Ethereum prices hold steady at $2,500 while network growth, whale accumulation, and ETF inflows hint at a bullish breakout.

As the broader crypto market maintains a sideways trend, Ethereum holds ground at $2,500. Despite quiet price movement, the utility and network growth, and increased whale support signal a potential bull run ahead.

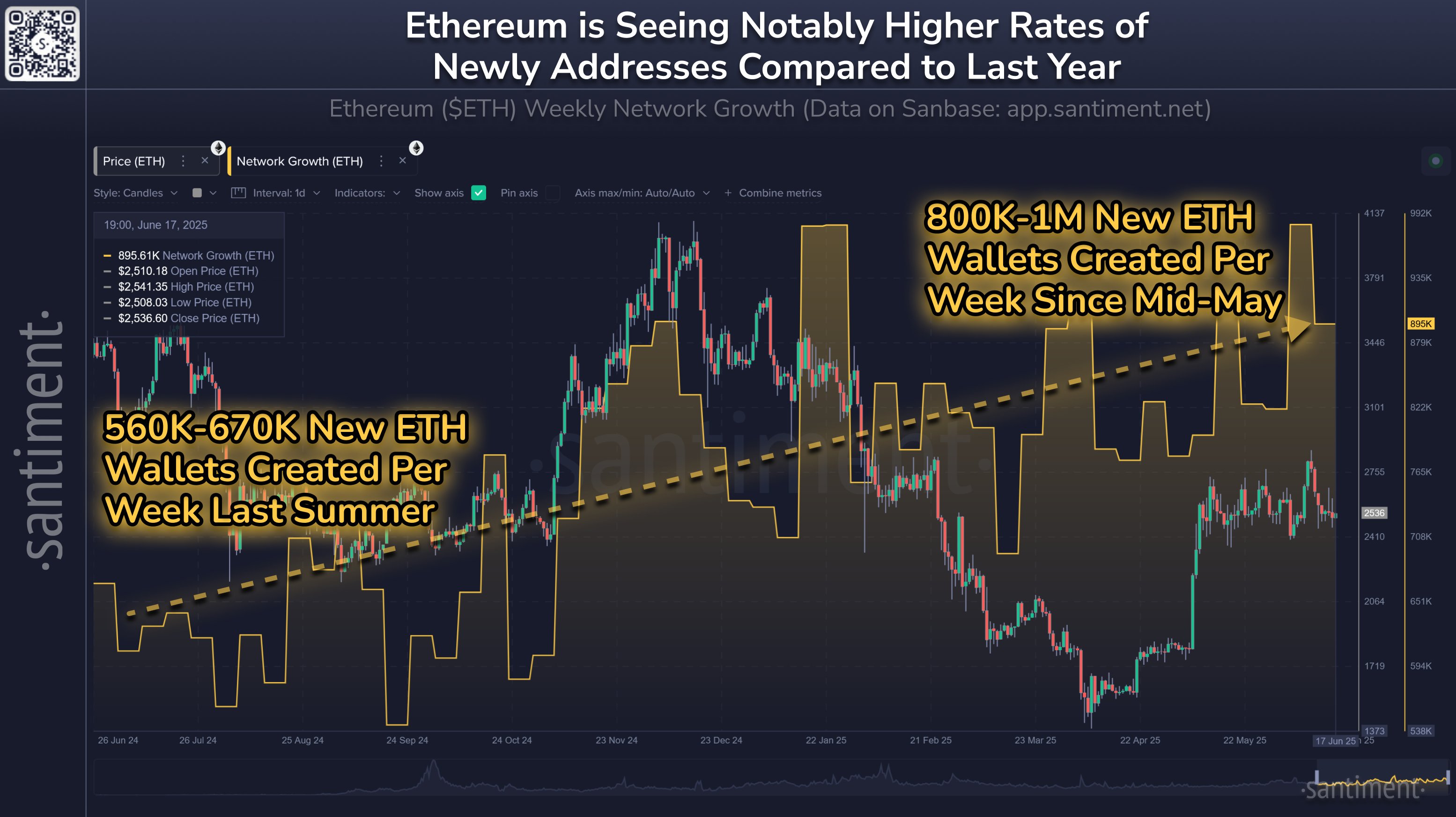

Ethereum Network Growth

In a recent tweet, Santiment, the on-chain analytics platform, highlighted Ethereum’s increased utility and network growth. The number of new weekly Ethereum addresses created has surged from 560k–670k last summer to 800k–1 million since mid-May. With more addresses being created on Ethereum, the fundamentals flash a bullish sign.

