Avalanche price stalled around the $21 mark on Thursday, August 15, maintaining its position above the $20 support level since the week’s start. Derivatives market data shows a spike in AVAX open interest over the last three days, potentially signaling a major breakout.

Bears Mounting Pressure on $20 Support

Avalanche delivered double-digit gains last week during a remarkable rebound fueled by the approval of Solana ETFs in Brazil. This event bolstered investor sentiment towards Layer-1 Proof of Stake (PoS) coins like AVAX. However, the excitement from the media has waned, leaving Avalanche struggling to attract new buyers this week.

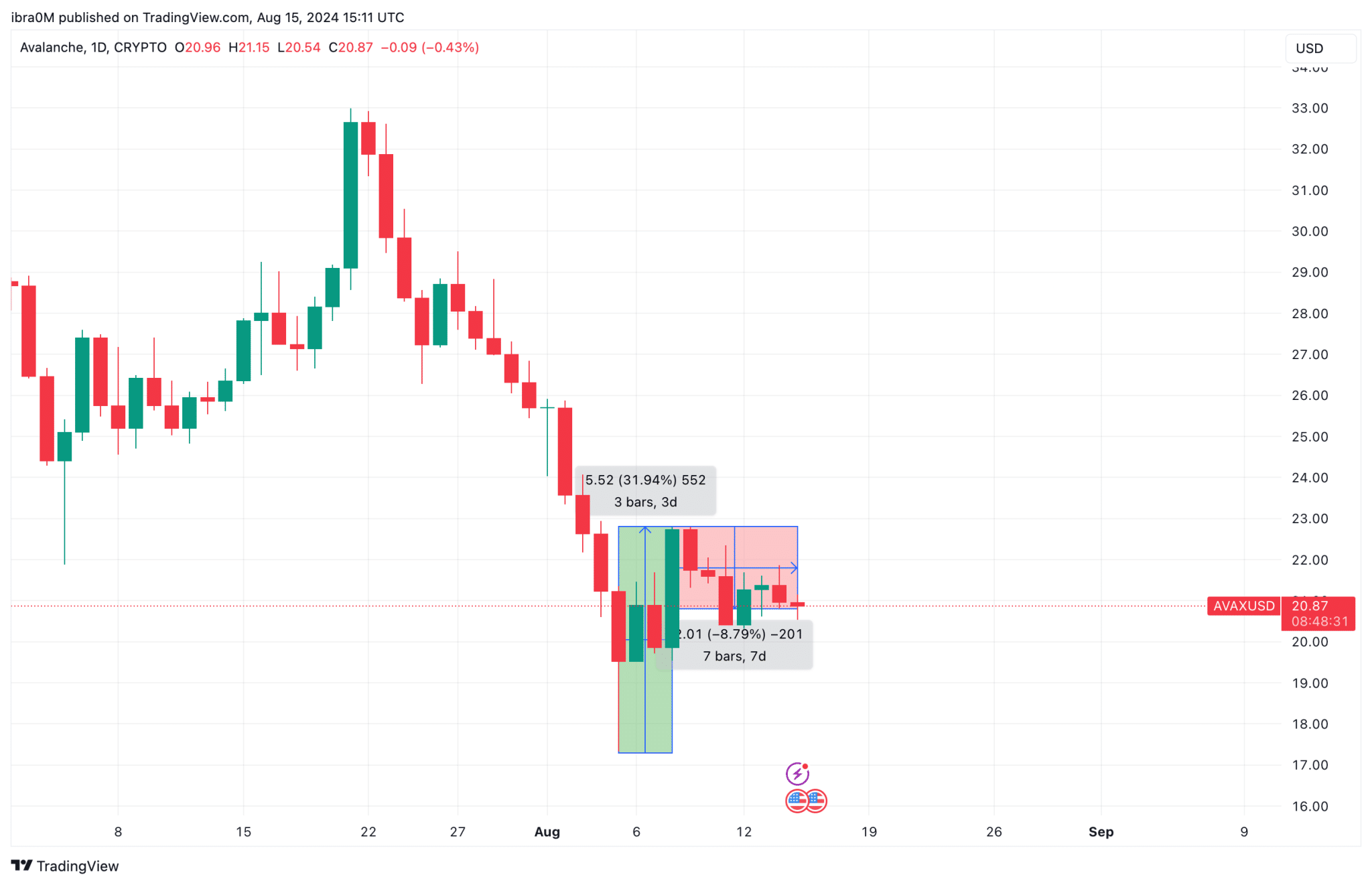

Following last week’s 31.94% rally, which peaked at $22.79 on August 9, Avalanche’s upward momentum has slowed. At the time of writing on August 15, Avalanche is trading at $20.85, reflecting an 8.79% dip since the week’s start.

