Cathie Wood Weighs in on SEC v. Ripple Case, Gives Timeline for Bitcoin Spot ETF. Both issues concern the SEC and have lingered for years.

In 2020, the United States Securities and Exchange Commission (SEC) accused Ripple and its executives of breaking securities laws by selling XRP to fund its business. It argued that the blockchain payments company should have registered the asset with the commission. After over two years, the extended legal battle finally awaits a court ruling.

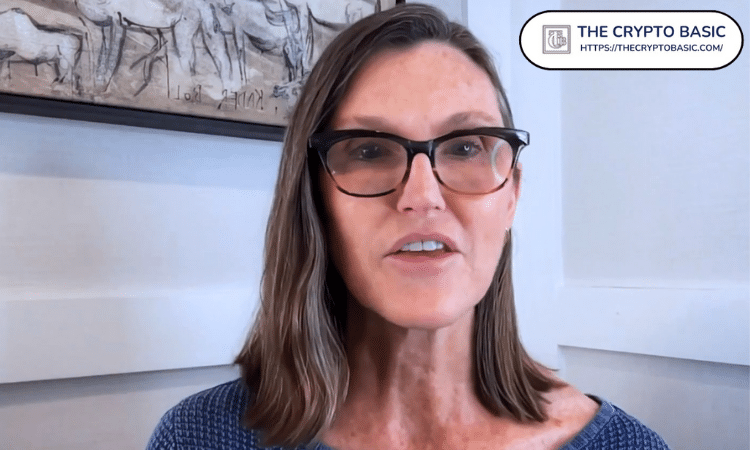

Ark Invest Chief Executive Officer Cathie Wood has weighed in on the case’s outcome. She believes that the SEC looks poised to lose the case. However, she does not explain why she believes this is the case.

“It seems they [the SEC] might be on the way to losing that [the Ripple case] as well,” Wood said in a recent interview, outlining recent losses the commission had taken in court.

It is worth noting that recent rulings in the legal battle appear to favor the blockchain payments company. As reported, Ripple Chief Legal Officer Stuart Alderoty said that the firm grew more confident with each ruling following Judge Analisa Torres’ ruling on Daubert motions.

Ripple has also recently filed letters citing court rulings from separate cases supporting its fair notice defense. As recently reported, the SEC has finally responded to these letters. However, pundits noted that the reply did little damage to Ripple’s arguments, particularly as regards statements from the judge in Voyager’s bankruptcy case.

Attorney John E. Deaton, who represents thousands of XRP holders in the legal battle as a friend of the court, has told community members to expect a ruling on so-called summary judgment in the next few weeks.

Notably, Wood’s latest statements came in response to inquiries about the possibility and timeline of an SEC-approved Bitcoin spot exchange-traded fund (ETF) in the U.S.

A Bitcoin Spot ETF in June?

The Ark Invest chief called out the commission for being inconsistent in approving Bitcoin ETF products citing statements from judges in the Grayscale appeal. As highlighted in a previous report, judges questioned why the same fraud protections were sufficient for the SEC to approve a futures ETF but insufficient for a spot ETF.

Consequently, Wood expects a favorable ruling for Grayscale, which she predicts will come in June. She said that the SEC would be left to choose between shutting down the Bitcoin futures product it approved or approving the Grayscale spot ETF.

Recall that Wood’s Ark Invest has submitted a Bitcoin spot ETF application twice in partnership with 21Shares; on both occasions, the SEC rejected the offering, with the most recent rejection coming in January.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.