Bitcoin whales are fueling the recent bullish rally, with on-chain data showing massive accumulation trends among large Bitcoin holders.

The prominent on-chain analytics firm Glassnode highlighted this trend in an X post on Thursday. According to the firm, different calibers of large Bitcoin holders have been on a buying spree and have contributed immensely to the recent uptick.

For context, Bitcoin has surged by over 8% since the start of this week and is on track for its largest single-week bullish candle since November. The uptick has contributed to the broader market rebound, with the global crypto market cap nearing $2.9 trillion at press time.

Bitcoin Whales Accumulating More Tokens

Glassnode noted that Bitcoin whales are back in full force. Its data indicate a strong accumulation trend across different whale cadres, spurring the price rebound.

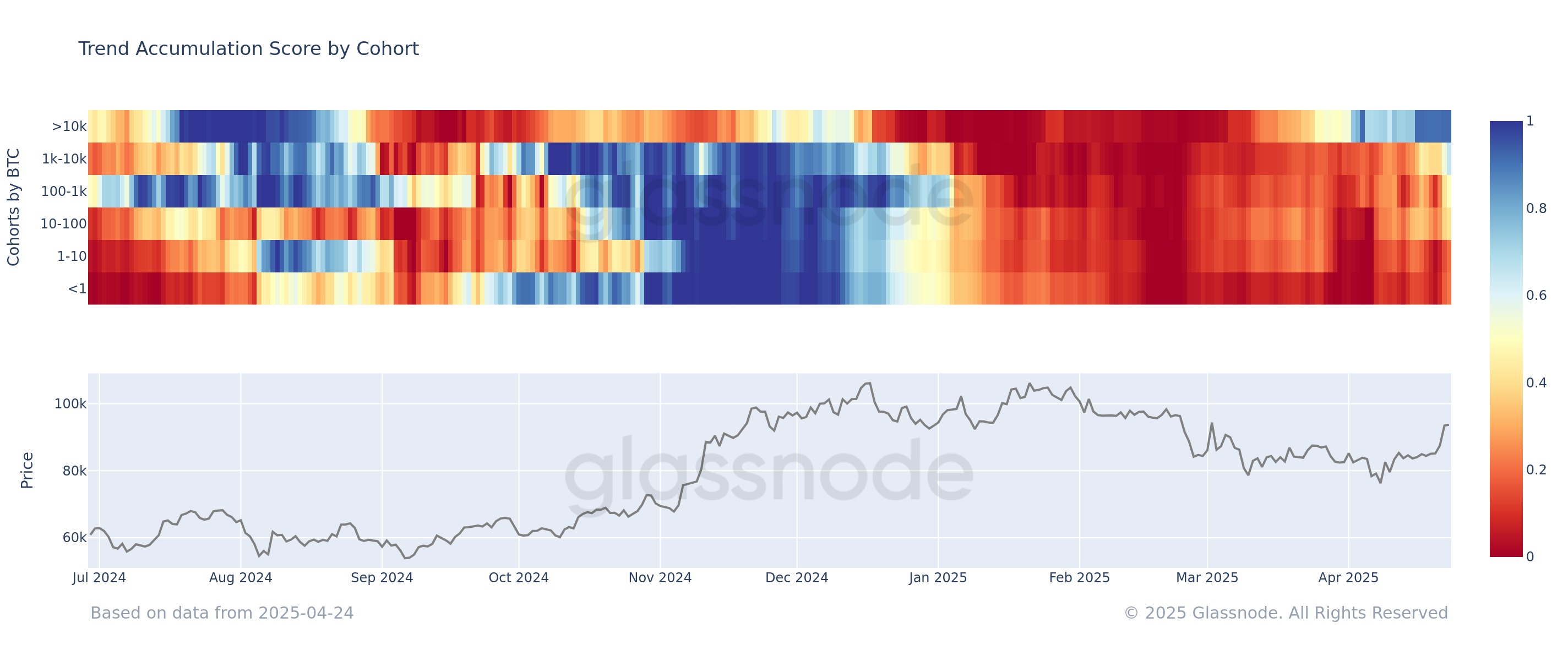

Notably, Glassnode cited the Bitcoin Trend Accumulation score to support its claims. For context, the indicator tracks market investor sentiment, revealing whether users are buying or selling Bitcoin over a period of time.

Specifically, the analysis highlights the scores among different Bitcoin holders over the past week. Note that a score above 0.5 signals accumulation, while a score below suggests distribution.

For perspective, holders of between 100 and 1,000 BTC have a score of 0.5, indicating a neutral distribution and accumulation trend among this caliber of whales. Further, whales holding between 1,000 and 10,000 BTC accumulated Bitcoin considerably in the past week, with a score of 0.7.

Meanwhile, large whales holding 10,000 BTC or more displayed the highest level of interest in the premier asset. Holders in this category have a near-perfect score of 0.9, depicting an aggressive accumulation trend among them.

Net Taker Volume Confirms Buying Spree

Interestingly, the Bitcoin net taker volume also supports the recent accumulation trend. Data from Ali Martinez shows that the metric, which tracks the difference in buying and selling volume in the derivative market, highlights an aggressive buying pressure.

Particularly, the indicator hit a new monthly high of nearly $62 million on Binance, as buying aggression continues to mount. This derivative bullish disposition, coupled with the accumulation trend, suggests that bulls are solidly behind the recent market rally.

In the meantime, Bitcoin trades at $93,229, retracing slightly from this week’s high of $94,662.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.