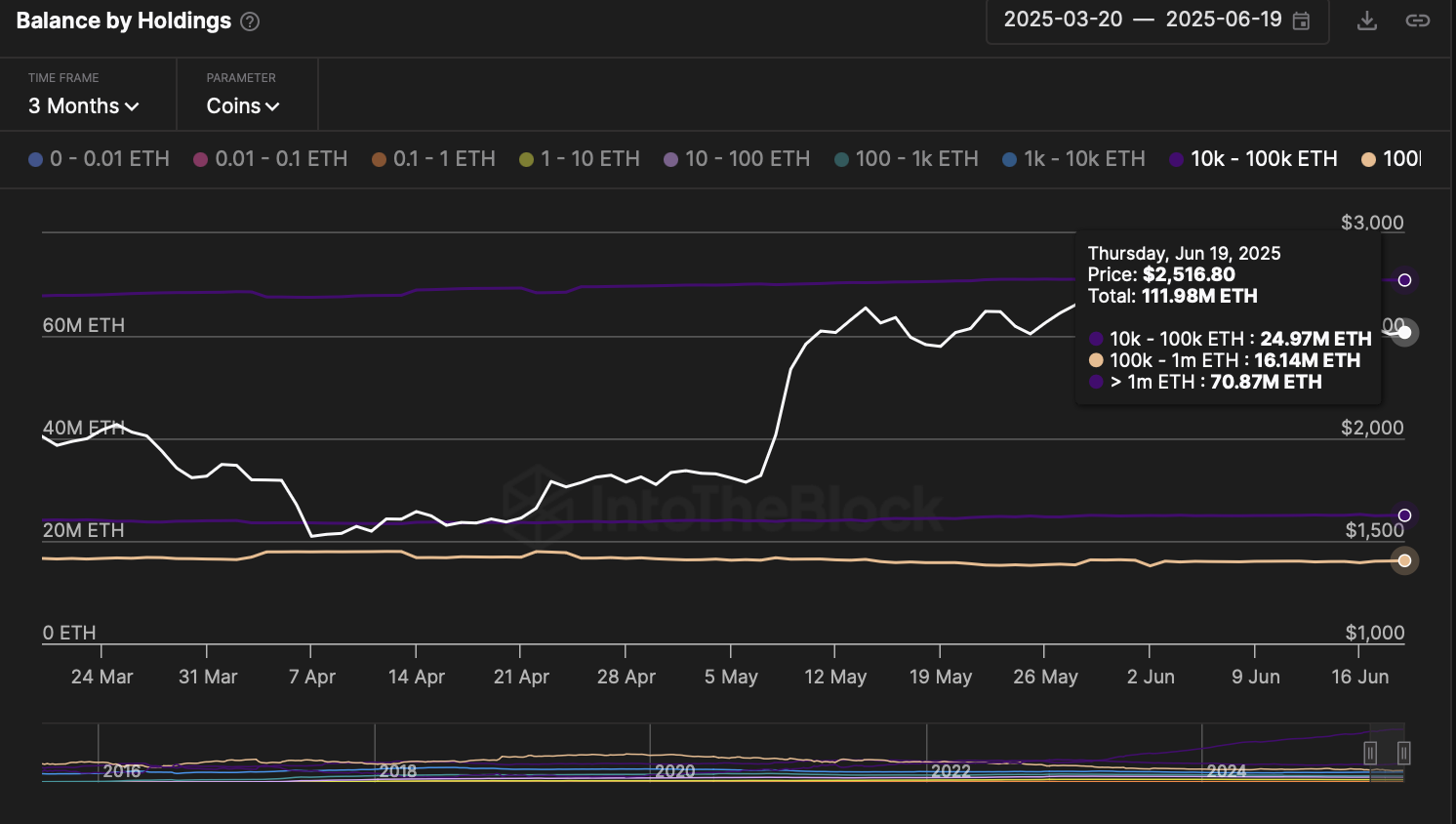

Whales and Institutions Acquire More Ethereum

Amid the rising network activity, IntoTheBlock data highlights an increase in holdings by investors with more than 1 million ETH. Over the past three months, their combined portfolio expanded from 67.81 million ETH to 70.87 million ETH.

Remarkably, the collective holdings of investors with more than 10,000 ETH have surged 24 million tokens. With increased confidence from whales, Ethereum is likely to witness a bullish reversal.

-

Ethereum Balance by Holdings | IntoTheBlock

Alongside crypto whales, institutional support is also on the rise for Ethereum. The daily net inflow into U.S. Ethereum spot ETFs on June 18 was $19.10 million. This marks the third consecutive day of inflows after a minor outflow of $2.18 million on June 13.

Overall, the monthly inflow so far totals $860.77 million, raising the total net assets in U.S. Ethereum spot ETFs to $9.94 billion.

