Leading Japanese financial giant SBI recently disclosed future developments for ODL in Japan as it leverages XRP for domestic and international remittances.

SBI VC Trade, the crypto asset exchange business of financial giant SBI Group, has revealed future developments for Ripple’s On-Demand Liquidity (ODL) product in Japan. The disclosure details how SBI aims to leverage XRP for ODL remittances in Japan and the Philippines.

SBI VC Trade made the announcement during its Zoom webinar on July 28. The webinar featured speeches from Emi Yoshikawa, Ripple’s Vice President of Strategy & Operations, and Tomohiko Kondo, the Representative Director and President of SBI VC Trade.

Notably, SBI VC Trade convened the webinar to deliberate on the recent court ruling in the Ripple case and disseminate crucial insights on utilizing XRP. Furthermore, the discussion encompassed forthcoming opportunities for XRP and Ripple’s ODL solution alongside initiatives from SBI Group.

Following the webinar, Kondo took to Twitter to share one of the slides used for the discussions. According to the SBI VC Trade Chief, the slide, which details the firm’s utilization of XRP and ODL in Japan, provides insights into SBI’s future developments for ODL.

XRPのウェビナーにご参加いただいた皆様、ありがとうございました。

最後のスライドが見えていなかったというコメントを頂戴しましたので、ODLの今後の展開のスライドをこちらで再掲させていただきます。

今後のアナウンスにご期待下さい。 https://t.co/eHpM2BQ6mD pic.twitter.com/oAlBvdbDO8

— 近藤 智彦@SBI VC Trade (@tomohiko_kondo) July 28, 2023

Mode of Operation

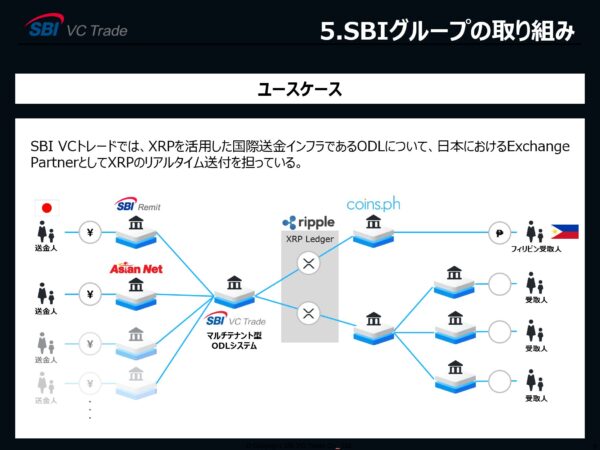

Information from the slide discloses that SBI VC Trade takes responsibility for transmitting XRP. The firm’s role in this business model is due to its position as Ripple’s exchange partner for ODL in Japan.

Notably, Japanese customers who wish to make domestic remittances or remittances to other countries like the Philippines would leverage a local payment company to make the transfer. The payment companies detailed in the slide include SBI Remit, a subsidiary of the SBI Group, and Asian Net.

The funds, sent in Japanese yen, would then move from these firms to SBI VC Trade through its newly-introduced multi-tenant system for ODL. Afterward, SBI VC Trade would convert the assets from yen to XRP on the XRP Ledger and then reconvert from XRP to the recipient’s local currency.

For recipients in the Philippines, SBI VC Trade would convert from XRP to the Philippine peso, leveraging coins.ph, a crypto exchange based in the Philippines, to initiate the payout to the recipient.

SBI’s Relationship with Ripple

The recent development further solidifies Ripple’s relationship with the SBI Group. Both companies have established close ties aimed at leveraging XRP, the XRPL, and ODL for remittances in Japan. Last June, SBI Africa disclosed plans to use ODL if Ripple wins the SEC lawsuit.

Following the favorable ruling in the case, SBI introduced a campaign for XRP dubbed the Midsummer XRP Festival. As earlier reported by The Crypto Basic, the campaign features several initiatives to bolster XRP’s presence in Japan. These initiatives include an XRP lottery and spot & leverage trading campaigns.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.