The crypto world has witnessed a major move as Bitcoin worth $1.26 billion was unstaked from Babylon.

Market watcher Lookonchain flagged the transaction on Wednesday in a tweet with details via Arkham Intelligence. It involved the withdrawal of 14,929 BTC from the decentralized Bitcoin staking platform Babylon.

The sheer scale of the withdrawal immediately drew attention, especially as it appeared to coincide with changes in Bitcoin’s price trajectory.

Bitcoin Price Reaction

Before the first unstaking event at 19:57:32 UTC, Bitcoin’s price had steadily climbed, reaching a daily high of $85,164. However, after the initial transaction, the price fell to $83,500.

Attempts at recovery followed, but Bitcoin remained below its earlier high. As of press time, Bitcoin’s price stands at $84,404. The price fluctuation indicates a strong response to the sudden increase in Bitcoin being removed from the staking platform.

Unstaking Details and Distribution

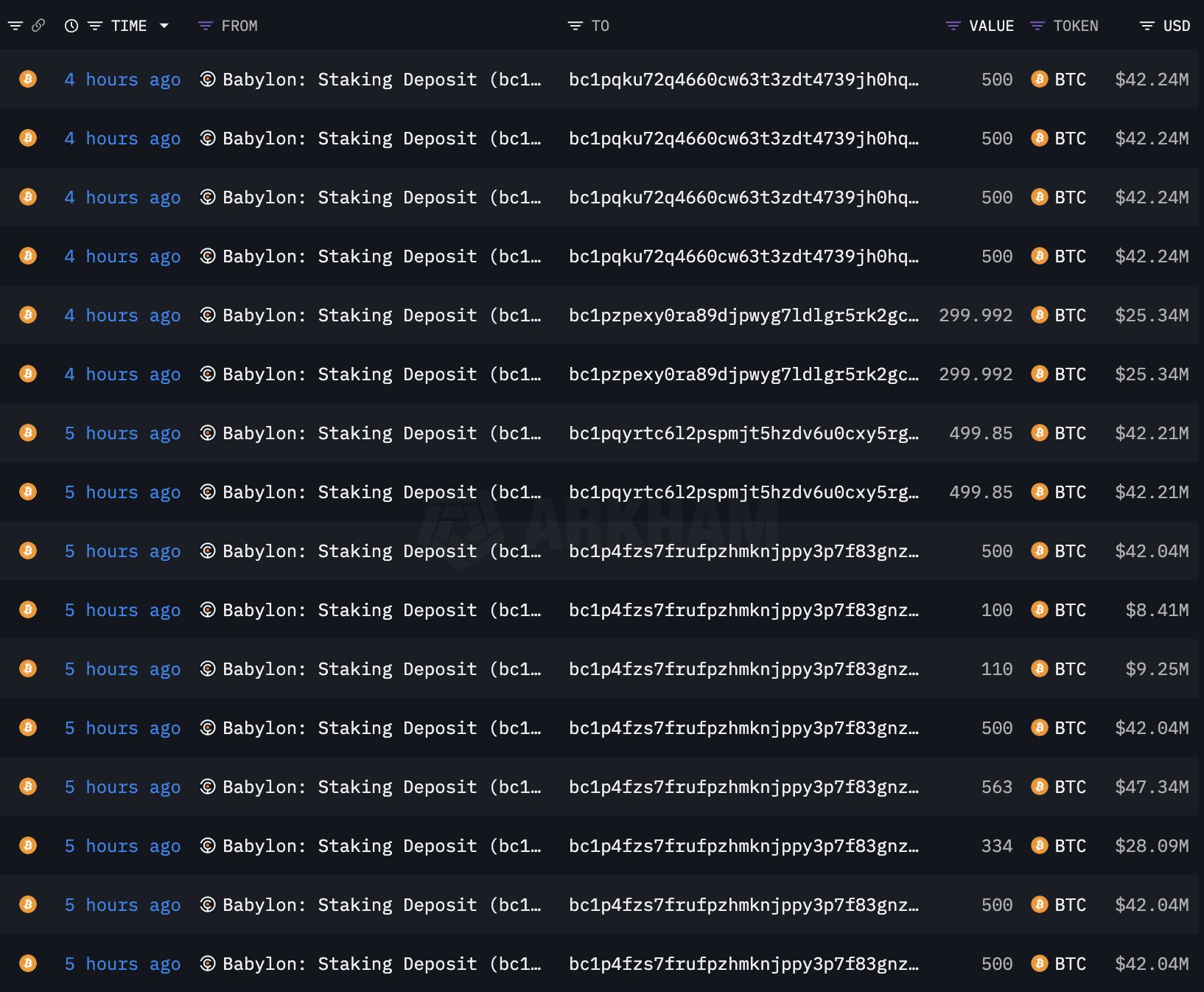

The whale behind the unstaking spread the BTC across multiple addresses in several large transactions. Notably, it executed the withdrawals in a series of transactions, which suggests a strategic move rather than a single uncoordinated action. Among the largest withdrawals, one transaction involved 563 BTC, worth $47.34 million.

