The crypto market has seen the liquidation of over $527 million worth of positions in the past 24 hours as Bitcoin fails to impress amid tension in the Middle East.

Crypto market liquidation has surged in the past 24 hours following a sharp fall in Bitcoin, Ethereum, and other crypto asset prices. About $527 million worth of market positions were rekt, with bulls majorly affected.

Market Downturn Amid Middle East Tension

The surging liquidation emerged following the unsettling environment in the Middle East. On Tuesday, Iran launched missiles in Israel, raising tensions over a possible World War 3.

The fierce rivalry between Israel, Iran, Lebanon, and Palestine has persisted for a while. Israel’s ploy to root out the Hamas group in Gaza earlier in the year has escalated to other nations, including Iran and Lebanon. Notably, this tension has affected the global market, with cryptocurrencies in the mix.

Despite the Uptober hype, Bitcoin and the broader crypto market experienced massive selloffs as investors took a cautious approach amid a possible WW3. These sentiments drew a sharp fall in Bitcoin, with the asset dropping over 4% to $61,669.

Altcoins like Ethereum and Solana also fell sharply, spiking position liquidations. Ethereum capitulated 6% to $2,480, while SOL fell over 5% to $148.

Liquidation Stakes Spike as Crypto Prices Decline

The sharp price decline spiked position liquidation in the crypto market, with long positions majorly affected. Per Coinglass, almost 155,000 traders were rekt, with over half of $1 billion liquidated in the past 24 hours.

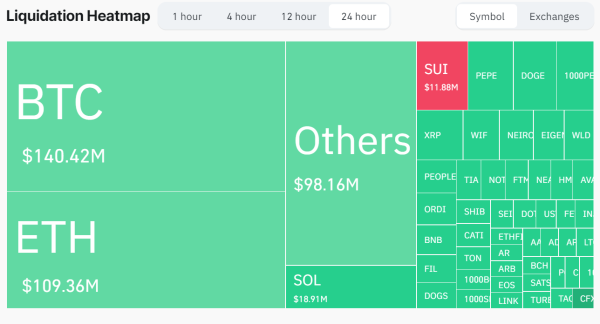

As expected, Bitcoin led the liquidation heatmap, with $140 million of positions involving the premier asset chalked off the market. Notably, about $124.6 million worth of longs were affected, with bearish positions worth $15.8 million also liquidated.

Furthermore, Ethereum traders lost $109.36 million from the market downturn. Bullish positions worth $97.8 million were rekt, while shorts amounting to $11.55 million were also liquidated.

Solana and SUI traders also saw substantial amounts liquidated in the past 24 hours, with positions worth $18.91 million and $11.88 million affected. Interestingly, a majority of SUI liquidations were short traders. SUI rebounded from the dip late Tuesday, liquidating $5.97 million in late shorts.

It bears mentioning that the trader with the biggest loss during the liquidation spree lost $12.66 million trading the BTC/USDT pair on Binance. The leading exchange also accounted for the largest amount of liquidation among trading platforms, with $260 million in position chalked off in the last 24 hours.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.