Ark Invest, a leading multibillion-dollar asset manager, has updated its Bitcoin price predictions for the end of the decade.

Notably, the firm now presents a bolder outlook for Bitcoin price than before. These updated projections are included in its latest industry report in the Big Ideas 2025 series.

In this revised edition, Ark Invest argues that the minimum price Bitcoin could reach in the next five years is between $300,000 and $500,000 per coin. This represents the worst-case scenario, where things do not unfold optimistically. Despite the bearish connotation, these targets still translate to a 220% to 533% increase.

Meanwhile, in a bullish scenario, the asset manager projects that the price of 1 Bitcoin could soar as high as $2.4 million by the end of 2030. This would mean a potential 2,462% increase. However, in the base case, Ark Invest expects BTC to reach $1.2 million per coin, a 1,181% increase from current levels.

At the moment, Bitcoin is trading at $93,000, with a $1.85 trillion valuation, putting it on par with silver, the world’s seventh most valuable asset.

The Arguments Behind the Bold Bitcoin Price Predictions

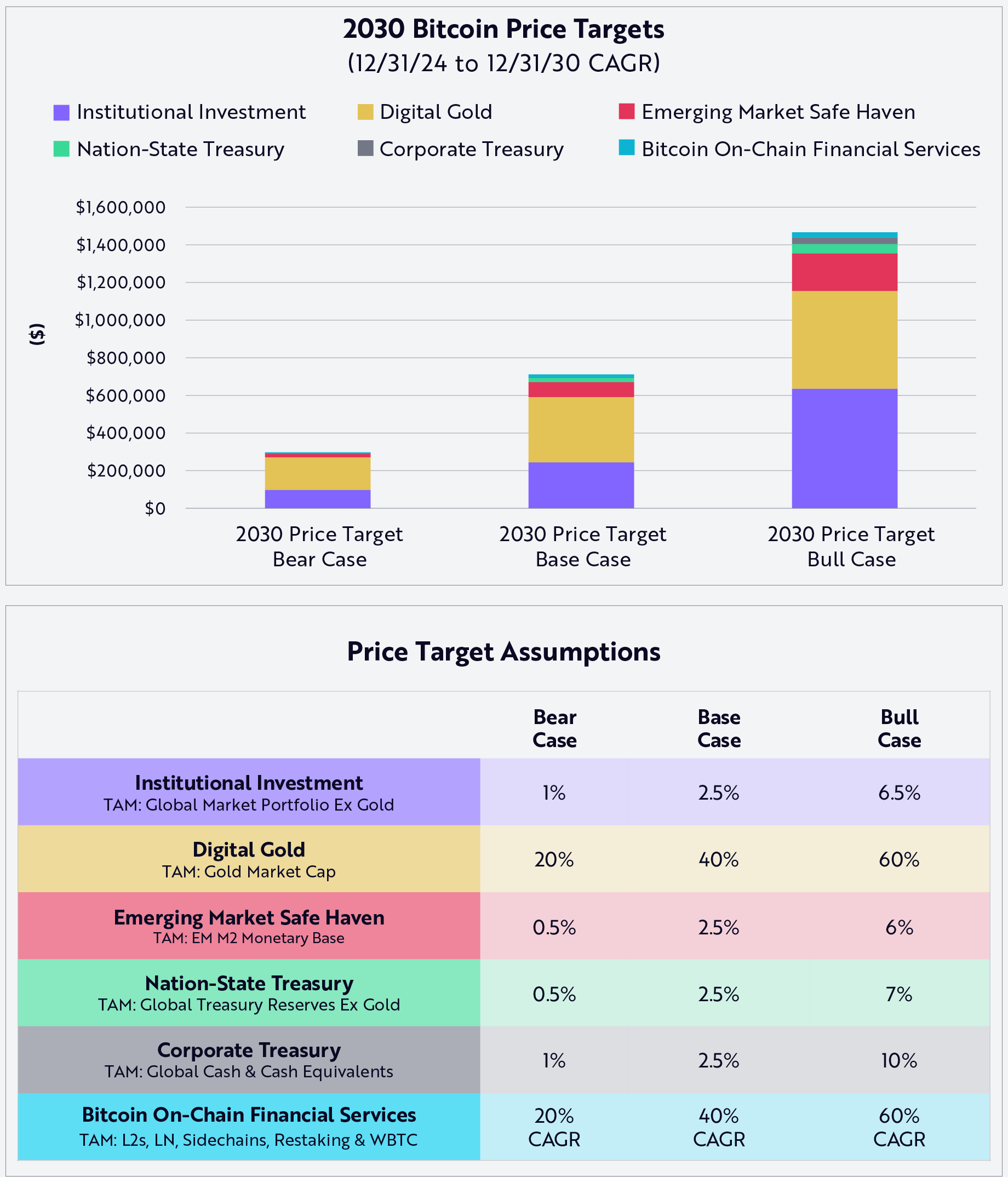

Ark Invest made these bold price predictions based on Bitcoin’s diverse use cases and potential to attract significant investment. The firm identified six key drivers behind Bitcoin’s price growth.

