Captain Faibik, a notable market analyst, believes XRP has bottomed amid the ongoing downtrend and predicts an imminent Mid-Term rally to $2.

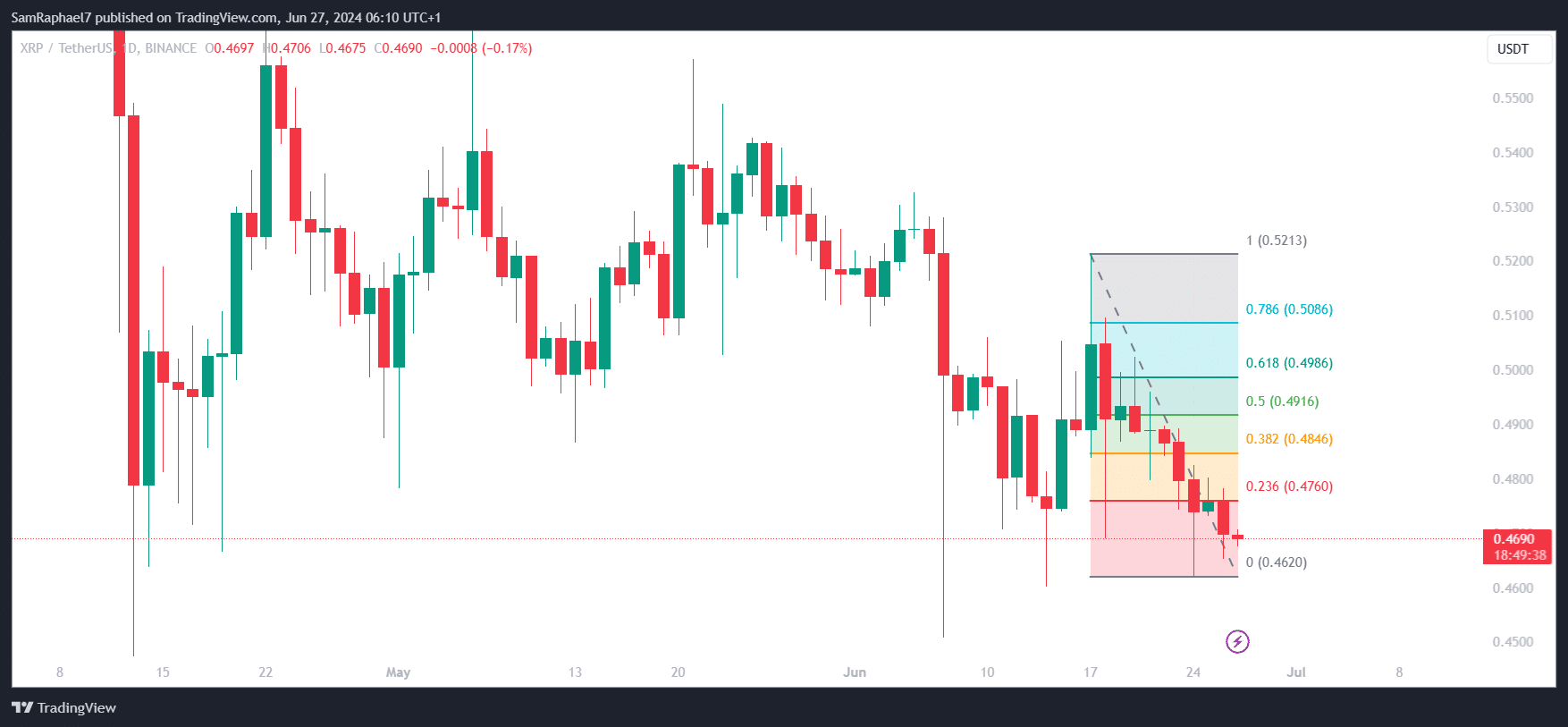

The chartist disclosed this in one of his most recent XRP price analyses, as prices dropped below the $0.50 region for the third consecutive month. XRP has demonstrated more resilience than the rest of the market in the downturn. However, it still collapsed to a low of $0.4620 on June 24.

Analyst: XRP Has Bottomed

Captain Faibik suggests that XRP has bottomed at this price level, suggesting its price is unlikely to drop below this point.

$XRP Seems like bottomed out & almost Ready to Bounce Back 📈

Midterm Target : $2 🔜#Crypto #XRP #XRPUSDT pic.twitter.com/zMLICiKbV4

— Captain Faibik (@CryptoFaibik) June 27, 2024

As identified in the chart below, the Fibonacci 0 level aligns with the $0.4620 floor. This Fib region acts as a robust support level for XRP, with the bulls looking to defend it against any breach.

If the support is potent enough, a retest of this level could serve as the launchpad for the much-awaited rebound. However, such a retest must occur at a time when the broader market is primed for a resurgence. The Crypto Basic confirmed earlier this week that Bitcoin (BTC) has already reached its highest oversold level since last August.

A Projected $2 Mid-Term Target

This metric suggests that the premier cryptocurrency could be on the verge of a recovery push. Notably, such a move would positively impact the rest of the market, granting XRP bulls enough strength to stage a rebound. Captain Faibik has already set a mid-term target of $2 for when this rebound occurs.