As seen in the attached price action chart, Avalanche’s price has consolidated within a narrow range over the past four days, suggesting that behind-the-scenes bullish catalysts may be nullifying sell-off attempts.

Bears have attempted to drive the price below the $20 psychological support level. Still, AVAX bulls have established a strong buy-wall, preventing a downward reversal. This consolidation, combined with the stability around $20, could indicate the potential for an imminent breakout.

AVAX Open Interest Crosses $200M After Dovish CPI Data

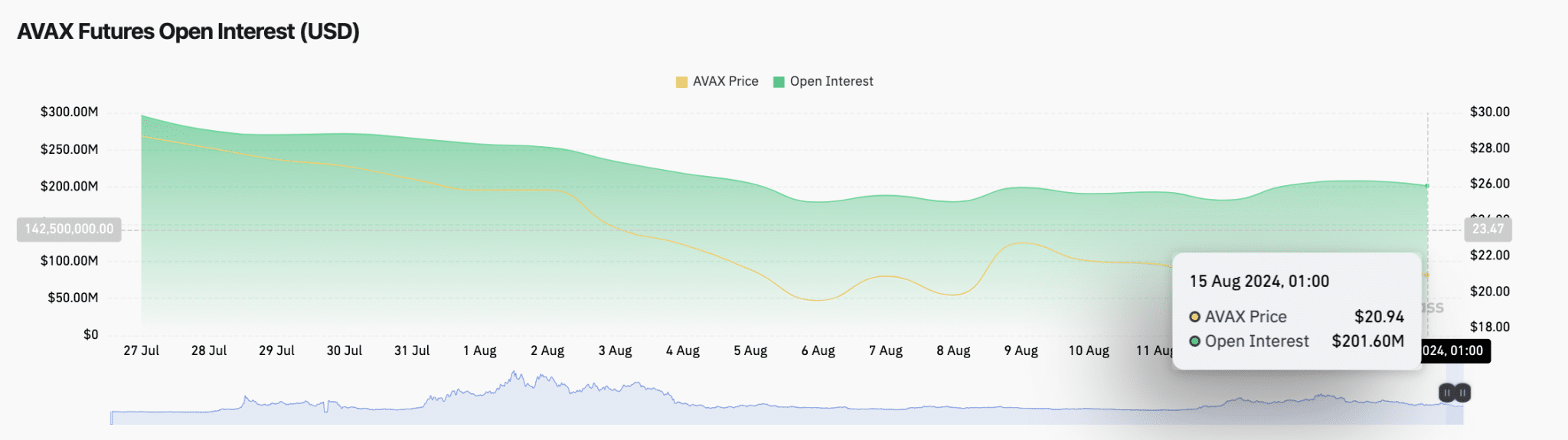

The release of Dovish CPI inflation data by the US Bureau of Labor Statistics on August 14 is one such bullish catalyst. The data showed slowing inflation, a positive factor that, while not immediately reflected in AVAX’s spot market, has shifted sentiment in the derivatives markets.

Open Interest, a key metric for price insights, has seen a notable increase. From $182 million on August 12, Avalanche’s Open Interest climbed to $201.6 million by August 15. This represents a $19.6 million increase, or approximately 10.77%, as illustrated in the attached chart. During this period, AVAX’s price remained relatively stable, further suggesting potential bullish momentum.

When Open Interest increases during a period of price consolidation, as currently observed, it often signals that a significant price movement is on the horizon. Two reasons this could be bullish for AVAX include renewed trader confidence in the asset and the possibility of a short squeeze if bears cannot push the price below key support levels.

