Whales are accumulating PEPE as technical indicators suggest a potential trend reversal. Will the meme coin reach $0.000015?

The frog-themed meme coin, Pepe, has recorded its fifth consecutive positive day, with an intraday recovery of over 7%. Could this short-term reversal in Pepe result in a price surge back to $0.000015?

PEPE Price Analysis

Pepe is showing a bullish turnaround from the 23.6% Fibonacci retracement level at the psychological support of $0.000010. With five consecutive bullish candles, the meme coin has recovered from last week’s two-day crash, which saw a 16% drop. The ongoing recovery rally now aims to challenge the 38.2% Fibonacci level at $0.00001352.

With an intraday gain of more than 7%, the growing bullish momentum hints at a potential crossover between the 100-day and 200-day EMAs, an indicator that could signal a buying opportunity for price action traders.

Additionally, the MACD and Signal lines are nearing a bullish crossover as the bearish histograms decline, suggesting a possible trend reversal with renewed bullish momentum.

Overall, the technical indicators maintain a positive outlook for the frog-themed meme coin.

A potential breakout above the 38.2% Fibonacci level would increase the likelihood of Pepe retesting the 50% level at $0.00001592. On the downside, the key support remains the 50-day EMA at $0.00001147.

Large Investors Bullish on PEPE

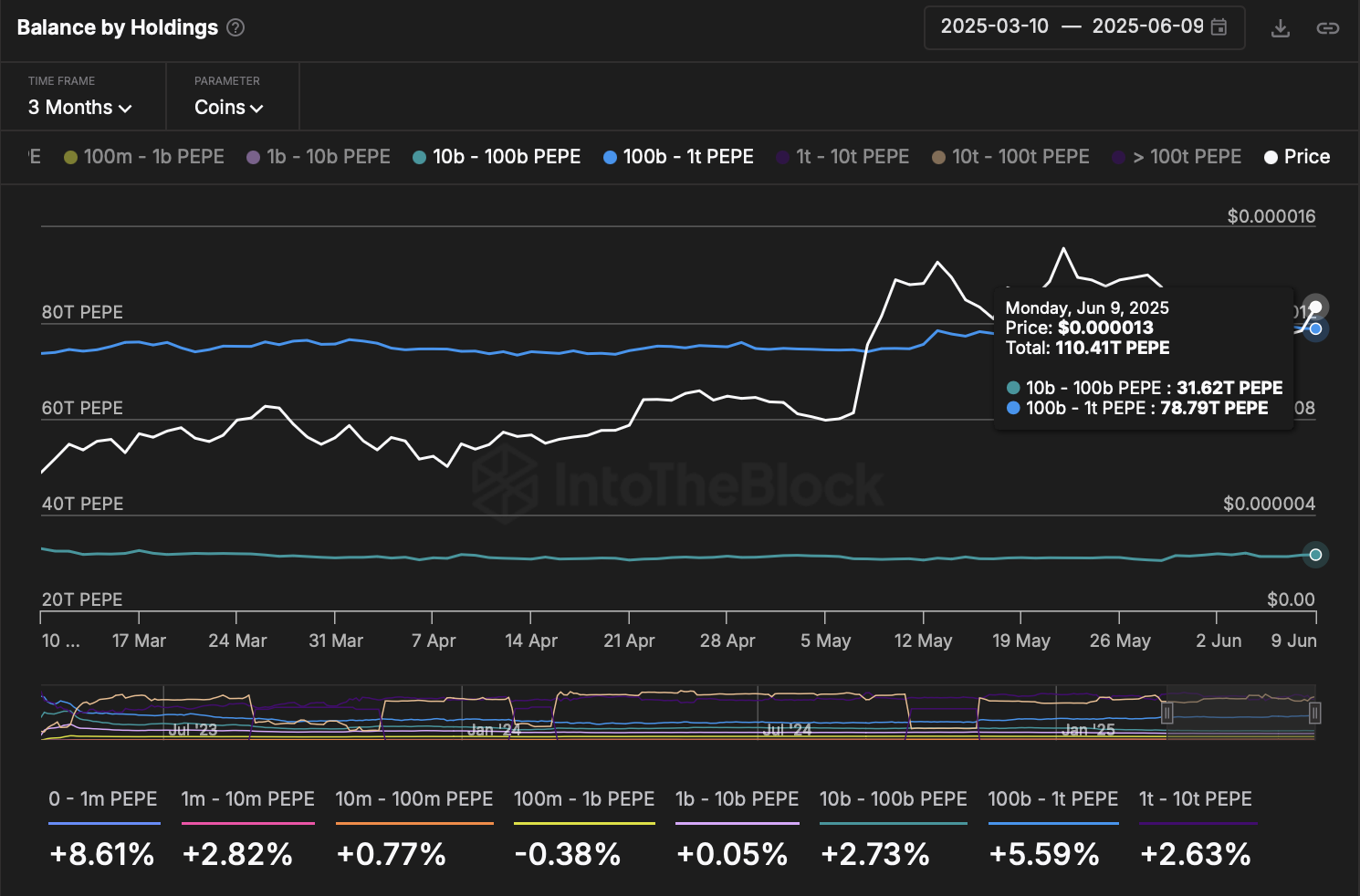

Despite heightened volatility over the past month, crypto whales remain optimistic about the PEPE meme coin.