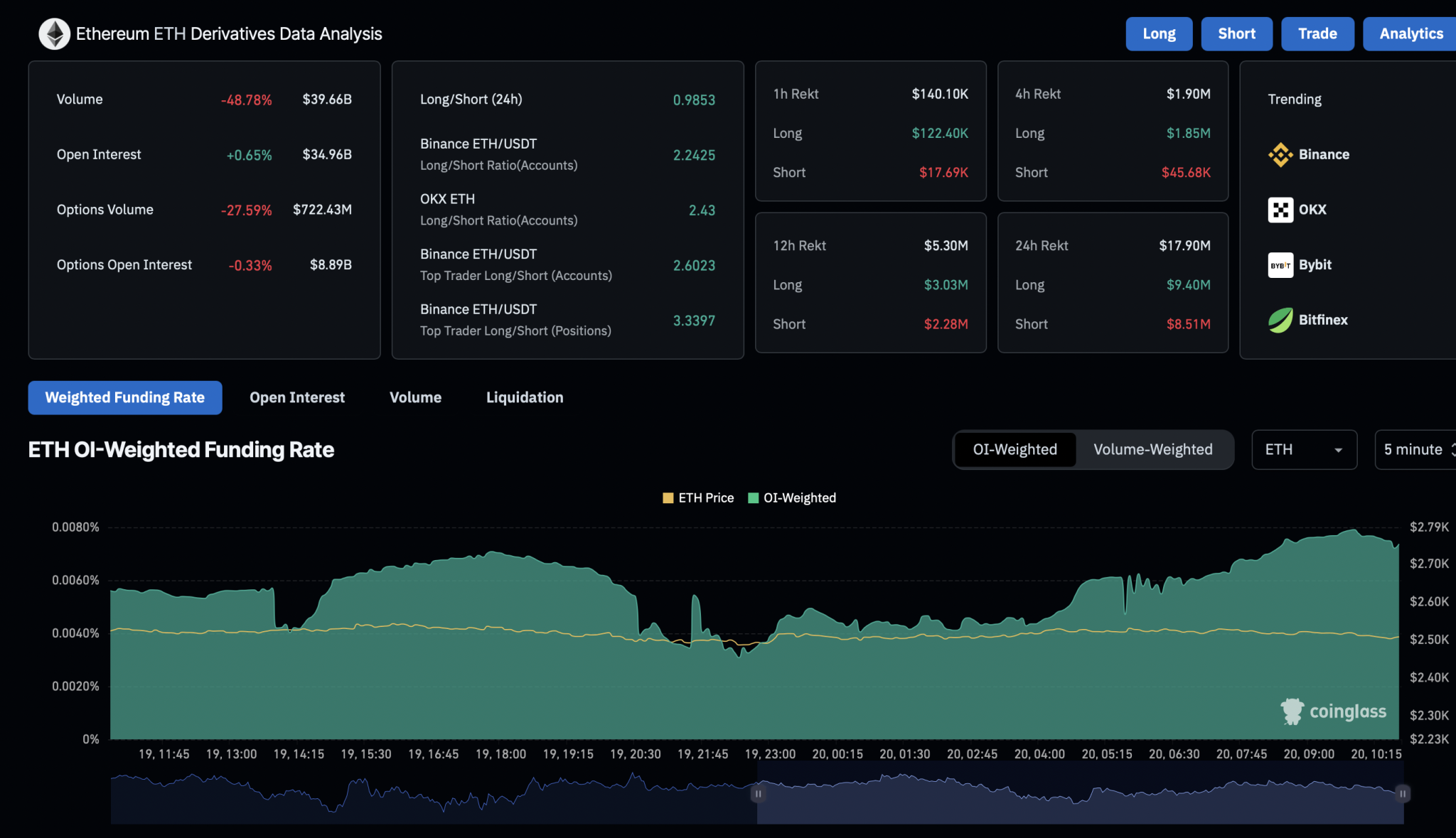

Ethereum Derivatives

In the derivatives market, optimism remains strong as Coinglass data shows open interest at $34.96 billion, with a minor increase of 0.65%. Over the past 24 hours, liquidations are almost evenly split: long liquidations at $9.4 million and short liquidations at $8.51 million.

However, short positions still marginally outnumber longs, with the long-to-short ratio at 0.9853. Nevertheless, bullish trading activity in Ethereum derivatives continues to grow, with the open interest-weighted funding rate rising to 0.0074%.

-

Ethereum Derivatives

Ethereum Price Analysis

On the daily chart, Ethereum maintains a sideways trend slightly above $2,500, as noted in our previous analysis. While momentum indicators remain bearish to neutral, lower price rejection in daily candles signals the possibility of a bullish turnaround.

The immediate resistance for Ethereum lies at the 50% Fibonacci retracement level of $2,699. If Ethereum surpasses this level, the uptrend could extend toward the 61.8% Fibonacci level near the $3,000 psychological mark.

On the downside, crucial support remains at $2,395.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.