Bitcoin achieves a historic milestone by staying above a crucial price threshold for 30 consecutive days.

The first-born crypto achieved a significant milestone by maintaining a price above $100,000 for a month, marking the first time in the asset’s history.

For context, Bitcoin first reached the $100,000 milestone on December 5, 2025. This surge in value was partly fueled by the announcement that U.S. President Donald Trump had nominated a prominent crypto advocate to head the SEC. Interestingly, Trump praised Bitcoin enthusiasts after the milestone.

Following the initial spike above $103,000, Bitcoin saw a decline, dipping to around $94,000 before surging again to a new all-time high of over $108,000. However, the rally was followed by a sharp pullback, with Bitcoin falling as low as $74,000. Despite this volatility, the crypto gradually regained momentum and successfully reclaimed the $100,000 mark on May 8.

Since then, Bitcoin has maintained a value above $100K for 33 days now and counting. Specifically, following a record-high of $112,000 on May 22, Bitcoin saw a slight pullback to $100,428 by June 6, but found support at this level.

Interestingly, weekend buying pressure pushed the price back up to $105,000, and by June 9, it surged again to $110,000, fueled by optimism around US-China trade talks.

Bitcoin Keeps on Setting Records

Bitcoin price has fluctuated significantly over the past month, setting even further records.

Notably, on May 18, Bitcoin achieved a new local peak above $106,000 and recorded its strongest weekly close at $106,446, surpassing its previous record of $106,146 set in January. Moreover, Bitcoin also closed at an unprecedented $106,909 on May 20, marking its highest daily close ever.

Bitcoin Price Predictions

As the asset holds above $100K, analysts remain optimistic about its potential, suggesting it could leverage the $100K as a launchpad for greater heights. Specifically, Bitwise analysts believe Bitcoin could hit $200,000 by the end of the year, citing its fair value at $230,000.

Similarly, Bernstein, an $800 billion AUM firm, maintains its $200,000 price target for Bitcoin, calling it “high-conviction but conservative.”

In contrast, Peter Brandt, a well-known figure in the trading community, warns of a potential 75% price drop, drawing comparisons to Bitcoin’s 2022 chart setup.

Derivatives Market Trends

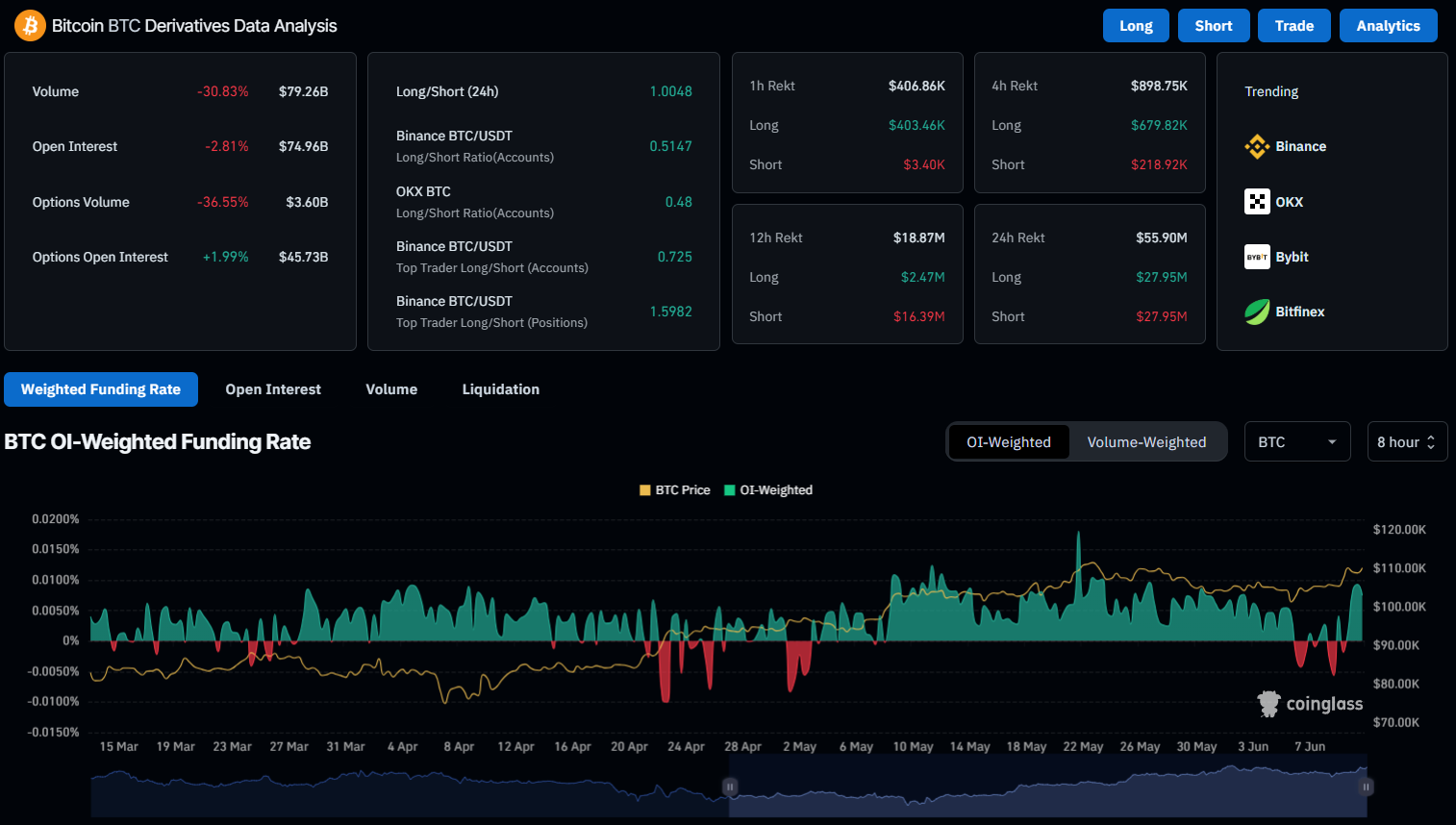

Meanwhile, Bitcoin’s derivatives market has been witnessing reduced activity. Trading volume for Bitcoin derivatives has decreased by 30.83%, settling at $79.26 billion. Open interest has also dropped by 2.81%, indicating fewer open contracts.

While options volume saw a decline of 36.55%, the open interest in options increased by 1.99%, reaching $45.73 billion. This suggests a shift in market participation, with traders holding fewer short-term positions and opting for longer-term contracts.

Liquidation Data Reveals Market Sentiment Shifts

The liquidation data for Bitcoin reveals notable market trends. In the past hour, $406.86 million in positions were liquidated, with the majority being long positions, totaling $403.46 million.

Over the last four hours, long liquidations dominated, accounting for $679.82 million of the total $898.75 million liquidated. The liquidation trend continued in the last 24 hours, with a near-even split between long and short liquidations, totaling $55.90 million.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.