Pepe fails to break above the 50-day EMA, tumbling back to a key trendline. Will it bounce or crash to $0.0000050?

As Bitcoin drops below $84K, supply pressure on meme coins increases sharply. Among the top meme coins, DOGE, SHIB, and PEPE have pulled back between 3% and 5% over the past 24 hours.

Pepe, the frog-themed meme coin, is down to $0.0000070, losing bullish momentum amid mounting selling pressure. With a potential downswing looming, is Pepe on the verge of plunging to $0.0000050?

Pepe Price Nears Retest of Broken Falling Wedge

Failing to sustain the bullish breakout from a falling wedge pattern, Pepe has taken a bearish turn. The price couldn’t climb above the 50-day EMA, which has acted as dynamic resistance since late March.

The recent bullish attempt topped out at a 7-day high of $0.0000077 before facing strong rejection. As the 50-day EMA carries heavy supply pressure, Pepe’s price action has formed long-wick candles.

Currently, the decline from the dynamic resistance line suggests a possible retest of the falling wedge’s broken resistance trendline. This presents a potential reversal opportunity for optimistic traders and investors, if the retest holds.

With bullish momentum fading, the MACD and signal lines are nearing a negative crossover. If confirmed, this technical signal could suggest a further bearish extension.

Hackers Accumulating Pepe?

Five new wallets have recently acquired 611 billion Pepe tokens worth $4.28 million at current discounted prices, all within the past 24 hours.

However, the funding source of these wallets is raising eyebrows. Each was funded with ETH withdrawn from Tornado Cash, a decentralized cryptocurrency mixer, 15 days ago.

This leads to a pressing question: Are hackers buying Pepe?

5 wallets spent $4.28M to buy 611B $PEPE in the past 8 hours.

All 5 wallets withdrew $ETH from #Tornado ~15 days ago—possibly linked to a hacker.

Are hackers buying $PEPE?

Address:

0x5D058264e34e27eE1b4f852216Dc4AFC7c320e25

0x53abA3F792d6c8097a7169C8916B1C3f7975f5ed… pic.twitter.com/8yUdFsUBVA— Lookonchain (@lookonchain) April 16, 2025

Will Long Liquidations Drive Pepe Down to $0.0000050?

Amid heightened volatility, Pepe has seen a -5.37% drop in open interest, now standing at $281.25 million. Interestingly, the volume-weighted funding rate has flipped positive, reaching 0.0063%.

One of the key drivers of the positive funding rate is the increase in long positions. Over the last 12 hours, long positions rose from 46.99% to 49.2%, bringing the Long/Short Ratio close to neutral at 0.9685.

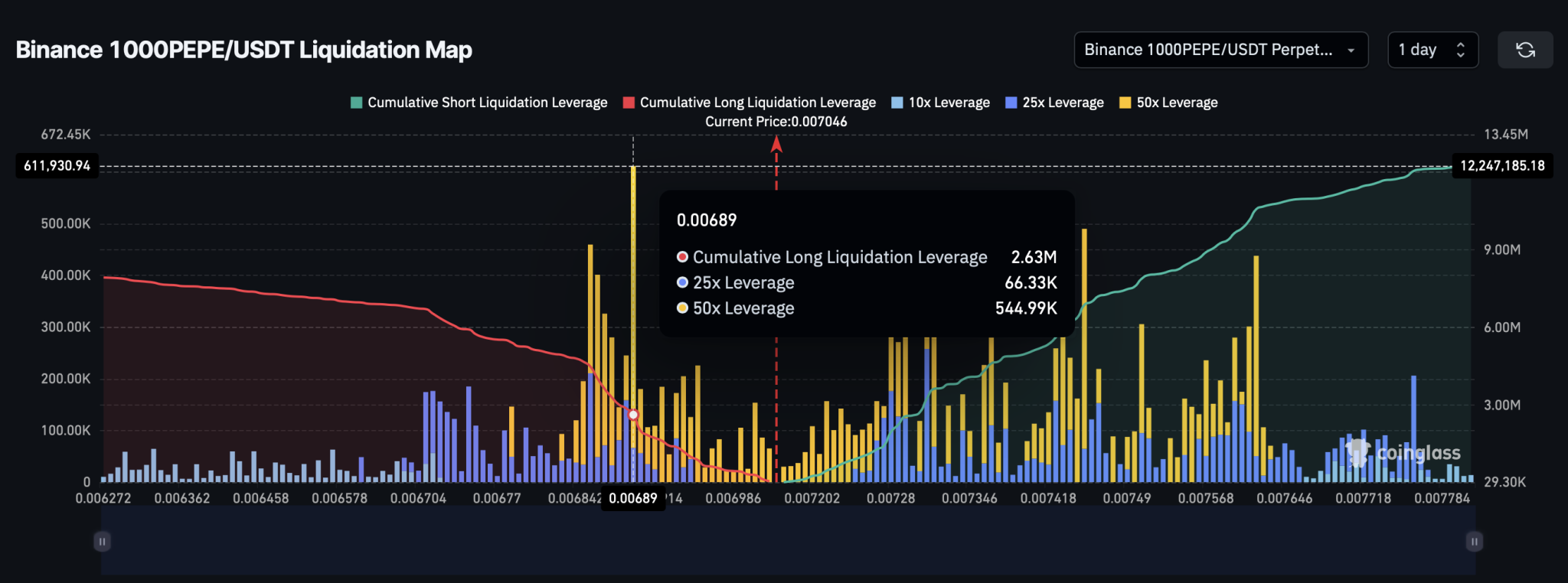

Long positions currently dominate at 55.9%, reflecting growing bullish sentiment for Pepe. However, if the downtrend continues and the price hits $0.00000689, a massive $2.63 million in long liquidations could shake out many buyers.

Pepe Price Targets

With increased price volatility and a broader market pullback, meme coin prices may continue to slide. In the short term, Pepe will likely retest the broken resistance trendline near $0.0000062.

Should this happen, a spike in long liquidations could drag the price down further to $0.0000050. However, from an optimistic standpoint, a successful post-retest bounce could propel Pepe back toward the 50-day EMA, near $0.0000078321.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.