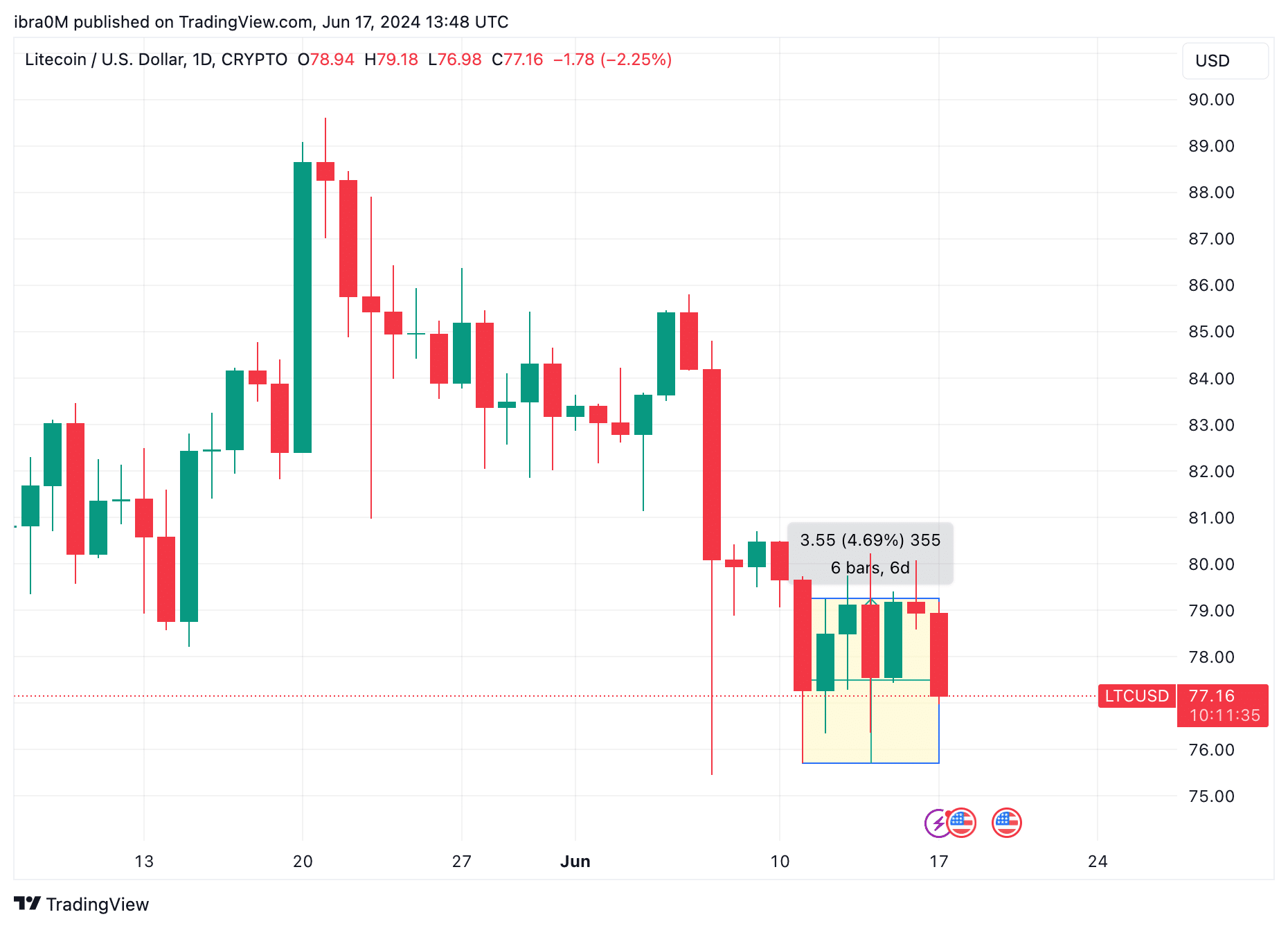

Litecoin price consolidated within the $77 – $80 narrow channel over the weekend, but the persistent selling trend observed among LTC miners in June 2024 raises major cause for bearish concern.

Litecoin Price Standstill Amid Intense Market Volatility

As the crypto market slipped into a correction phase following negative macroeconomic indices published by US authorities in recent weeks, Litecoin bulls have managed to avert the adverse effects of the intense market volatility.