Interestingly, the last time XRP saw the $2 level was in 2018 during its historic rally. XRP failed to breach $2 in the 2021 bull run despite most assets recording new all-time highs. Many ascribed XRP’s underperformance to legal pressure from the SEC’s lawsuit against Ripple.

Faibik’s chart reveals a symmetrical triangle that XRP has battled on the weekly chart since 2020. With the SEC case now in remedies, analysts expect an XRP recovery after it sees a decisive end. This recovery could prepare the groundwork for a break above the triangle’s upper trendline, allowing XRP to clinch Faibik’s $2 mid-term target.

XRP Records Bullish Market Metrics

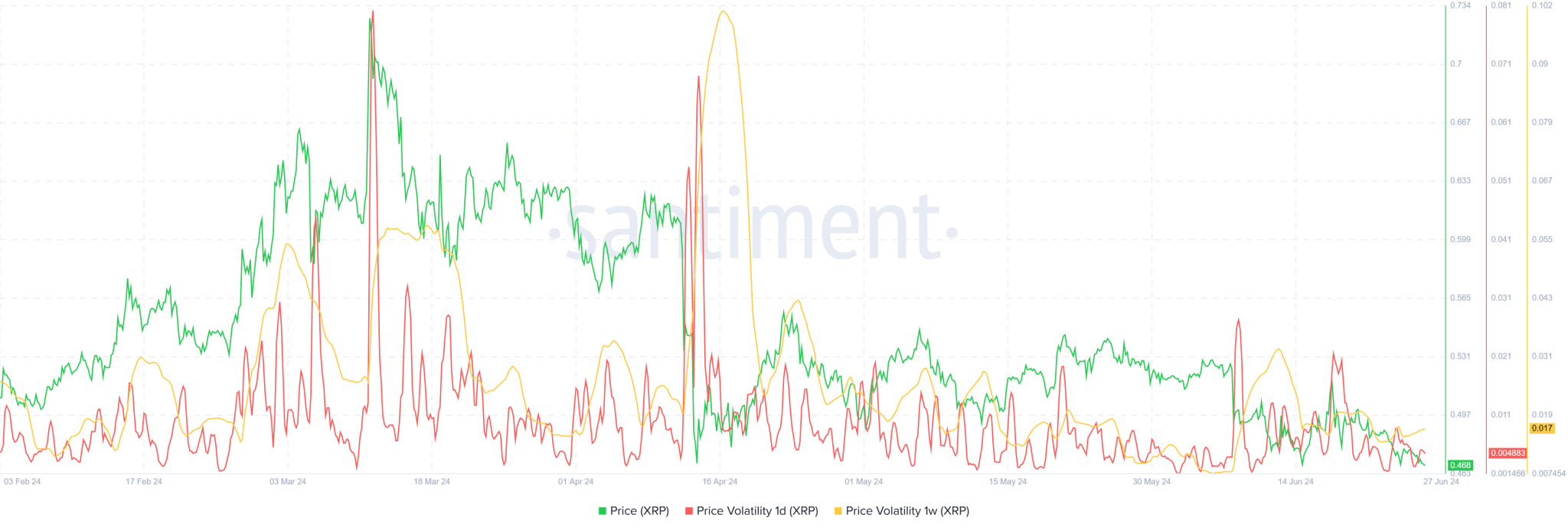

Meanwhile, market data from Santiment indicates that XRP’s price volatility has continued to drop on multiple timeframes. The daily volatility (red) has collapsed to 0.004883, while the weekly volatility (yellow) has slumped to 0.016566. These values represent the lowest figures since earlier this month.

Reduced price volatility during a downtrend can signify market consolidation, where buyers and sellers reach a temporary equilibrium. This could indicate that the downtrend is losing momentum and might be nearing an end or preparing for a reversal.

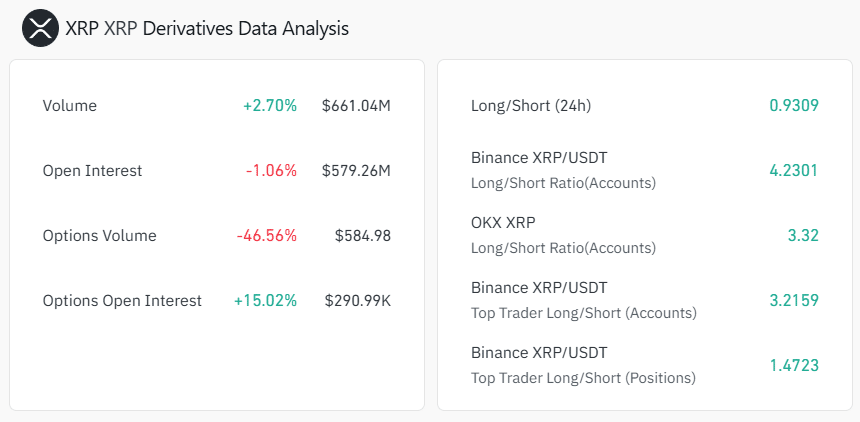

XRP currently changes hands at $0.4690 as of press time, down 0.17% this morning. Coinglass data shows that the token’s Long/Short Ratio remains below 1, currently at 0.9309. This represents a predominance of shorts, a trend that could support the rebound strength if a recovery push clears these short positions.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.