SUI price holds above $3.30 amid a bullish wedge breakout. Derivatives data shows rising interest. Can SUI reach $4.63 or even $6 in the next leg up?

As the crypto market remained quiet on Tuesday, SUI witnessed a minor gain of 0.19%, maintaining dominance over the $3.30 demand zone. With SUI rejecting lower prices near the 50-day EMA and this demand zone, is a bullish reversal possible this week?

SUI Price Analysis

On the daily chart, SUI’s price action reflects a bullish effort to sustain a falling wedge breakout rally. The rally surpassed the 23.60% trend-based Fibonacci level at $3.30 but is struggling to maintain a higher-high trend.

After a secondary test of the $3.30 demand zone, SUI now tests the 50-day EMA at $3.38. The intraday candle shows a lower price rejection near the 24-hour low of $3.40, with the current market price at $3.57.

Short-term price action reflects a resistance trendline formed after rejection near $4.29. As SUI struggles to prolong its uptrend, the daily RSI indicates a loss of momentum.

The daily RSI has dropped below the midpoint of the overbought region, signaling weakening strength.

Despite this short-term struggle, a potential bounce from the 23.60% Fibonacci level could test the 38.20% level at $4.63 if SUI breaches the local support trendline.

The bullish trend may extend to the 50% Fibonacci level near the $6 psychological mark, aiming for a new all-time high. On the downside, the 200-day EMA near the $3 psychological level serves as crucial support in case of a breakdown.

Derivatives Traders Remain Hopeful on SUI

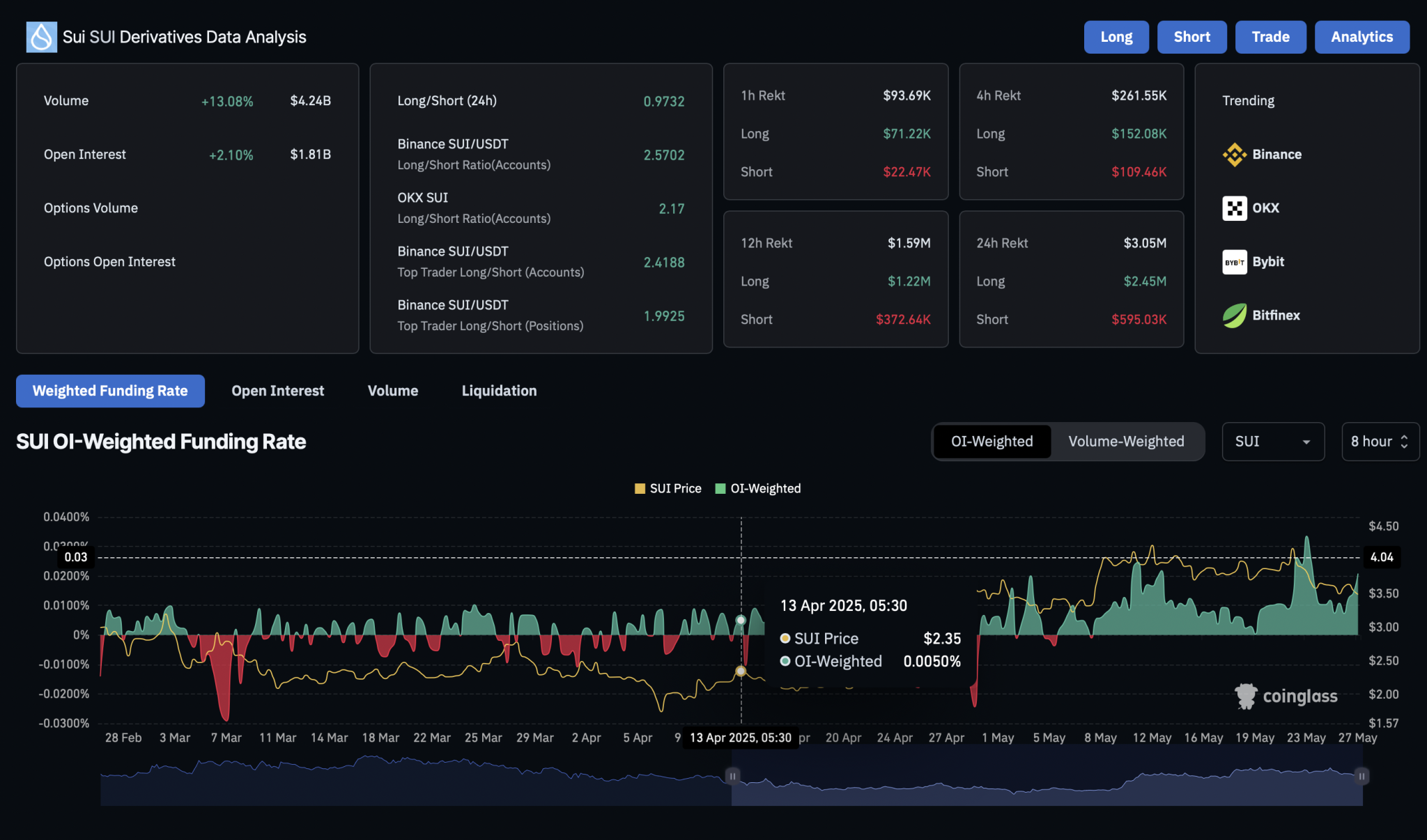

Over the past 24 hours, the bullish narrative in the SUI derivatives market has strengthened significantly. Open interest increased by 2.10%, reaching $1.81 billion, while the funding rate rose by 20.02%. This reflects a surge in bullish trading activity despite a recent wipeout of bullish players.

This is highlighted by $2.45 million in long liquidations compared to $595K in short liquidations over the last 24 hours. With bullish sentiment largely unaffected in SUI derivatives, traders anticipate a potential reversal.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.