One of the most powerful indicators for Bitcoin has emerged as Bitcoin whales scoop up thousands more BTC in an effort to bolster their holdings.

Bitcoin (BTC) has shown notable price stability around $93,000 as of Friday, following a strong 10% rally this week. After surging past key resistance levels earlier this week, Bitcoin briefly reached a high of $94,430 on April 24 before stabilizing below this mark.

This price action has drawn attention from analysts, with a focus on the behavior of large Bitcoin holders, often referred to as whales and sharks. Market intelligence platform Santiment provides insights into the link between Bitcoin’s price movements and the accumulation patterns of these stakeholders.

Whale Accumulation Correlates with Price Surge

Santiment’s analysis reveals a correlation between Bitcoin’s recent price rise and the accumulation activities of wallets holding between 10,000 and 100,000 BTC. These wallets represent some of the most influential players in the market.

In the past week alone, wallets in this category added 19,255 BTC, driving the total holdings of this group to 13.47 million BTC. This figure represents an all-time high in their cumulative balance.

Notably, this surge in accumulation has coincided with a steady price increase, from fluctuations between $75,000 and $85,000 earlier in the year to the more recent rise above $93,000.

Despite a brief dip in early April, which also saw Bitcoin’s price retreat temporarily, the overall trend from mid-March has been upward. This consistent accumulation suggests that these large holders remain confident in Bitcoin’s long-term price potential. The purchase spree, coupled with the price increase, indicates a growing belief in Bitcoin’s bullish momentum.

Market Participation Support Positive Outlook

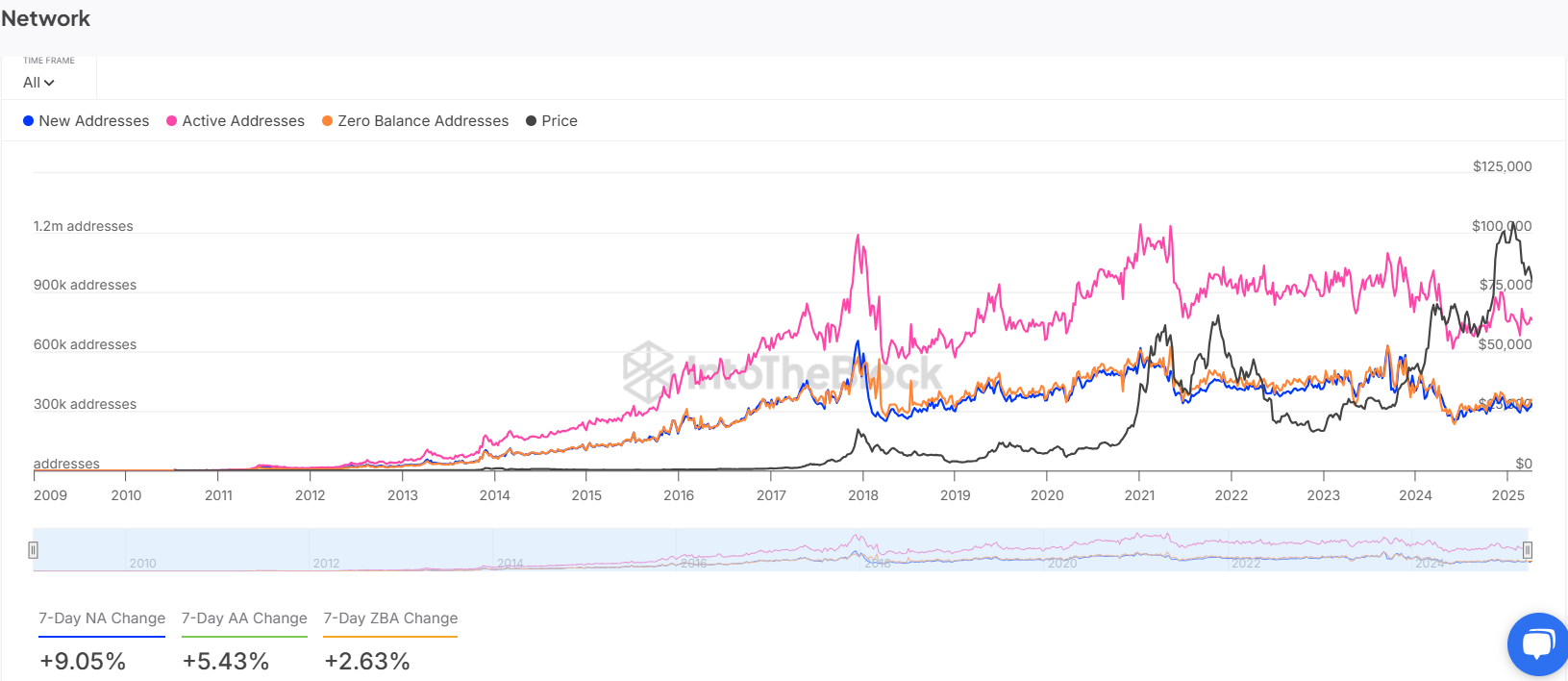

Other key indicators provide further support for a continued upward trend in Bitcoin’s price. Data from IntoTheBlock highlights significant network growth metrics, such as a 9.05% increase in new addresses and a 5.43% rise in active addresses over the past week.

Additionally, the number of zero balance addresses has risen by 2.63%. These metrics suggest that more users are entering the Bitcoin network, further strengthening the case for ongoing bullish momentum.

Meanwhile, Bitcoin’s derivatives market shows an increase in open interest, with Coinglass data showing a steady rise of 2.04%, reaching $64.92 billion.

This growth in open interest signals a rising level of market participation. Further, the long-to-short ratio in the futures market stands at 1.0392, suggesting a slightly higher number of long positions than short positions. This sentiment is further confirmed by liquidation data, which shows that short positions have been liquidated at a higher rate compared to long positions.

Coinglass data shows that, over various time frames, the liquidation of short positions has consistently outpaced the liquidation of long positions.

For example, in the last 24 hours, $27.69M worth of short positions were liquidated, compared to only $21.92M in long liquidations.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.