One of the primary drivers is institutional investment, mainly through spot ETFs. Another is Bitcoin’s role as “digital gold”—a store of value and a safe haven in emerging markets facing inflation and currency devaluation.

Ark also cited secondary drivers, including Bitcoin’s adoption as a nation-state treasury asset, a corporate treasury reserve, and its use in on-chain financial services.

Assumptions Per Scenario

From the point of institutional investment, Ark Invest projects Bitcoin sees a 1% contribution in the bear case, 2.5% in the base case, and 6.5% in the bull case.

As for the “digital gold” factor, it projects a 20% contribution in the bear case, 40% in the base case, and 60% in the bull case.

Meanwhile, for emerging market safe haven use, corporate treasury, and nation-state adoption, the firm suggests a contribution ranging from 0.5% to 7%, depending on the scenario.

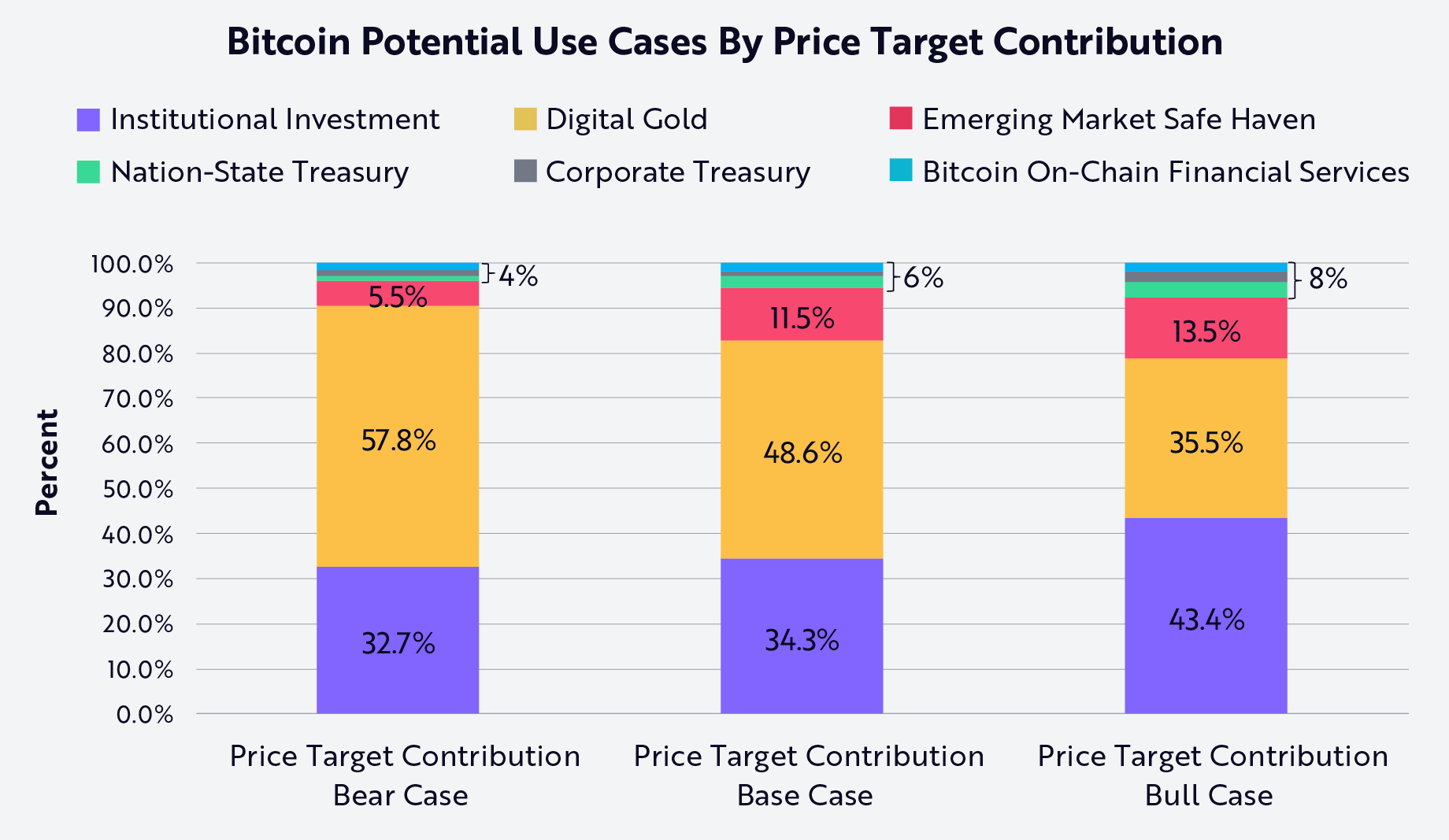

Notably, digital gold remains the largest contributor in all scenarios, but it’s penalized in Ark’s model since it competes directly with gold in a zero-sum market.

Meanwhile, in terms of use-case contribution, Ark Invest suggests that in a bull case, institutional adoption becomes the dominant driver, surpassing digital gold, with a 43.4% contribution.