Meanwhile, 500 BTC was unstaked in four separate transactions, each valued at $42.24 million. Two other transactions involved 499.85 BTC, each valued at $42.21 million. Additionally, 299.992 BTC were withdrawn in two transactions, each valued at $25.34 million. Another 334 BTC was also unstaked in one transaction valued at $28.25 million.

At the time of this report, Babylon’s portfolio, based on Arkham data, shows $3.84 billion, with 45,555 BTC held on the platform.

Large Bitcoin Holders Withdrawing?

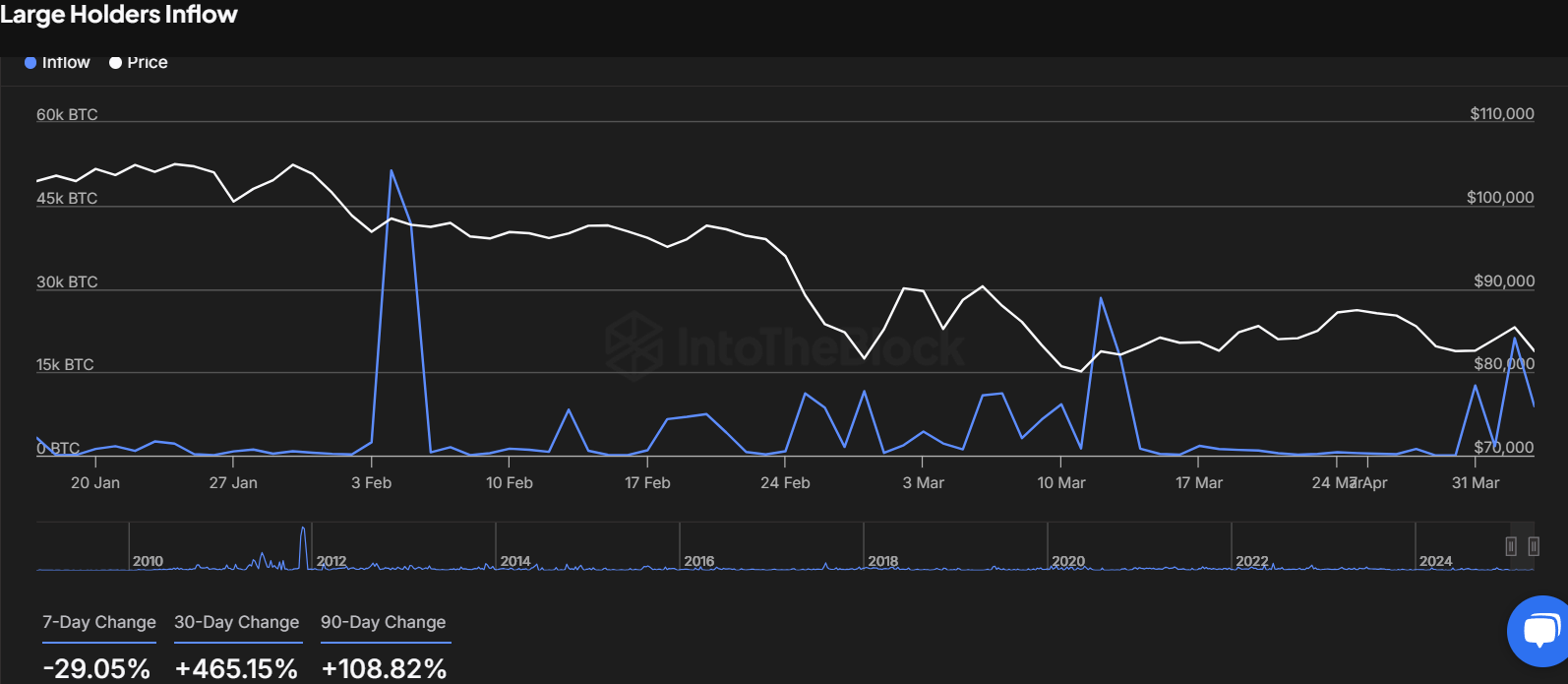

Additionally, data from IntoTheBlock highlights a significant shift in Bitcoin’s movement among large holders. Over the past seven days, inflows from large holders have decreased by 29.05%, coinciding with the large unstaking activity.

In contrast, the 30-day change shows a 465.15% increase in inflows, likely driven by a spike in early February and March. Despite this recent drop, large holders’ activity has generally risen over the past three months, according to the data.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.