The COTI-issued Cardano stablecoin Djed has allegedly depegged from the dollar on the open market as the token’s reserve ratio recently fell below par.

Launched on mainnet in January 2023, the Cardano algorithmic stablecoin Djed is already causing problems related to de-pegging for its users, The Cardano Times (TCT) disclosed.

According to the free media network of Cardano, the reserve ratio of Djed has fallen below the percentage range needed to keep the algorithm-based stablecoin stable.

REPORT: $DJED, the stablecoin issued by Coti; has failed to maintain a reserve ratio between 400-800% making it un-mintable through the $DJED protocol for users, which has caused a consistent de-pegging on all #Cardano DEXs with $DJED trading at a price of $1.078 as of writing. pic.twitter.com/mZLUd0E2bC

— The Cardano Times (@TheCardanoTimes) July 5, 2023

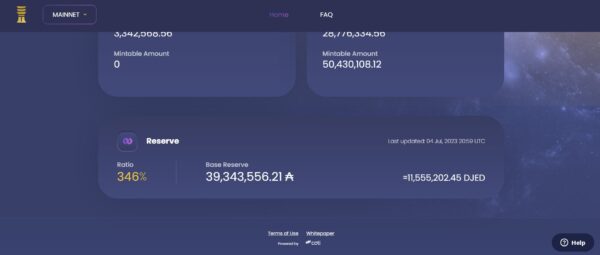

The Cardano stablecoin’s reserve ratio has declined to 346% per a snapshot shared on Wednesday by TCT. As of July 4, its base reserve had roughly 39, 343,556 ADA, equivalent to 11,555,202 DJED tokens.

This has made the asset un-mintable. The stablecoin, which has the DAG-based Layer-1 protocol COTI as its official issuer, now trades slightly above the dollar.

The tweet noted: “DJED, the stablecoin issued by Coti, has failed to maintain a reserve ratio between 400-800% making it un-mintable through the DJED protocol for users, which has caused a consistent de-pegging on all Cardano DEXs.”

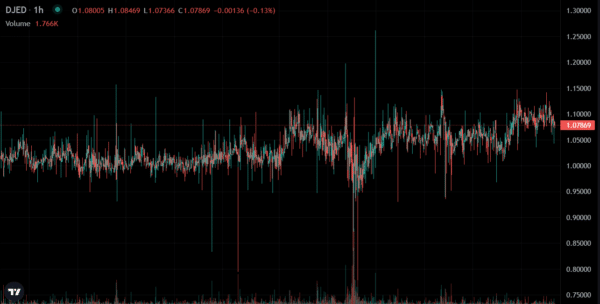

To further buttress this, The Cardano Times shared a chart depicting June’s trading history of Djed, alleging that users cannot buy the stablecoin at $1.

Cardano Community Reacts

This development triggered a mild fuss in the Cardano community. While some users noted that Coti has failed to ensure sufficient liquidity for the stablecoin, others claimed that Djed is working as intended.

Djed holders can still get the $ amount of ADA when selling via https://t.co/mZzY9X7wGI or ~10% more when selling via a DEX. I would say djed works as intended, it needs time for ppl to realize the investment opportunity by holding SHEN. Organic adoption doesn't happen over night

— Bj₳rne?| TECH Pool ? (@CardanoTech) July 5, 2023

Responding to the user who submitted that the stablecoin has “completely failed” regarding liquidity, TCT claimed Djed has only de-pegged on all Cardano DEXs and not on the protocol itself.

Though the algorithmic stablecoin still maintains a price of $1.00 on its protocol through its burn mechanism, TCT claimed that it was impossible to buy the token at $1 in the open market at the time of its announcement.

de-pegging on Cardano DEXs*

The protocol itself maintains a price of $1.00 through its burn mechanism, but obtaining $DJED for a price of $1.00 through the open market or through the protocol itself is impossible at the time of writing this tweet.

— The Cardano Times (@TheCardanoTimes) July 5, 2023

On the other hand, the EMURGO Academy Community Lead Jonah Koch noted that the stablecoin is working as designed. He further suggested ways to help Djed maintain its peg. He added that the stablecoin issuer should stop minting the reserve token SHEN to pay COTI holders. Koch stressed that SHEN should only be minted to maintain Djed’s peg.

It bears noting that this development comes shortly after Cardano’s overcollateralized dollar-pegged stablecoin Djed became available for lending and borrowing on Liqwid.

COTI CM Provides Clarification

Shortly after the report from The Cardano Times, Prince Pratap Singh, Community Manager at COTI Network, provided a detailed response to address concerns raised.

According to Pratap, there is no need for concerns, as the protocol is working as intended. He focused on two key aspects: the reserve and the peg.

????? ??????:

The protocol is functioning as intended, and everything is fine.???? ??????:

(1) Reserve:

As part of the safety mechanism, it is necessary to ensure sufficient collateral for Djed at all times.Once the reserve ratio falls below 400%,…

— Prince (@PrincePratapS_) July 5, 2023

With regards to the reserve, Pratap emphasized the utmost importance of maintaining adequate collateral for DJED.

Should the reserve ratio fall below 400%, DJED minting would be prohibited. He confirmed that this is normal procedure and triggers no alarm bells. The ratio could fluctuate below 400% or surpass 800%, depending on ADA’s price and fees within the ecosystem.

Despite these fluctuations, DJED can be redeemed at any given time regardless of the prevailing collateral ratio at the time.

Regarding the peg, Satrap emphasized that most stablecoins, including DJED, possess both a market price and a peg.

The market price can experience fluctuations on decentralized exchanges due to factors such as demand, supply, and the conditions of the market. Notably, DJED is currently trading for $1.0688, per data from CoinMarketCap.

Stablecoin market prices, particularly in their early stages, may exhibit volatility.

However, the peg is the value of the collateral that the stablecoin could be redeemed against. He stressed that DJED has maintained its peg and can be exchanged for $1 worth of ADA within the djed.xyz protocol despite the fluctuations observed with the market price.

Note: DJED did not in fact lose its peg against the dollar, and could be burned or redeemed at all times. The stablecoin’s market price merely experiences fluctuations due to the volatility observed as a result of its nascence. The CM of COTI recently provided clarifications on this. Notably, the article was updated on July 7, 5:26 (UTC) to reflect this fact.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.