Solana price experienced an 8.52% upswing over the weekend, briefly surpassing the $150 milestone. This upward momentum was spurred by the integration of PayPal’s PYUSD stablecoin into Solana’s DeFi ecosystem. Here’s an in-depth analysis of what could unfold in the coming week.

$45M PYUSD Deployed on Solana, Fuelling Weekend Price Rally

The recent incorporation of PayPal’s native stablecoin, PYUSD, into both the Solana blockchain has generated positive buzz around SOL price action. This integration, announced on May 29, seeks to leverage Solana’s scalability, high speed, and low fees, thereby enhancing PYUSD’s reach within the cryptocurrency space.

Launched in August 2023, PYUSD has quickly garnered a market valuation of over $420 million, according to CoinMarketCap data. The decision to integrate with Solana and Injective is part of a broader strategy to boost PYUSD adoption by capitalizing on more efficient and scalable blockchains.

After the initial announcement on May 29, the SOL market response was largely subdued due to broader bearish trends influenced by Ethereum ETF approval news and unfavorable US economic indicators.

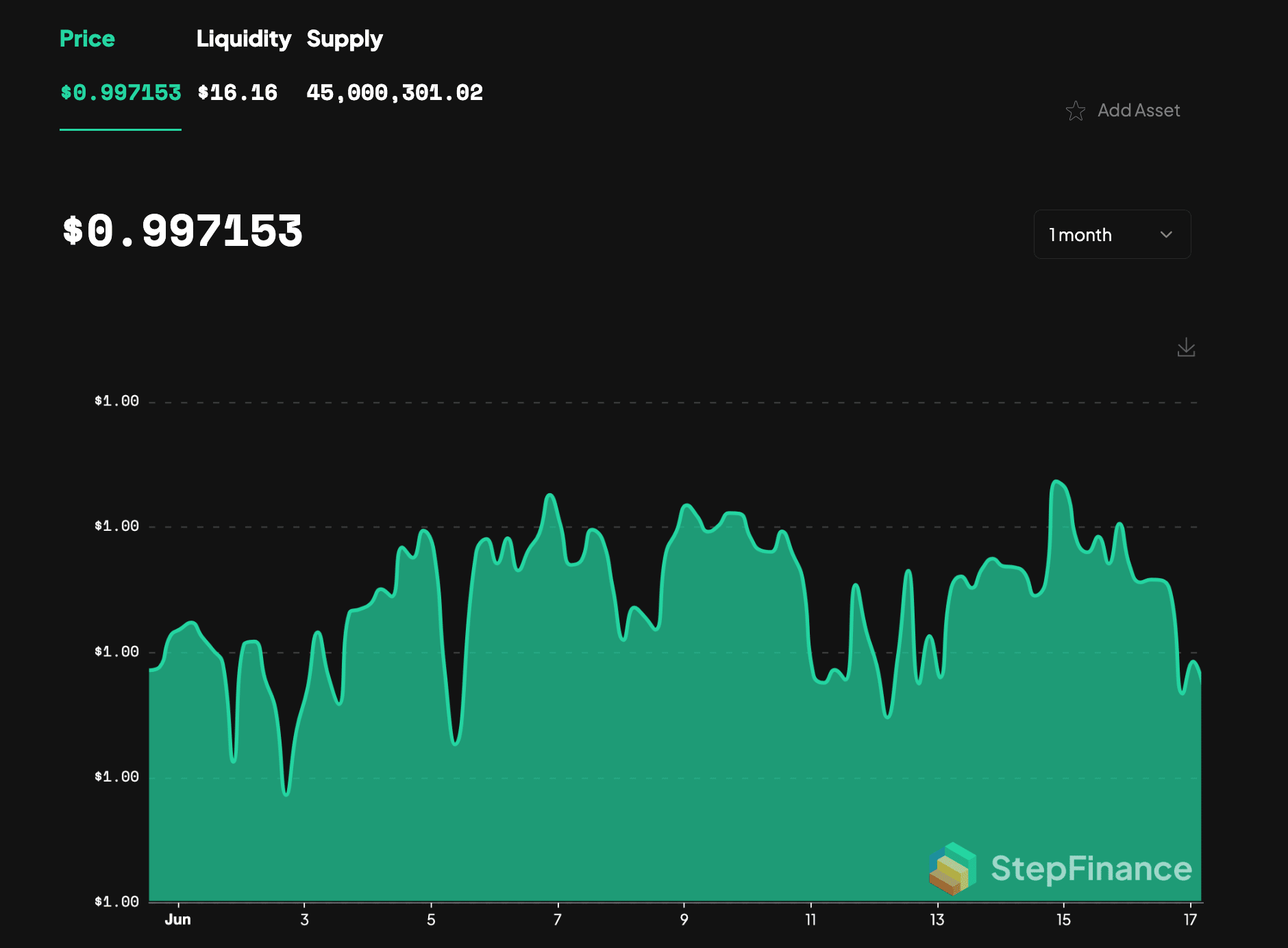

However, according to Step. Finance, a Solana native portfolio management tool, over $45 million worth of PYUSD was already circulating within the Solana DeFi ecosystem as of June 17.

