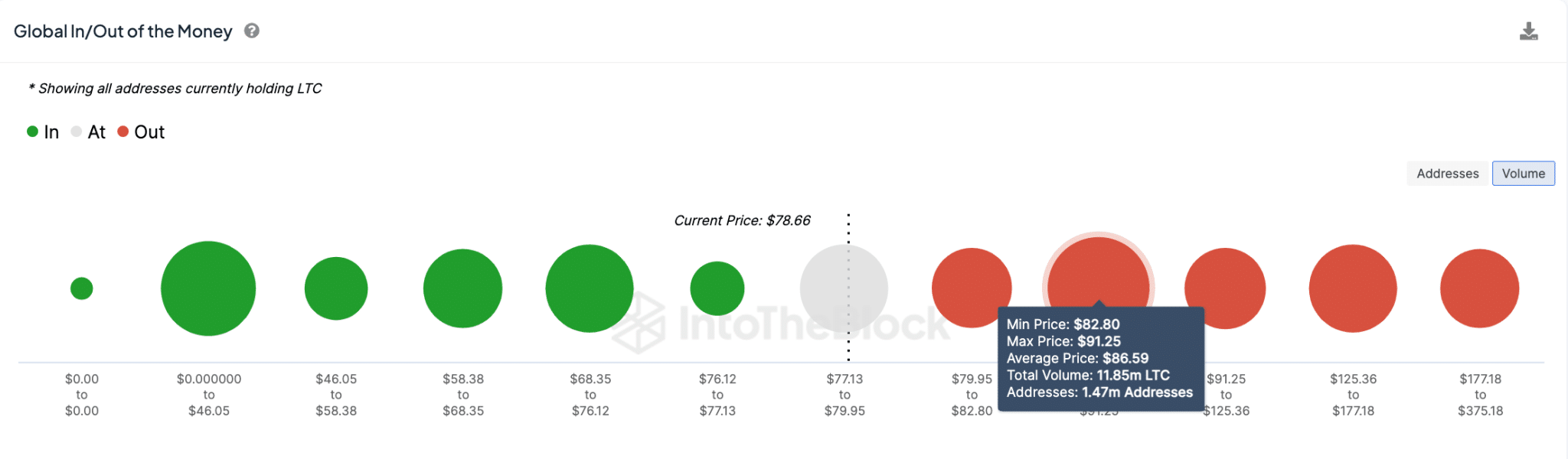

Litecoin Price Forecast: $83 Resistance Looms Large

The 27% surge in whale demand explains why Litecoin price has posted a relatively more resilient performance compared to the like of Solana during the week. However, it remains to be seen if the LTC bull can generate sufficient momentum to break above the next critical resistance at $83 in the days ahead.

As depicted below, the over 1.47 million addresses had purchased 11.85 million LTC at the average price of $82.80. If majority of them opt to book profits early, Litecoin price could struggled to advance further.

Hence given the whales’ intent to defend the $75 support, LTC price is like to avoid major swings and rather consolidate around the $76 to $80 channel as the weekend unfolds.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.