Attorney Deaton slams the U.S. SEC for engaging in an unconstitutional expansion of the Howey test, adding that it violates the law.

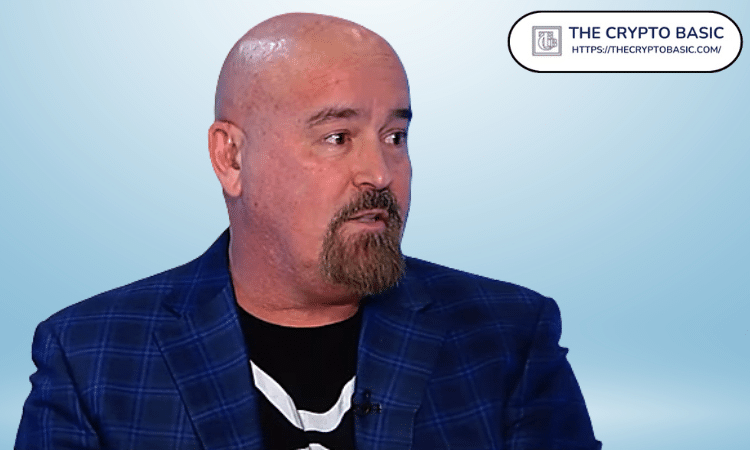

Pro-XRP lawyer John Deaton supports Coinbase Chief Legal Officer Paul Grewal for saying the SEC is violating the law.

In a tweet yesterday, Grewal said the SEC’s interpretation of investment contracts violates the law. Grewal made the comment after reading the Major Questions Doctrine of the Supreme Court’s opinion in Nebraska.

I’ve read, re-reread, and re-re-read the Major Questions Doctrine holding in Nebraska at p. 19-26. Swap out “Secretary” for “Chair,” “digital asset” for “student loans,” and there is no conclusion but one: the SEC’s interpretation of “investment contract” violates the law. 1/3

— paulgrewal.eth (@iampaulgrewal) July 4, 2023

It is worth noting that Grewal’s remark stirred mixed reactions within the crypto community.

However, attorney Deaton believes the Coinbase Chief Legal Officer was on point with his assertion. The pro-XRP lawyer noted that the Securities and Exchange Commission illegally expanded the Howey test.

Deaton Provides Facts Showing SEC Is Violating the Law

Notably, attorney Deaton provided a few facts to show that the SEC’s interpretation of investment contracts violates the law.

According to Deaton, until 2018, the SEC had no policy preventing its staff from owning crypto. This is because the regulator was unsure about the emerging assets.

Is @iampaulgrewal engaging in hyperbole by claiming the SEC is violating the law?

LET’S REVIEW A FEW FACTS:

1) up until 2018, the SEC had no policy whatsoever regarding SEC staff owning Crypto because these digital assets were a new asset class and the SEC was unsure about it; https://t.co/9UU4jzuoZl

— John E Deaton (@JohnEDeaton1) July 4, 2023

Secondly, Deaton noted that in 2018 when Hinman was drafting his speech on cryptocurrencies, top officials at the commission acknowledged that crypto fell into a regulatory gap. He added that these officials were not confident that the commission could regulate cryptos.

Thirdly, the pro-XRP lawyer also highlighted the annual FSOC report published in 2019 as another fact backing his claim. Notably, officials like Jerome Powell and Jay Clayton signed the report, highlighting XRP and BTC as virtual currencies.

For the fourth fact, Deaton said SEC Chair Gary Gensler acknowledged during his confirmation in early 2021 that this regulatory gap exists regarding how to regulate crypto.

Per Deaton, Gensler also noted that there is no existing regulation for crypto companies because these assets fall outside the SEC and CFTC framework.

Deaton Highlights Other Facts

Furthermore, Deaton said there has never been a case in the United States which finds that an investment contract exists between the promoter/issuer of an asset and the buyer when there is no privity or communication between the buyer and the issuer.

Similarly, the lawyer pointed out that no case in the U.S. finds that an asset’s secondary sale utilized in an investment contract transaction could also constitute a security.

He also mentioned the Supreme Court’s decisions on West Virginia vs. EPA (Environmental Protection Agency) and the SCOTUS opinion in Nebraska. Notably, both decisions struck down different agencies’ unauthorized use of power.

Additionally, Deaton said the recently proposed legislation for crypto limits the SEC’s regulatory authority in the industry. Lastly, Deaton said President Joe Biden’s executive order favors the CFTC more than the SEC.

“Paul Grewal is not being hyperbolic by claiming Gensler and the SEC are violating the law,” said Deaton.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.