AVAX Price Forecast: Imminent Breakout From $20 Support

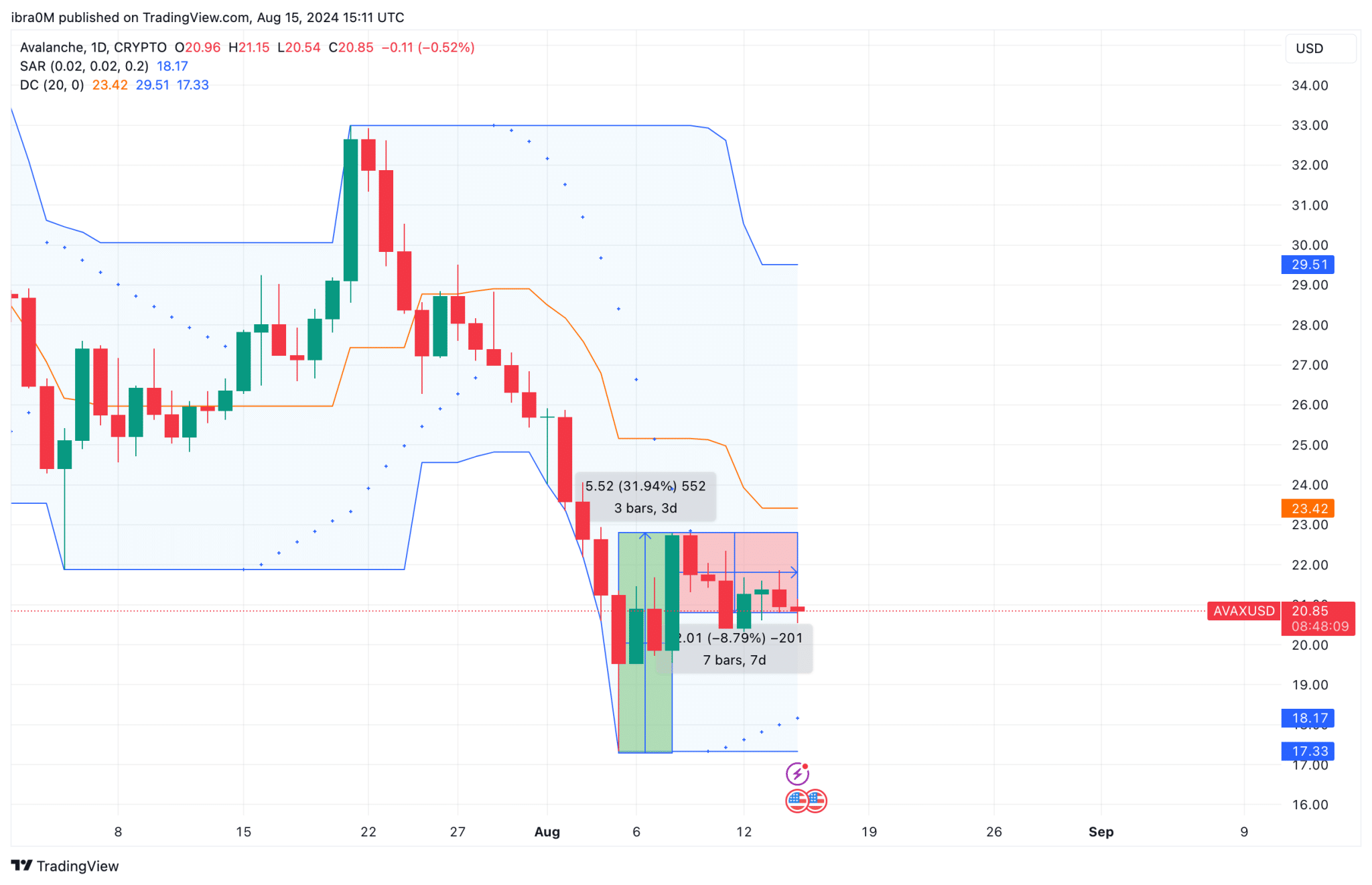

The combination of technical indicators and market sentiment suggests that Avalanche may be gearing up for a breakout from the $20 support level. The Parabolic SAR (Stop and Reverse) indicator, as seen in the price action chart, currently shows support at $18.17. This indicates that while the bears have attempted to push the price lower, they have not yet succeeded in breaking this key support level.

Moreover, the Donchian Channels, which measure volatility, are tightening, indicating reduced price movement. This often precedes a significant breakout. With resistance at $23.42, a break above this level could see AVAX retesting the $25 mark.

In conclusion, if AVAX maintains its current support and the Open Interest continues to rise, a bullish breakout seems increasingly likely. Traders should watch for a decisive move above $23.42, which could signal the start of a new upward trend toward $25 and beyond.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.