Ethereum price reached $67,432 on July, up 6% for the day as bull traders place bet worth $1.38 billion ahead of Trump’s speech at Bitcoin Conference this weekend. ETH price looks set to record more upside amid the ongoing market shakeup.

Ethereum Price Pumps 6% on Trump Speech Speculations

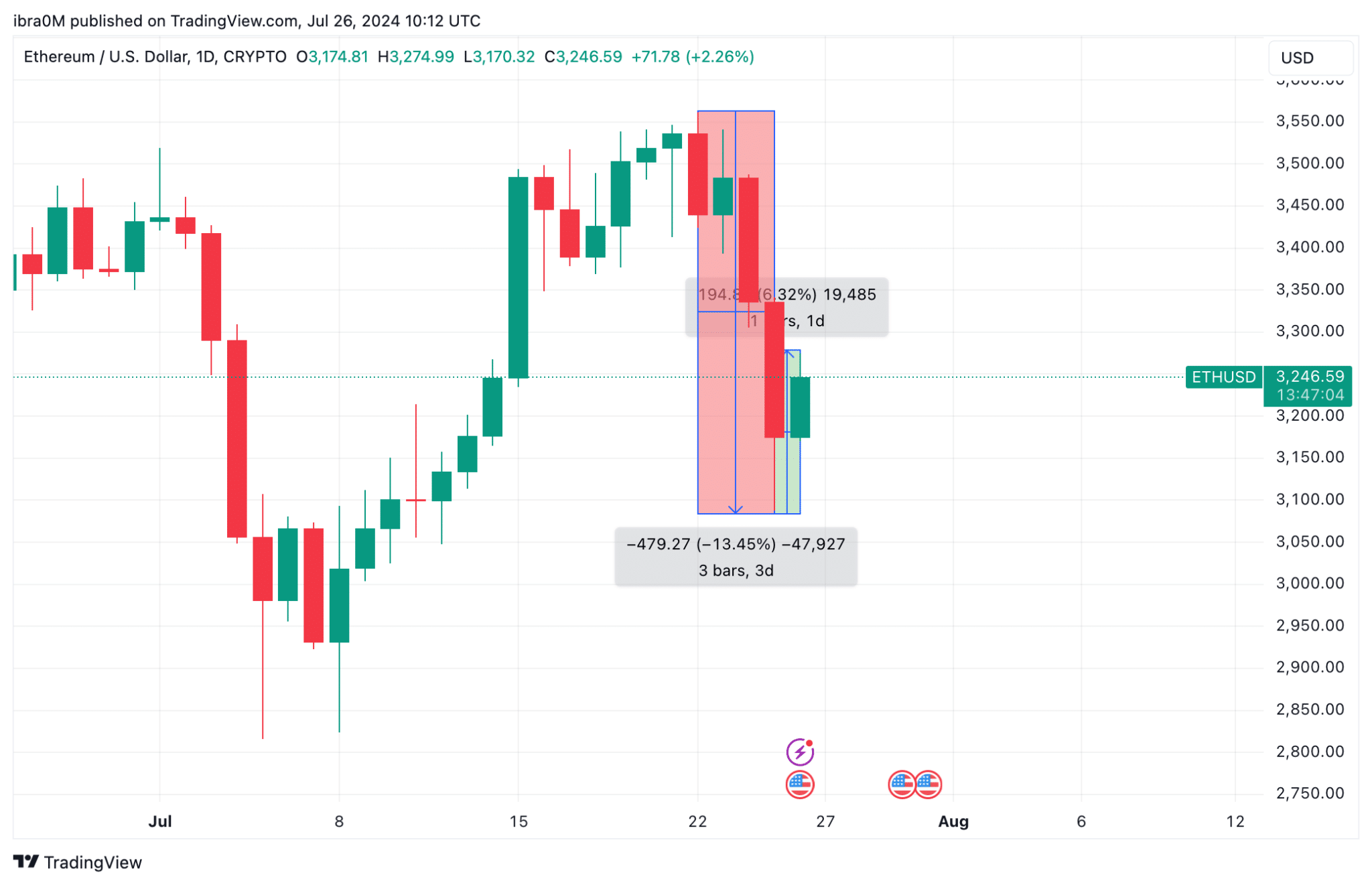

ETH price entered a worrying 13.45% downtrend mid-week amid a sell-the-news wave that greeted the spot Ethereum ETFs launch on Tuesday, June 23. However, the sector sentiment flipped bullish on Friday, July 26, as markets began to react to Donald Trump’s confirmed appearance at an upcoming Bitcoin Conference in the USA.

On July 25, 2024, the “Bitcoin 2024” conference kicked off in Nashville. This annual Ethereum event has been held since 2013 and has garnered a global following over the years.

This year, high-profile speakers confirmed to appear at the event include Republican Presidential candidate Donald Trump, MicroStrategy’s Michael Saylor, Cathie Wood of Ark Invest, Robert F. Kennedy Jr, Russell Brand, Edward Snowden, and a host of others.

Political discussions such as taxation, regulation, and adoption of cryptocurrency products across the US have dominated the discourse for this year’s edition.