Since the US Fed rate announcement on June 12, top layer-1 altcoins like Solana (SOL), Ethereum (ETH), and Bitcoin (BTC) have all registered considerable downsizing. But curiously, LTC price has managed to hold firmly above the $75 support level.

As depicted above, LTC price has consolidated within the 2% boundaries from $79 – $77 for the better part of the last 3-days. While Litecoin has managed to defying the intense bearish market sentiment that has surrounded the crypto market since June 12, recent on-chain data trends suggest that the critical $75 support could now be at risk in the week ahead.

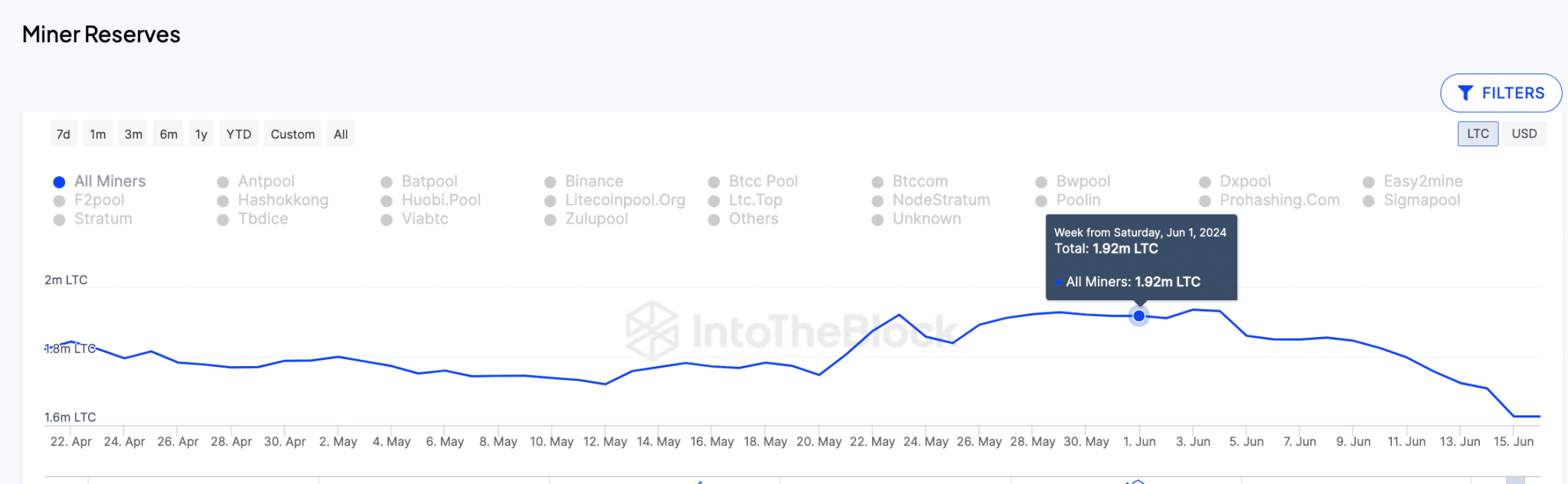

Miners Have Offloaded $23 Million Worth of LTC this Month

Litecoin’s resilient price performance in the last two weeks can be attributed to rising network activity and steady whale demand. But interestingly, it appears that Litecoin miners currently do not share the same level of optimism.

In a clear indication of this, on-chain data trends show that LTC miners have been on a selling spree since the beginning of June 2024, a move that could trigger a bearish downswing in the days ahead.

Looking at the chart above, Litecoin miners held a total of 1.92 million LTC in their cumulative reserve balances as of June 1. But since then they have embarked on a relentless selling frenzy.

At the time of writing on June 17, Litecoin miners now hold only 1.62 million LTC collectively. Essentially, this suggest that that they have offloaded about 300,000 LTC over the course of the month.

Valued at the current prices, the newly offloaded LTC coins are worth approximately $23.1 million.

When miners sell such a large amount of coins within a short period, it triggers a bearish price impact for a number of reasons. Firstly, unloading over $23 million worth of newly mined coins could potentially dilute the short-term market supply.

More so, due to their strong influence within the blockchain ecosystem, miners’ selling trends could spook other strategic investors to take bearish positions as well.

It the miners’ sell-off persists, these crucial factors could combine to send LTC price into a downward spiral below the $75 mark as the week unfolds.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.