CryptoQuant data shows rising XRP open interest, neutral funding, and seller absorption—signs of a possible bullish breakout.

XRP’s price chart over the last seven days reflects a steady uptrend, climbing from just above $2.00 to nearly $2.60. The most significant spike came around May 12, when the asset briefly touched a weekly high before consolidating slightly below that peak.

Meanwhile, current market signals suggest that price action alone may not fully capture the underlying dynamics driving XRP’s recent movement.

XRP’s Rising Open Interest and Shifting Market Sentiment

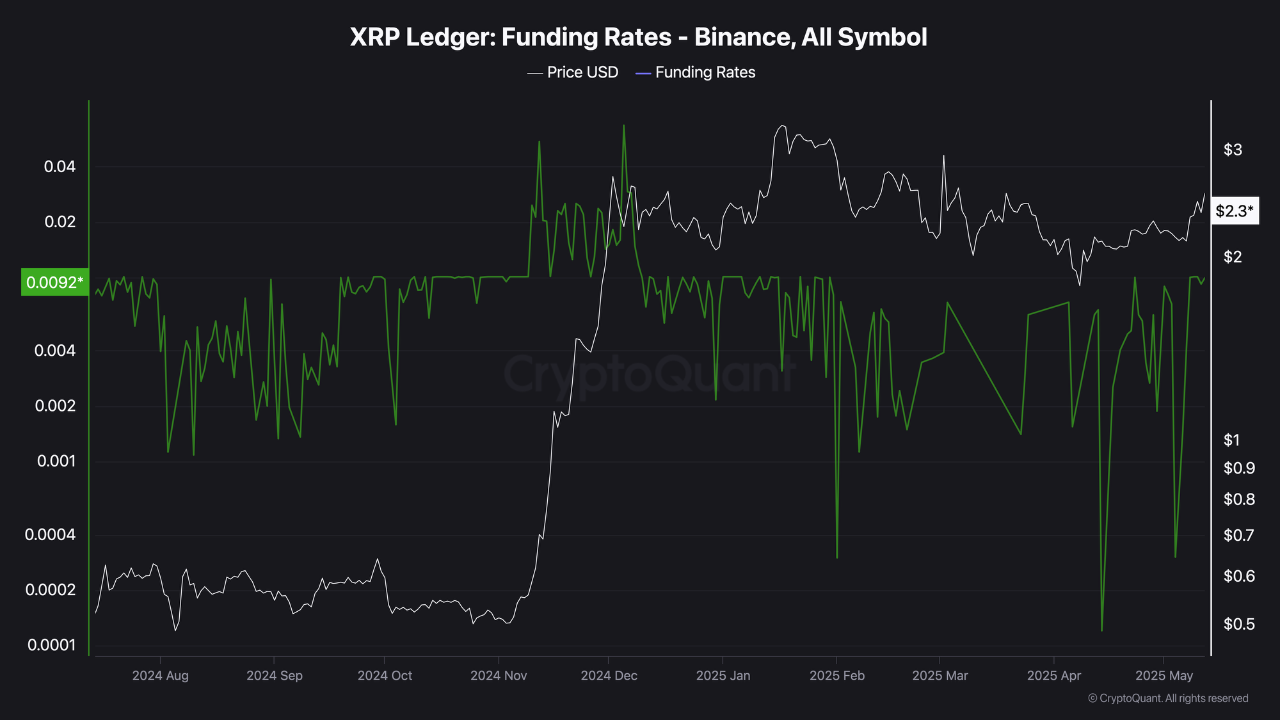

An analyst at CryptoQuant, Boris Vest, reported that XRP’s futures activity on Binance is showing signs of a resurgence in speculation.

After reaching an all-time high Open Interest of $1.5 billion earlier, the figure sharply declined to $530 million, removing many overleveraged positions. Now, Open Interest is again trending upward, pointing to renewed trader engagement and potential volatility.