However, in the bear case, it expects digital gold to take the lead with 57.8%, while institutions make up 32.7%, and the rest contribute less than 10%. In the base case, Ark estimates digital gold contributes 48.6%, while institutional adoption accounts for 34.2%.

Notably, Ark Invest assumes that Bitcoin on-chain financial services will grow at a compound annual growth rate (CAGR) of 20–60% over the next five years.

Bitcoin Price Predictions Based on Active Supply

Based on these factors, Ark Invest estimates that Bitcoin’s minimum price by 2030 will be around $300,000. On average, it expects Bitcoin to reach $710,000, with a bullish scenario projecting a price of up to $1.5 million per coin.

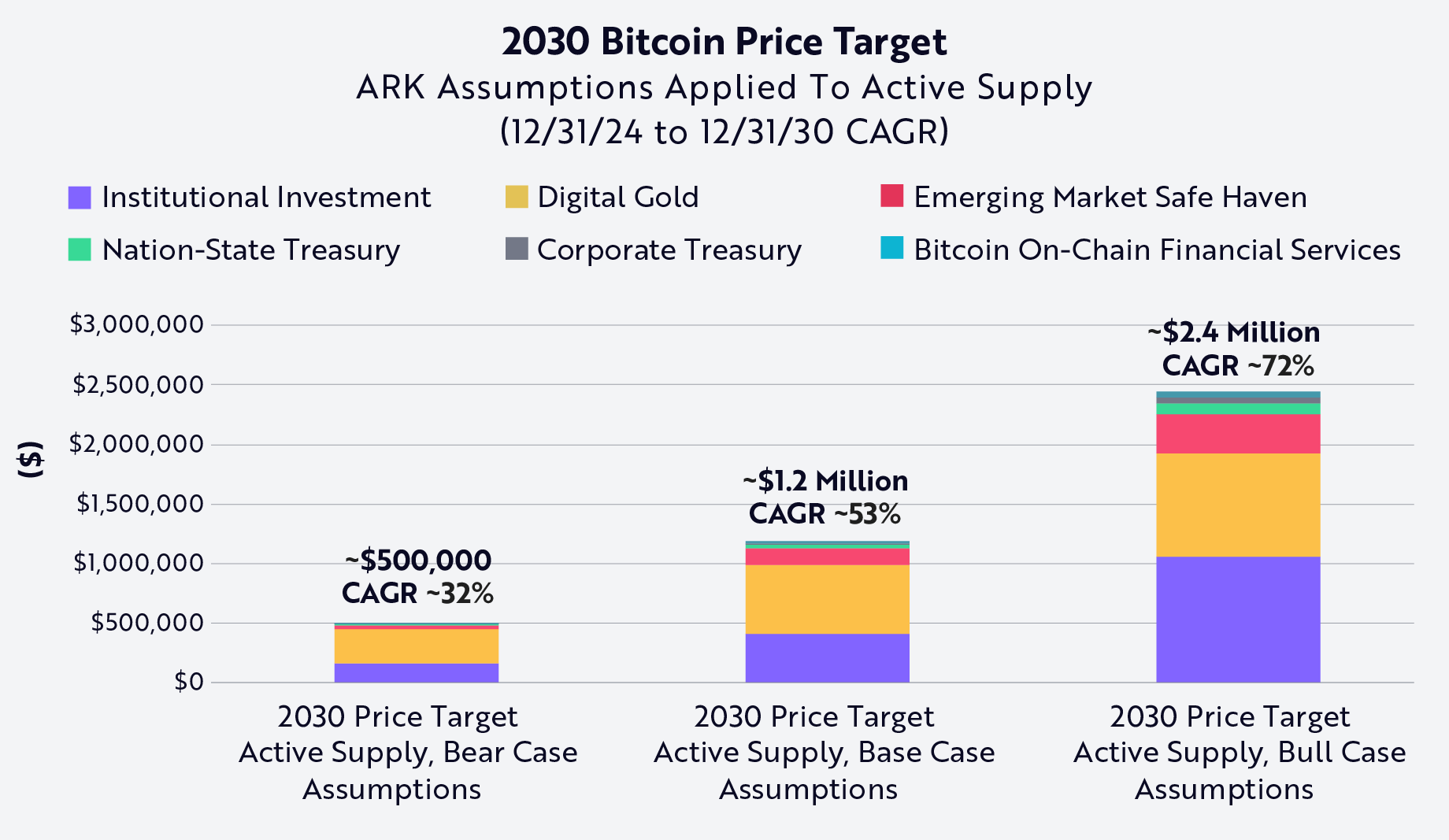

These projections consider Bitcoin’s entire supply. However, the firm noted that Bitcoin’s network liveliness has hovered around 60% since early 2018. This suggests that approximately 40% of the supply is “vaulted”, or inactive.

Taking this into account, Ark adjusted its Bitcoin price predictions upward by roughly 40% to reflect only the active supply. The revised targets are as follows:

- Bitcoin Bear Case (with active supply): ~$500,000 (~32% CAGR)

- Base Case: ~$1.2 million (~53% CAGR)

- Bull Case: ~$2.4 million (~72% CAGR)

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.