Evidently, this additional liquidity has a vital key role in spurring SOL market activity as bullish investors regained confidence over the weekend.

Market Dynamics and Price Movements

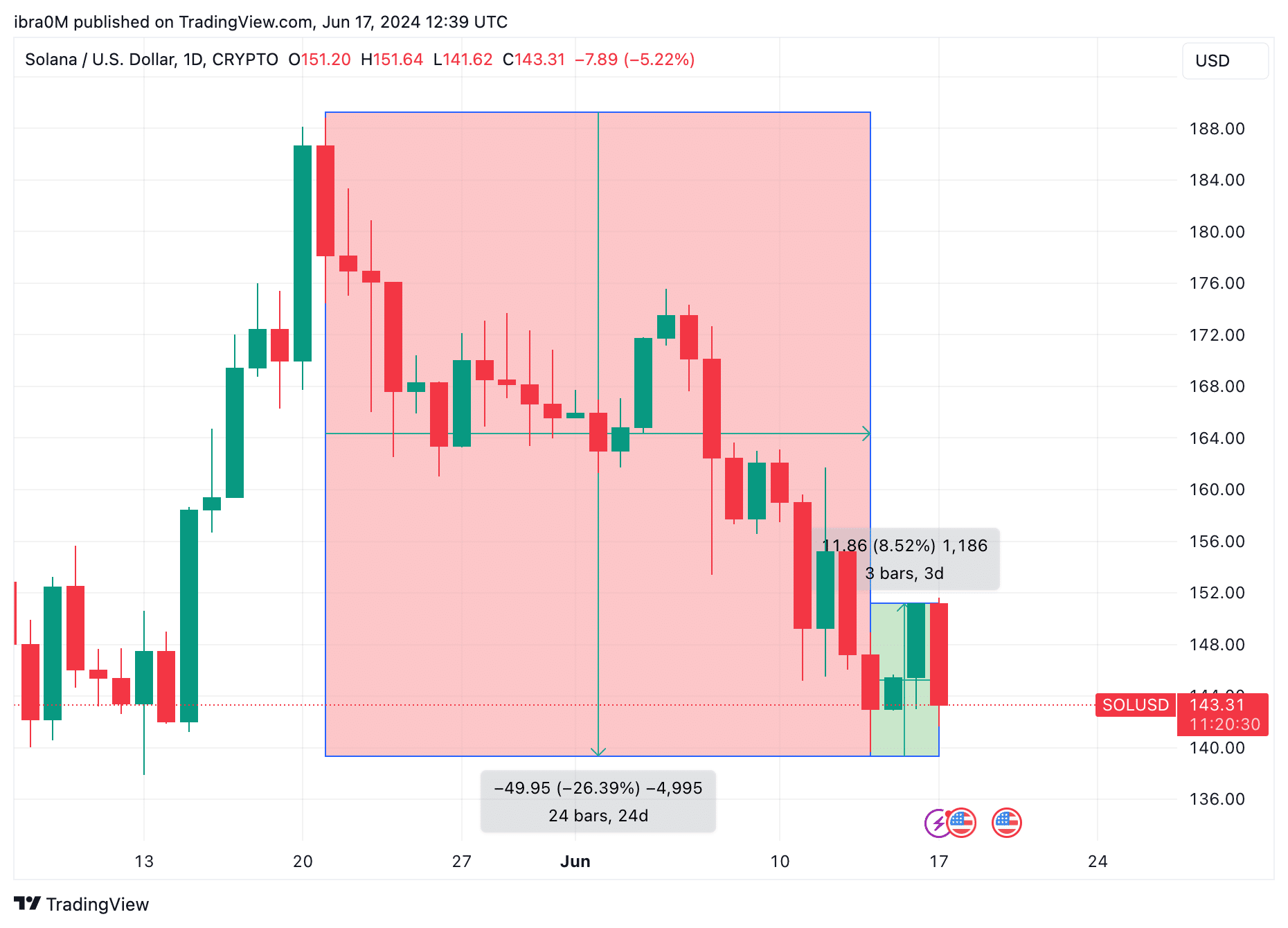

On June 14, Solana’s price started to recover from a 30-day bottom of $139, briefly grazing $151 territory over the weekend. This rally marked the end of a nearly 25-day decline triggered by hostile macro economic landscape in US.