Specifically, open interest for XRP has surpassed $730 million, according to CryptoQuant’s chart.

While Open Interest climbs, the funding rate has stayed neutral. This signals a balance between long and short positions. However, the analyst highlighted that short positions are gradually increasing while prices continue rising. This disconnect suggests a mild short squeeze is in effect, pushing the asset upward in the absence of overt buying pressure.

Meanwhile, the Binance Taker Buy/Sell Ratio, which currently stands at 0.91, also reflects aggressive selling. Despite this, XRP’s price has remained relatively stable. According to CryptoQuant, this indicates that sell orders are being absorbed, which is a bullish signal.

According to Vest, this pattern of quiet accumulation beneath the surface suggests that market participants may be positioning ahead of a potential upward move.

Bullish Pressure Despite Mixed Positions

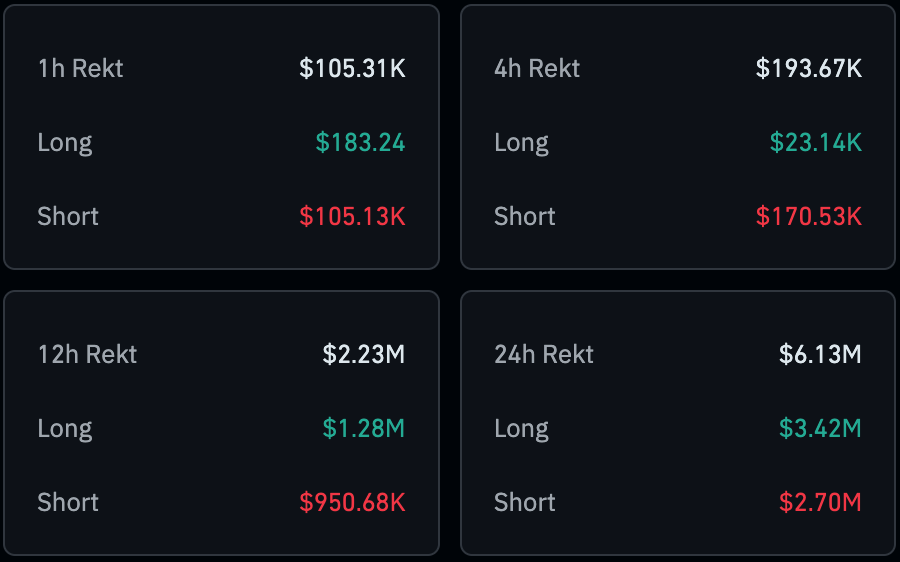

Coinglass derivatives data adds another layer to the market snapshot. Over the past 24 hours, short liquidations totaled $2.70 million. Notably, the last four hours revealed a surge in short liquidations—$170,000 compared to just $23,000 in longs. Notably, the final hour alone saw $105,000 in shorts wiped out against $183 in long positions.

This short-term liquidation pattern suggests rising bullish pressure, even in a market that remains broadly indecisive.

Looking at the broader picture, total liquidations over 24 hours reached $6.13 million, with $3.42 million in long positions and $2.70 million in shorts. While longs slightly edge out shorts overall, suggesting some traders may have over-leveraged bullish positions, the balance still leans toward a volatile but bullishly skewed market.

This Analyst Raises Long-Term Price Speculation

Separately, market analyst “DK64Trades” highlighted XRP’s market dominance across cycles. He observed that in January 2018, XRP traded at $3.84 with a dominance of 31.33%. In contrast, when XRP reached $3.34 in January 2025, dominance stood at only 5%.

DK64Trades noted that XRP’s current dominance remains significantly lower despite similar price levels. Based on this, he projected that a return to previous dominance levels could imply substantial market cap growth.

If XRP recovered its 2018 dominance share, the resulting $1.04 trillion valuation could correspond to a price near $17.8, considering the current $3.33 trillion global crypto market cap.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.