The price of Cardano has dropped 3% as it tests key support. With rising liquidations and weakening derivatives sentiment, will ADA plunge to $0.50?

Cardano faces the risk of breaking down from a crucial support trendline after falling over 3% on Tuesday. Could this drop push ADA to the psychological $0.50 level? Let’s explore.

Cardano Price Analysis Warns of Wedge Breakdown

On the daily chart, Cardano shows a bearish reversal from a long-standing resistance trendline, leading to a pullback of over 15% in the past week. At the time of writing, ADA trades at $0.61 with a modest intraday recovery of over 0.5%.

-

Cardano Price Chart

Amid the ongoing downtrend, Cardano is now testing a critical local support trendline, as bulls struggle to absorb increasing selling pressure. The current price action reveals a wedge pattern formed by converging trendlines.

While the trend suggests a possible bearish continuation, technical indicators are giving mixed signals. The MACD and signal lines remain in a downtrend, whereas the daily RSI shows a minor bullish divergence.

If selling pressure persists, a decisive close below the support trendline could extend Cardano’s decline toward the psychological $0.50 mark. However, a rebound could see ADA retest immediate resistance near the overhead trendline at $0.68.

Cardano Derivatives Traders Hold Bearish Bias

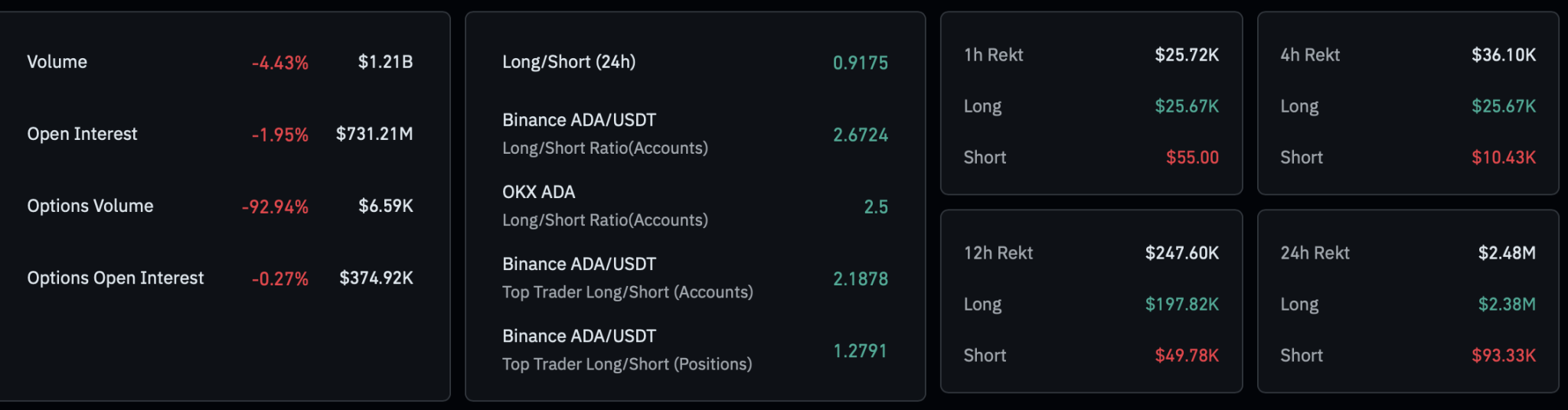

Meanwhile, optimism in Cardano’s derivatives market continues to fade as downside risks increase. According to Coinglass data, Cardano’s open interest has declined by 1.95%, falling to $731.21 million.

Adding to the bearish sentiment, long liquidations over the past 24 hours reached $2.38 million, substantially higher than the $93,330 in short liquidations.

-

Cardano Derivatives

This imbalance has pushed the 24-hour long-to-short ratio down to 0.9175, indicating a larger proportion of active selling positions. With bearish dominance evident in the Cardano derivatives market, traders appear to be bracing for a deeper correction.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.