As prices flirt with the $0.52 zone, XRP recently witnessed its largest surge in the movement of dormant tokens in nearly three weeks amid an increase in Open Interest.

With the prevalent downturn in the broader market comes a turbulent period for XRP and other cryptocurrencies. While XRP recently dropped 10.1% over a seven-day period, a report from The Crypto Basic yesterday confirmed that it outperformed the broader market, which collapsed 13.3% within the same timeframe.

XRP briefly slid to a low of $0.4782 on the first day of this month, but a quick recovery move has seen it reclaim the pivotal levels at $0.50, $0.51, and, most recently, $0.52. Amid the recovery push, Santiment called attention to an observable rise in the movement of dormant XRP tokens.

XRP Sees Spike in Dormant Token Movement

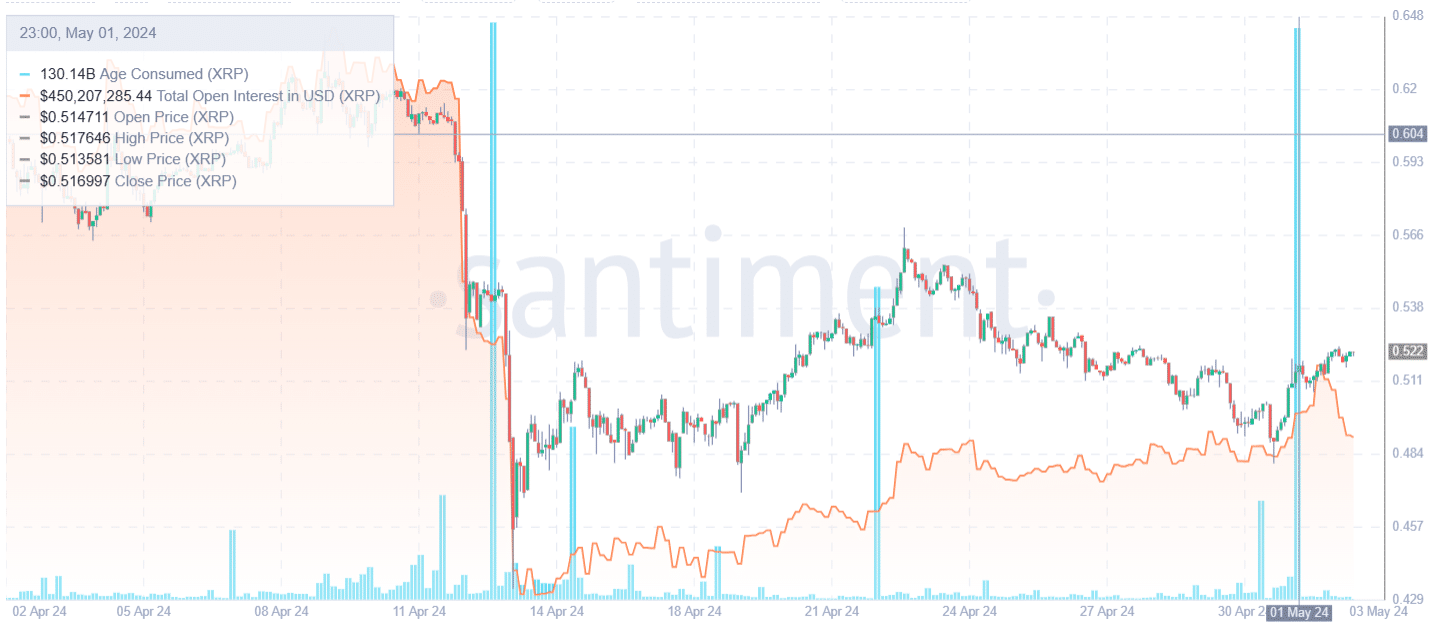

In an analytical post yesterday, the crypto behavior resource leveraged its Token Age Consumed metric to identify a massive spike in the number of old tokens moved by market participants, with the value surging to 130.14 billion on May 1.

🤑 #XRPLedger has been seeing an abundance of dormant tokens moving to open up May. Our Token Age Consumed metric indicates that this was a remarkably similar spike in old coins being moved compared to the April 13th spike, just before markets tanked and $XRP dropped -16% in… pic.twitter.com/vHpaDuJNaE

— Santiment (@santimentfeed) May 2, 2024

Notably, this indicator tracks the amount of XRP tokens moved by traders on a particular day and then multiplies this figure by the last time the tokens were moved. The latest data marks the highest value since April 13, suggesting that market participants moved a large amount of dormant XRP tokens on May 1.

