A recent Glassnode analysis has leveraged the URPD metric to identify the largest resistance level Dogecoin might face on its path to recovery.

The disclosure comes on the back of a rebound effort engineered by Dogecoin (DOGE) amid the broader market recovery that has seen Bitcoin (BTC), the leading crypto asset reclaim the $87,000 mark.

Particularly, DOGE has ridden on this upward push to secure four consecutive intraday gains, a new record this year. Notably, since Saturday, March 22, Dogecoin has increased by nearly 18%, soaring from $0.16 to trade around the $0.19 region at press time.

Major Dogecoin Resistance

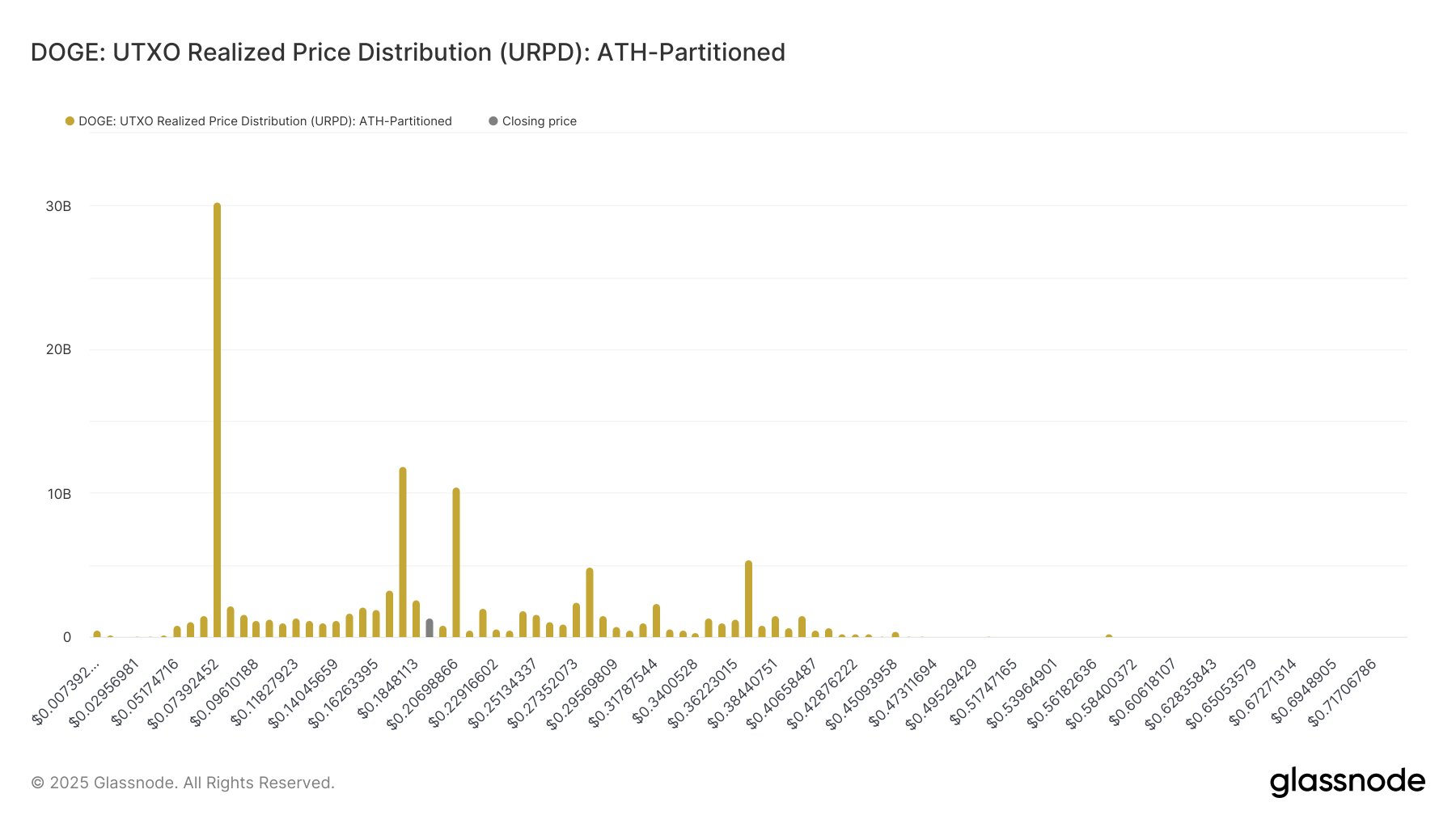

Amid this bullish trend, Glassnode called attention to the $0.20 psychological resistance as the meme coin’s largest roadblock on its recovery path. For context, Dogecoin gave up the $0.20 mark earlier this month amid a massive collapse from March 6 to 10.

According to Glassnode, the Dogecoin UTXO Realized Price Distribution (URPD) points to a large supply wall at the $0.20 region, representing a zone where a massive whale volume exists. The analysis confirmed that the supply wall at $0.20 represents the third largest for DOGE, only behind the ones at $0.07 and $0.17.

Notably, Glassnode stressed that this large cluster formed with massive inflows at the $0.20 mark on Jan. 22, 2025, but an earlier accumulation might have occurred before this date, and this trend elevated the whales’ cost basis. The analytical resource stressed that this area marks a major near-term resistance.

Notably, the $0.20 resistance came into play earlier today when DOGE attempted to break above. The asset soared to a two-week peak of $0.2058 this morning but immediately witnessed a pullback to the $0.19 level.

Interestingly, Glassnode emphasized that once the bulls overcome the resistance at $0.20, Dogecoin will likely face less resistance before $0.31. This is because the meme coin faces no major supply walls before this level, presenting a smooth sail higher on the recovery path once $0.20 gives way.