Notably, Republican Candidate Donald Trump is scheduled to speak at the event. While he has claimed multiple times to be a crypto-friendly President, many crypto enthusiasts are speculating that Trump could announce the decision to champion the addition of Bitcoin to the USA’s official strategic treasury reserve.

This would see the US government invest directly in Bitcoin and hold BTC in its balance sheet perpetually, as currently observed in countries like El Salvador and Central African Republic (CAR).

Ethereum Traders Mount LONG Positions ahead of Bitcoin Conference

In a bid to front-run gains from this optimistic speculation, ETH futures traders have mounted an unusually heavy volume of LONG positions.

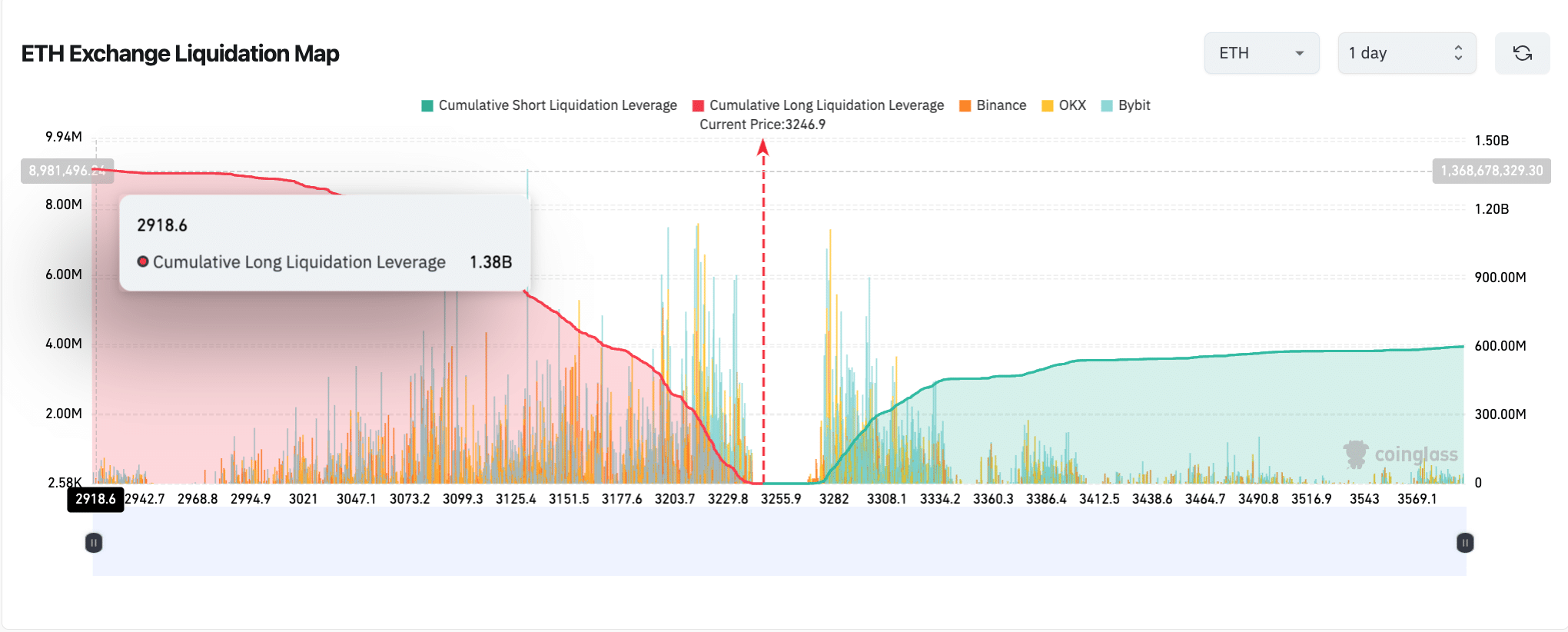

Indicating this, the Coinglass chart below presents the total value of ETH LONG contracts compared to active SHORT positions listed around the 20% boundaries of the current prices. This provides clear insights into investors’ short-term sentiments.

Higher LONG positions often mean that investors are confident in an imminent price surge and are deploying more leverage to maximize profits on those potential gains.

In total, Ethereum derivatives traders currently have about $2 billion locked in speculative perpetual futures contracts within the $2,918 to $3,570 price boundaries.

Glaringly, these contracts are heavily skewed bullish, with $1.38 billion in LONG contracts mounted against $600 million worth of SHORT positions.

Donald Trump is scheduled to speak at the ‘Bitcoin Nashville’ conference in less than 24 hours from the time of publication. These heavily skewed futures contracts clearly indicate that traders are anticipating a major Ethereum price breakout on the back of the conference.

Media buzz generated by the in the last 24 hours has already powered ETH into a 6% rally toward $3,245 at the time of writing. Many expect that a major pronouncement from Donald Trump, such as the speculated addition of BTC to the USA’s treasury, could spark a major buying frenzy.

Considering the level of leverage currently applied, there’s a chance that such a major pronouncement could propel ETH to new all-time highs above $5,000 if the bullish scenario plays out.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.