Santiment confirmed that while the XRP network witnessed a similar surge on April 13, amounting to 131.41 billion, the market responded with a massive collapse. This rise coincided with an already bearish phase for XRP, as it had already recorded an 11.54% drop on April 11 and 12.

As a result, the rise in the Token Age Consumed metric on April 13 was a result of investors moving to sell off or distribute their holdings as a hedge against steeper declines. This resulted in a massive 12.44% price collapse for XRP on April 13, its largest intraday loss since Aug. 17, 2023.

However, industry pundits believe the spike in tokens moved on May 1 could lead to a different result. As asserted by Santiment, the recent surge in movement could be due to investors rushing to scoop up more XRP tokens. This could consequently bolster the ongoing relief rally staged by XRP, which has already seen it reclaim $0.52.

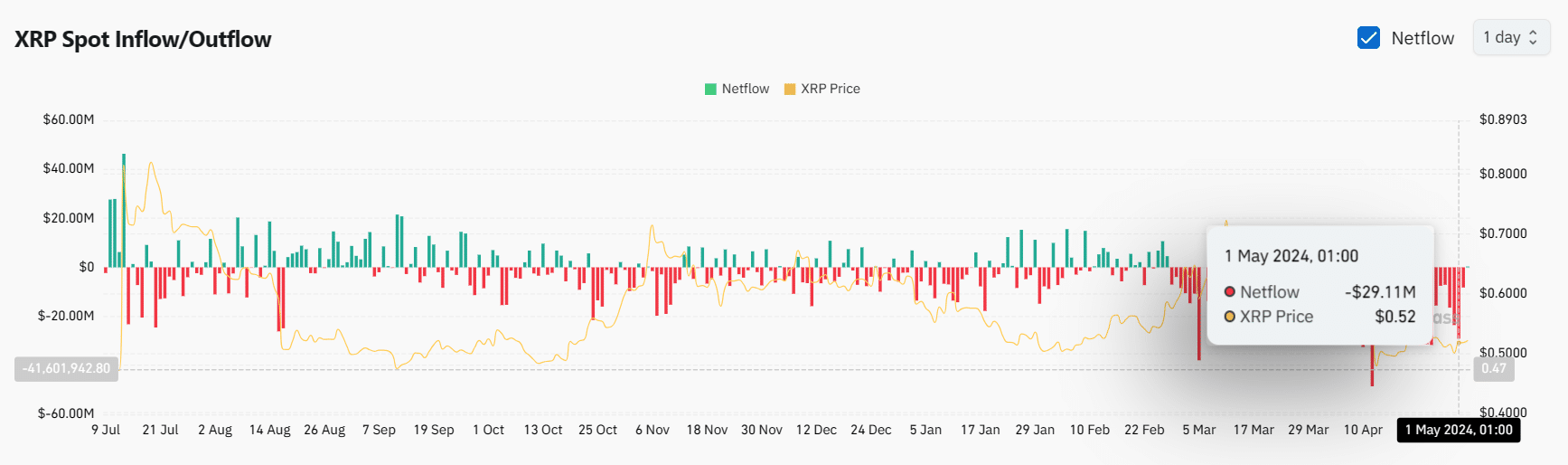

Investors Moving Their Tokens Out of Exchanges

In addition, further data sourced by Coinglass shows a bullish trend, confirming that exchanges witnessed a spike in negative Netflow on May 1, amounting to -$29.11 million. This was as a result of investors pulling out their XRP tokens from exchanges possibly for long-term storage in cold wallets.

Santiment also called attention to a rise in XRP open interest, which spiked to a 3-week high above $480 million on May 2. An increase in Open Interest when prices are recovering suggests an inflow of new money, bolstering strength in the recovery push and improving liquidity. These typically indicate growing bullish sentiments.

Notably, XRP is up 3.90% this month as it looks to recoup the 20.44% loss suffered in April. XRP has reclaimed the $0.52 territory, currently trading for $0.5202, but changing hands underneath the 20-day EMA ($0.5279). The bulls need to firmly defend the $0.4851 level to hedge against any steeper drops this month.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.