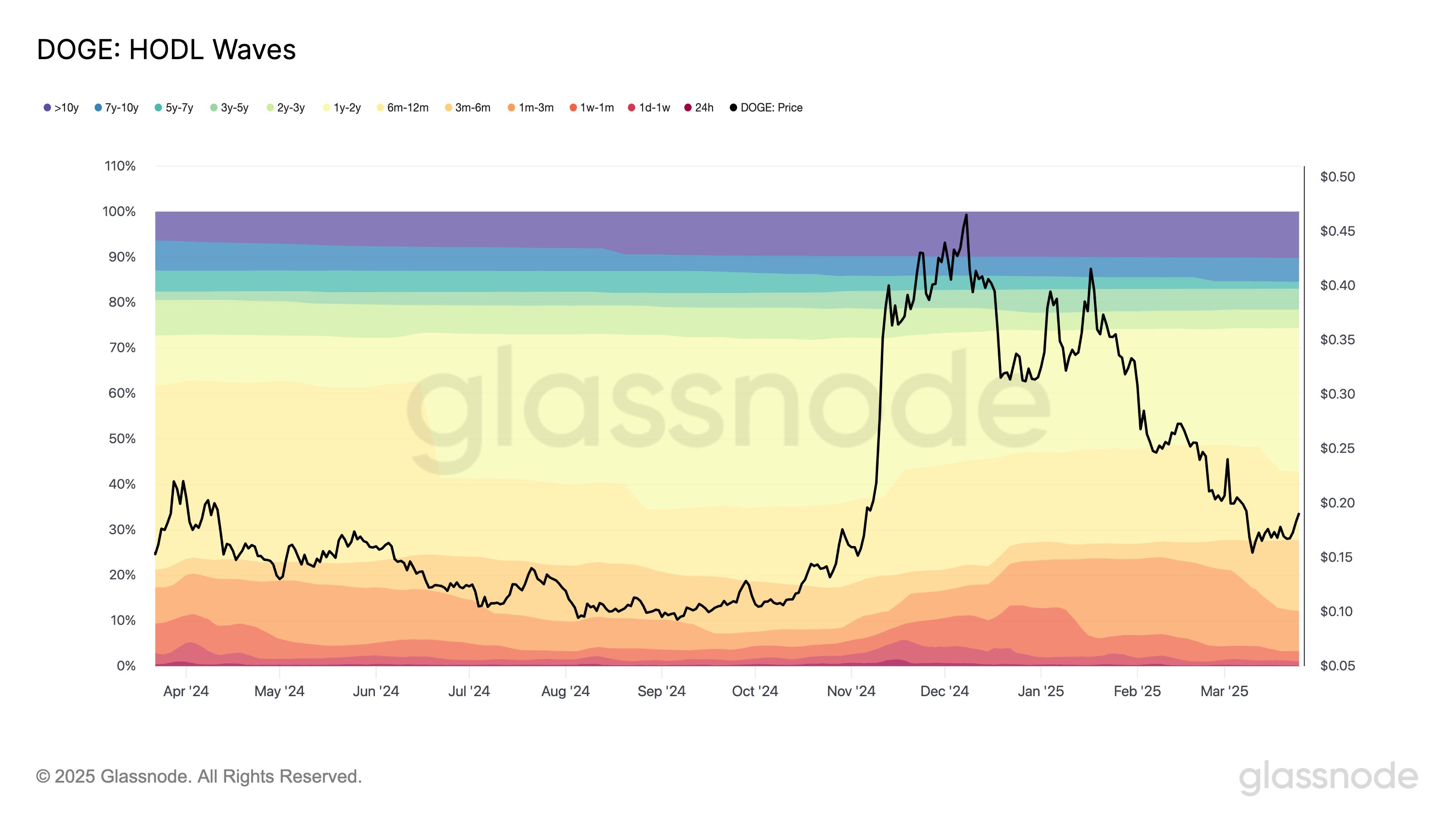

Meanwhile, Dogecoin’s 3-6M HODL Wave has witnessed a gradual increase since March began, according to Glassnode. They stressed that this suggests most investors entered the market when Dogecoin recovered from $0.32 to $0.41 in January. This likely forms the next supply wall beyond $0.31.

Since early March, the 3–6M HODL Wave has started to swell. This suggests many bought during the Jan bounce from $0.32 to $0.41. If price returns to those levels, some may look to exit at break even – creating possible resistance ahead for $DOGE. pic.twitter.com/qfGpbxkvEs

— glassnode (@glassnode) March 26, 2025

DOGE Holders Maintain Conviction Amid Healthy Recovery

Further, Glassnode highlighted a trend that might assist the bulls as they look to breach the $0.20 roadblock. Specifically, 15% of the Dogecoin supply has remained dormant for six to twelve months.

According to Glassnode, the investors who hold this supply likely bought before the Q4 2024 upsurge. The fact that they still hold onto their bag confirms their confidence in Dogecoin.

