Amid the massive renewal in XRP trading activity, South Korea’s largest exchange Upbit leads in 24-hour trading volume, commanding $2.5 billion.

XRP’s victory in the Ripple vs. SEC lawsuit has expectedly triggered a massive influx of trading activity as the market sees a renewal of interest. Amid this uptick in activity, South Korea’s largest exchange Upbit has recorded the largest 24-hour trade volume, towering above all other exchanges, including Binance.

Colin Wu, a reputable blockchain reporter, first called public attention to the bullish development in a tweet today. According to Wu, this confirms that South Korean investors have made massive contributions to the recent XRP rally.

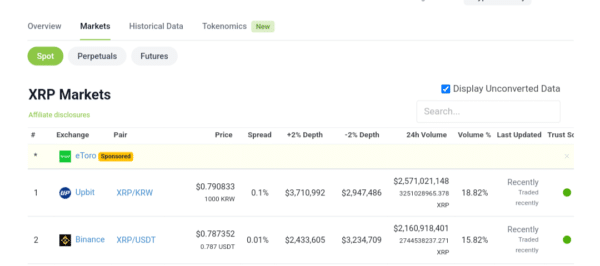

According to Coingecko, South Korea’s largest exchange, Upbit, ranks first in the trading volume of XRP, reaching $2.1 billion in 24 hours, Binance is 1.7 billion, and OKX ranks third with 500m; showing Korean investors still a major thrust of this XRP pump.…

— Wu Blockchain (@WuBlockchain) July 14, 2023

It is essential to note that the renewal of investors’ interest catalyzed a rapid surge in XRP’s trade volume. As of July 13, XRP’s 24-hour volume was $613.5 million. However, trade volume has surged to the current value of $13.58 billion. This represents a 2,114% increase.

At the time of Wu’s disclosure, the reporter revealed that XRP trade volume on Upbit stood at $2.1 billion over 24 hours, while Binance had a trade 24-hour volume of $1.7 billion. However, current data suggest a more impressive figure.

Per data from CoinGecko, Upbit’s 24-hour trade volume for XRP is currently $2.57 billion for the XRP/KRW pair. This figure represents 18.82% of the global trade volume for XRP across all exchanges.

The XRP trade volume on Binance has also surged to $2.16 billion for the XRP/USDT pair. This value represents 15.82% of the global XRP trade volume of $13.58 billion. Notably, Binance also commands trade volume from other XRP pairs, including XRP/BUSD, XRP/TRY, and XRP/EUR.

XRP Secures Victory

The surge in trade activity comes a few hours after Judge Torres ruled that XRP is not a security, as previously reported by The Crypto Basic. The Judge also ruled on the SEC’s allegations against Ripple and its executives on sales of XRP.

While Judge Torres ruled that Ripple’s institutional sales of XRP constituted an investment contract, she noted that programmatic sales, Chris Larson’s and Brad Garlinghouse’s sales, and other distributions do not constitute investment contracts.

The XRP victory elicited a wave of euphoria within the XRP community and the broader crypto space. Investors trooped into XRP as it secured a position as the only regulated crypto asset. As a result, XRP rallied 30% in less than 3 hours.

Due to the massive trade activity, the Uphold faced issues as it could not handle all the load. Exchanges such as Coinbase and Kraken swiftly relisted the asset after over two years. XRP sustained its rally, surging by 77% to a one-year high of $0.82. XRP is currently trading for $0.79, up 68% over the last 24 hours despite a modest drop in momentum.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.