According to IntoTheBlock’s Balanced Buy Holding Indicator, holdings by large investors with portfolios of 10 billion to 1 trillion PEPE have increased from 106.54 trillion tokens to 110.41 trillion tokens.

Notably, holdings by investors with 100 billion to 1 trillion PEPE have grown from 73.64 trillion to 78.79 trillion tokens.

Over the past 30 days, portfolios holding 10 billion to 100 billion PEPE have increased by 2.73%, while those with 100 billion to 1 trillion have expanded by 5.59%.

Interestingly, massive whales holding between 1 trillion and 10 trillion PEPE have also increased their holdings by 2.63% over the same period, reflecting growing confidence in the Ethereum-based meme coin among large investors.

Derivative Traders See Upside

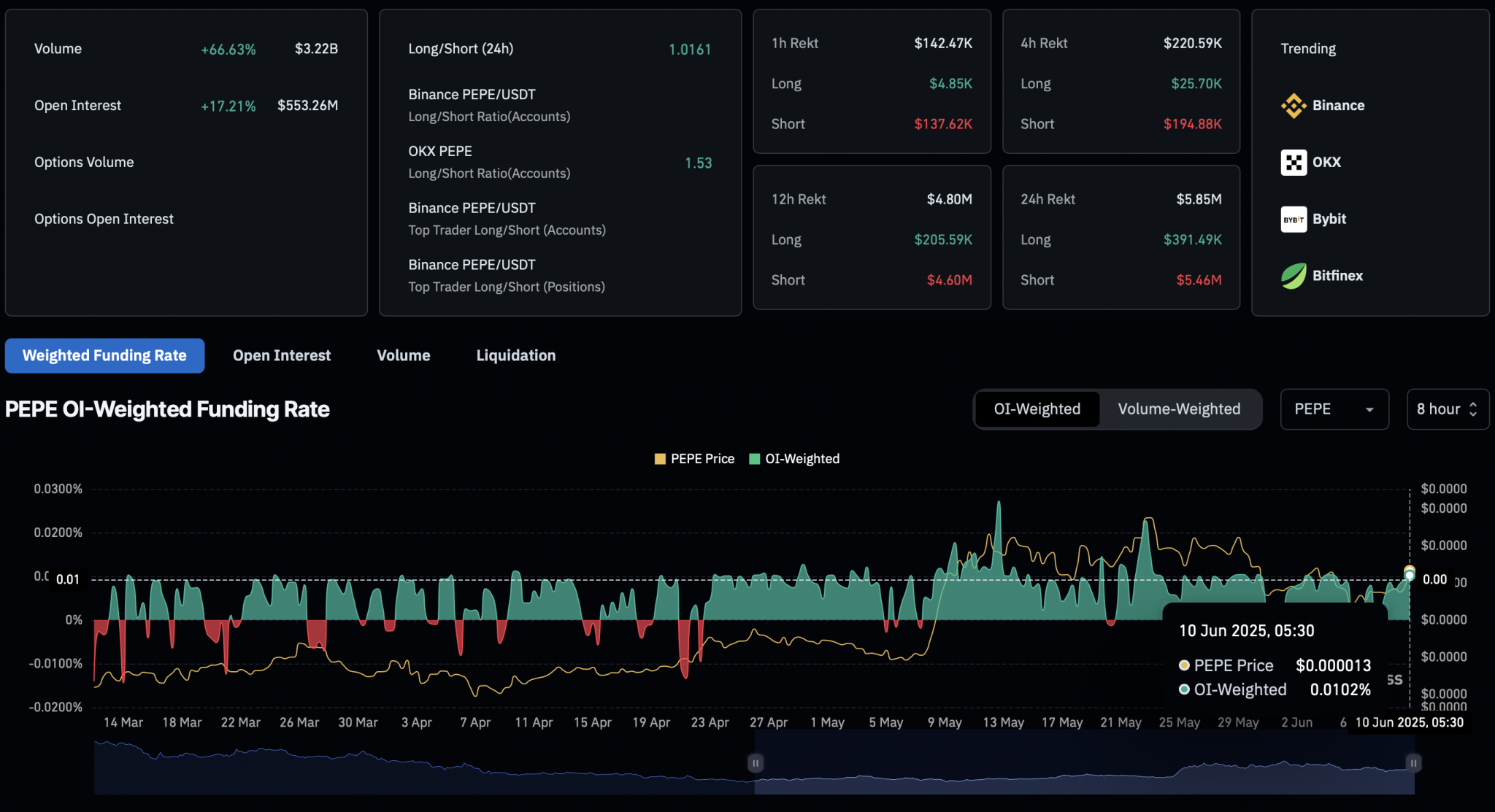

Further confirming the rising confidence in Pepe, Coinglass derivatives data shows an 18% increase in open interest, which has climbed to $556.49 million. This surge indicates heightened trading activity in Pepe derivatives.

The rising funding rate, which has increased to 0.0104%, reinforces the bullish sentiment. This indicates that bulls are willing to pay a premium to bears to maintain price alignment between spot and swap markets.

In the past 24 hours, the long-to-short ratio has risen above 1, suggesting a greater number of long positions compared to shorts.

During the same period, $5.54 million in short liquidations were recorded, signaling a significant wipeout of bearish traders and reinforcing bullish dominance in Pepe derivatives.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.