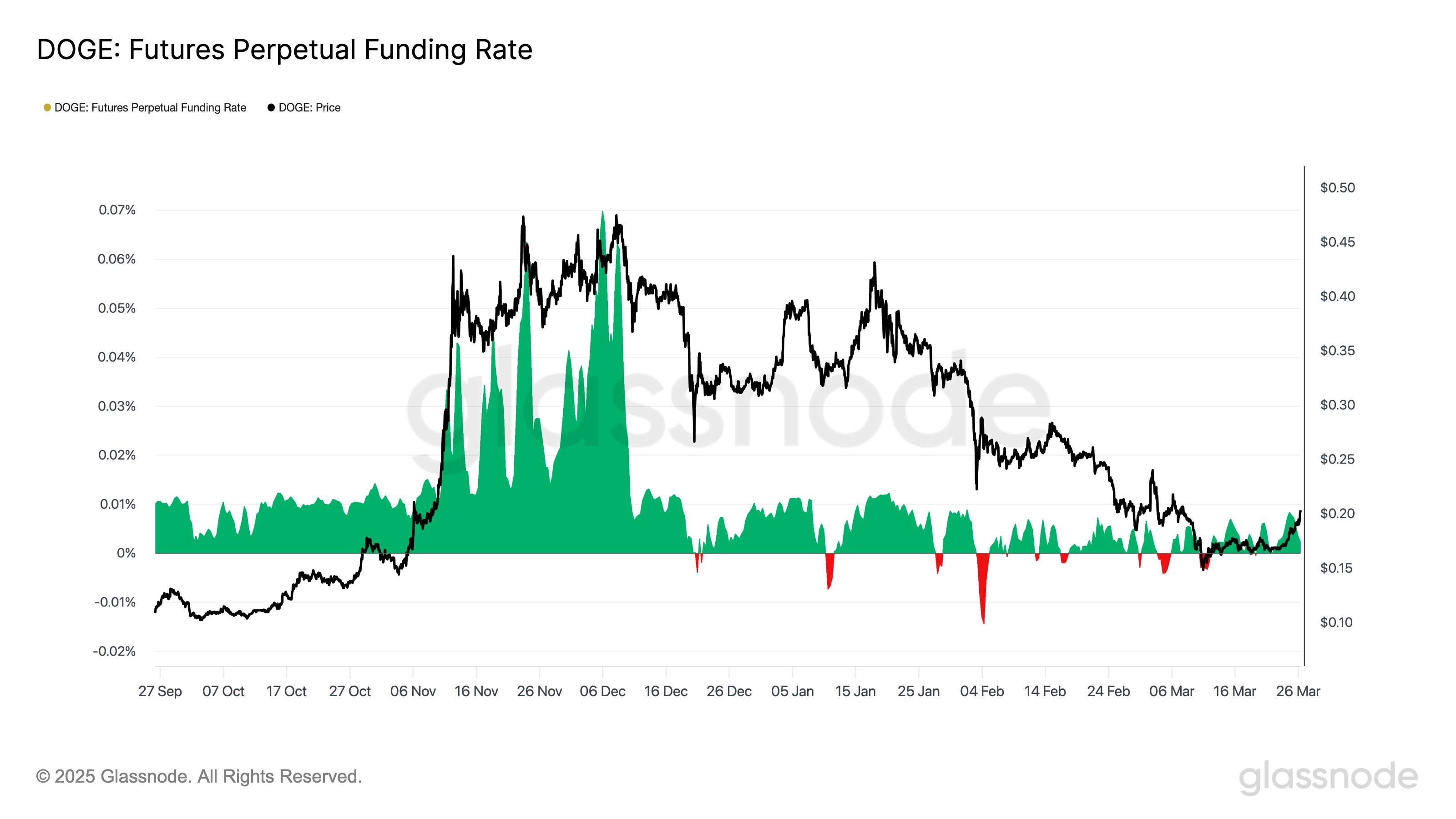

In addition, the analytical firm pointed out two futures market metrics that indicate the ongoing recovery is healthy. For one, Futures Open Interest (OI) has dropped from the Q4 2024 average of $3 billion to the current figure of $1 billion. This shows that there are fewer leverage positions, confirming that the rally comes mostly from the spot market.

Futures OI for $DOGE sits at ~$1B – well below the Nov/Dec 2024 average of ~$3B. 7D SMA of futures volume is rising from the bottom, but still near Oct 2024 levels. The rally so far appears more spot-driven, not fueled by leveraged speculation. pic.twitter.com/kgml4Oked6

— glassnode (@glassnode) March 26, 2025

Moreover, Dogecoin Funding Rates have collapsed in recent times, moving closer to the neutral level. This trend further confirms that the futures market is observing a drop in leveraged positions, especially longs. At press time, Dogecoin currently trades for $0.1959, up 13% in the past week.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.