Although the price retracted to around $145 after facing another bearish wave on June 17, the majority of traders remain optimistic. Data from Coinglass reveals that speculative traders are heavily favoring bullish positions, with $108.37 million in long positions compared to $82 million in short positions, indicating a strong short-term bullish sentiment.

Solana Price Outlook: Key Resistance and Support Levels

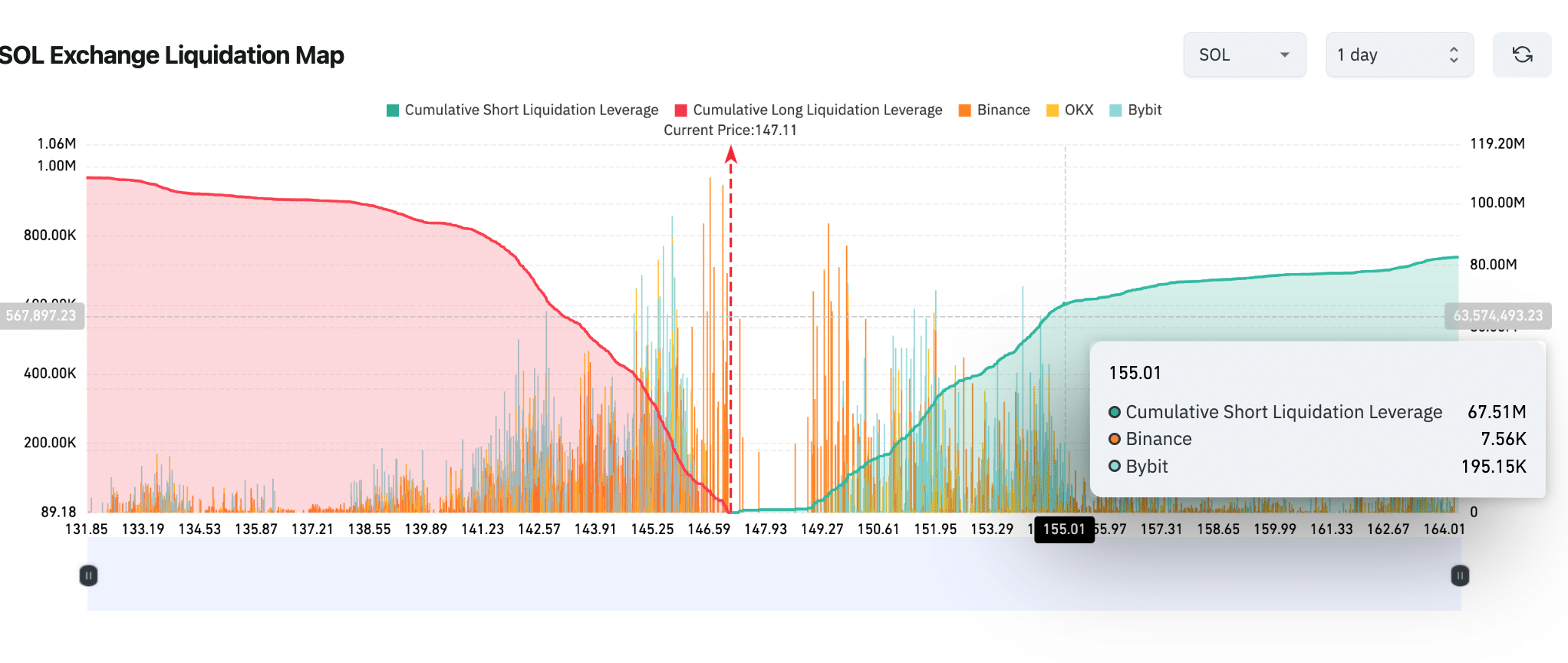

As Solana’s price rose by 8% over the weekend, bullish traders significantly outpaced the bears in the derivatives market. However, the $155 resistance level looms large due to prevailing bearish sentiment in the broader crypto market, particularly after Bitcoin prices tumbled towards $65,000 on Monday.

The Coinglass Liquidation Map shows substantial short positions around the $155 level. If Solana’s price rises above this threshold, short traders could face considerable losses, which might prompt stop-loss orders or large sell-offs, potentially halting the SOL price recovery phase.

In terms of support, Solana Bulls are expected to defend the $140 level to avoid liquidation losses exceeding $93 million. This defense could lead to Solana consolidating within a narrow price range of $142 to $153 as the traders look forward to the next major market catalyst.

In summary, while Solana’s recent price surge is encouraging, the $155 resistance and $140 support levels will be crucial in determining the next phase of its price action. As the impact of PayPal’s PYUSD integration continues to unfold, investors will be closely monitoring these broader crypto market Santiment for potential momentum swings.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.