Bitcoin traders are watching the Federal Reserve closely today following a pattern of strong price moves after past FOMC meetings.

Specifically, prominent market analyst Merlijn The Trader posted on X that “Bitcoin loves FOMC,” noting that 5 out of the last 7 meetings resulted in upside movements. Data from an accompanying chart confirms this disclosure, with Bitcoin rallying at least 10% immediately after the past three meetings.

For context, Bitcoin surged by as much as 40% following the November 2024 meeting after a 16% rally in October 2024. Meanwhile, in 2025, past FOMC meetings in April, June, and July had led to 18%, 10%, and 14% surge in Bitcoin, respectively.

Only two FOMC meetings led to declines: a mild 2% drop in January 2025 and a larger 29% correction in February.

Given this historical pattern of predominantly positive price movement, Merlijn anticipates the potential for another upward shift if similar conditions unfold. Notably, Bitcoin is trading at $117,558, a 1.2% drop in the past day, reducing its monthly gain to 9.2%.

No Rate Change Expected, Focus on Powell’s Comments

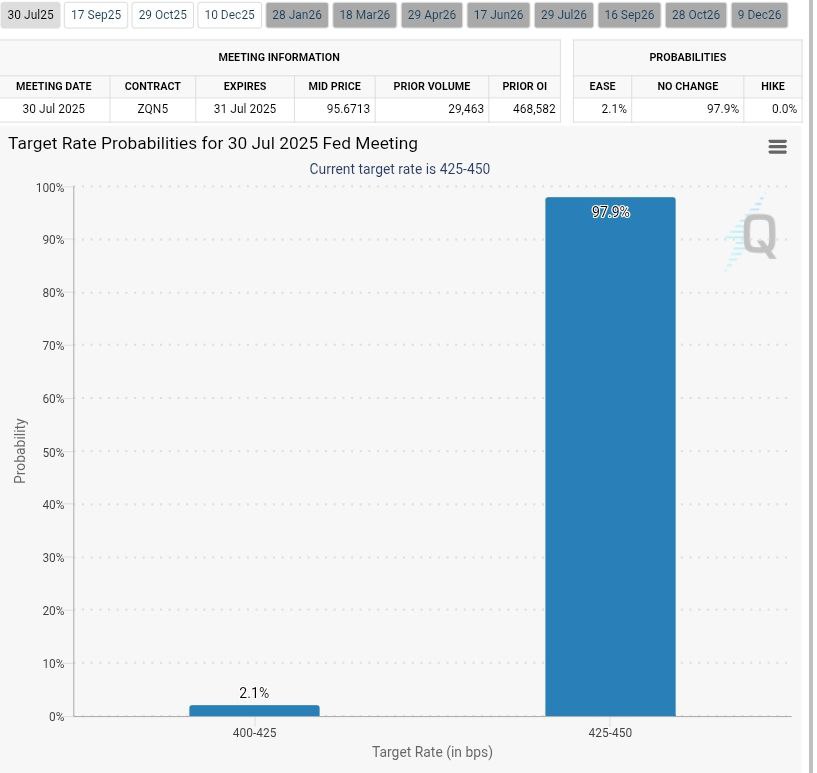

Today’s FOMC decision is scheduled for 2 p.m. ET. According to market data, there is a 97.9% probability the Fed will hold rates steady. This reflects the current economic outlook and recent inflation readings.

However, the market does not treat the rate decision as the main event. Instead, traders are focused on what Powell will say during the press conference following the announcement.

Financial analyst Cas Abbé highlighted the potential for sharp market moves surrounding today’s events, pointing to the importance of Jerome Powell’s press conference as the key moment that could drive volatility.

He noted that recent meetings between Powell and political leaders, including Donald Trump, have raised speculation that Powell may strike a more dovish tone.

Dovish Signals Could Trigger a Rally

In monetary policy, a dovish stance indicates the potential for rate cuts or looser financial conditions. If Powell signals such a shift, traders believe it could increase risk assets, especially Bitcoin.

Bitcoin often reacts strongly to Fed guidance, reflecting broader sentiment around liquidity and risk-taking. If Powell hints at easing in the months ahead, traders may take that as a green light to rotate capital into crypto and tech-related assets.

Notably, Merlijn also pointed to a strong link between rising global liquidity and Bitcoin’s recent price gains, highlighting that Bitcoin has closely tracked increases in Global M2.

BITCOIN LIQUIDITY IS STACKING BOTH SIDES| ETH COILING| ALTCOINS BLEEDING – BUT THE FOMC IS THE HEAT!

Watch here:👇https://t.co/65imkQetAN pic.twitter.com/tIH5PBWJBA

— Merlijn The Trader (@MerlijnTrader) July 30, 2025

He emphasized that liquidity is building ahead of today’s FOMC meeting, positioning the event as a key catalyst. With Ethereum consolidating and altcoins weakening, he suggests that the outcome of the Fed’s decision could drive the next major move in the crypto market.

Bitcoin’s Price Analysis

Meanwhile, Bitcoin is consolidating tightly within a symmetrical triangle pattern ahead of today’s FOMC meeting. Price has been range-bound between $117,000 and $118,700 over the past 72 hours, with volatility expected to increase as the pattern approaches its apex.

Despite short-term weakness indicated by technical signals like the Parabolic SAR and VWAP rejection near $118,099, Bitcoin defends its ascending trendline.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.