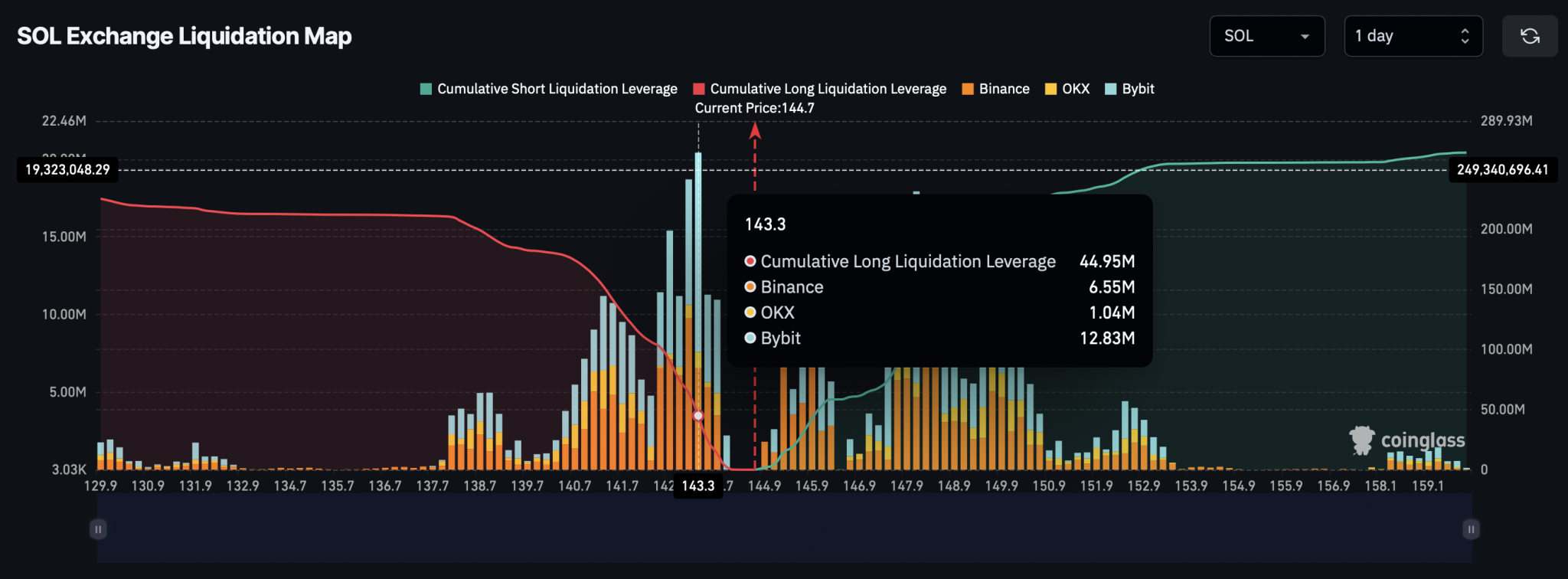

Solana is nearing a triangle breakout at $145, with $44.95 million in long liquidations looming below $143. Will SOL crash to $134?

With the broader market experiencing a slight pullback, Solana is trading at $144.48. After a nearly 2% surge on May 5, the price is undergoing an intraday decline of approximately 1.5%.

Amid short-term volatility, Solana’s price is approaching the apex of a triangle pattern, suggesting an imminent breakout. Will the SOL price avoid a breakdown below $143 and the potential liquidation of nearly $45 million in long positions?

Solana Price Nears Triangle Breakout

On the 4-hour chart, Solana’s price trend is forming a symmetrical triangle pattern, marked by two converging trend lines. This indicates a tightening of the SOL price range near the $145 level.

The recent pullback within the triangle has caused the price to breach both the 50- and 100-period simple moving averages. This raises the risk of a negative crossover between these averages, potentially triggering a sell signal.

However, as Solana nears the triangle’s apex, the MACD and signal lines are converging in negative territory, hinting at a possible shift in momentum.

SOL Price Targets

While Solana continues to trade within the triangle, it remains in a no-trade zone. A breakout from the pattern could test the immediate resistance at $155.

A successful breakout rally would significantly increase the probability of Solana reaching the $180 level. Conversely, a breakdown could lead to a retest of the 200-period simple moving average at $134, signaling a potential downside of nearly 7%.

Bearish Sentiments on the Rise in Solana Derivatives

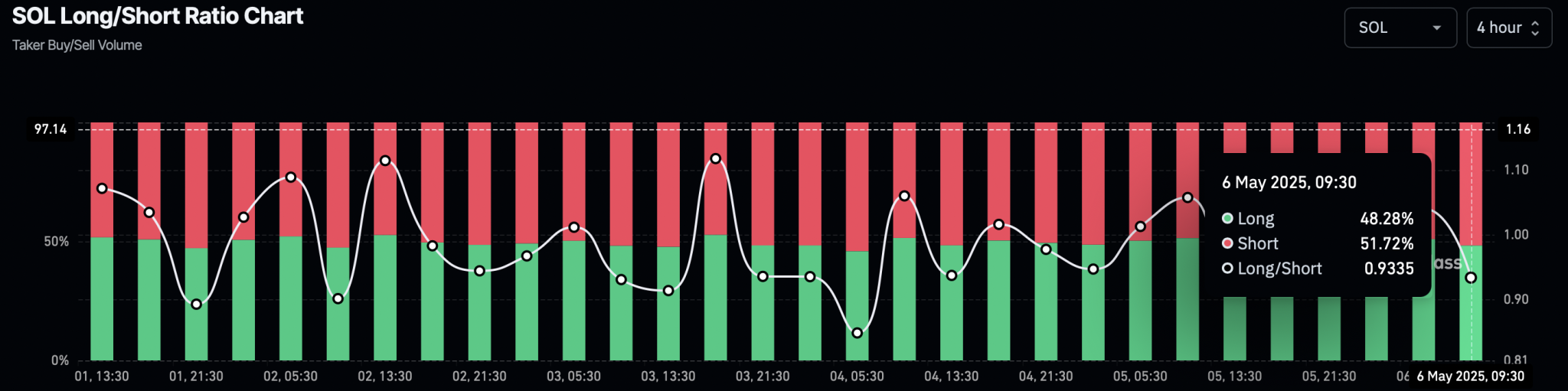

While Solana holds within the triangle pattern, the derivatives market shows a slight uptick in bearish sentiment. According to CoinGlass’s long-to-short ratio chart, short positions have increased to 51.72% over the past four hours.

This shift has brought the long-to-short ratio down to 0.9335, indicating a marginally bearish-dominated market.

Additionally, the SOL exchange liquidation map signals a potential $44.95 million in long liquidations if Solana drops to $143.3. A sharp increase in long liquidations could trigger a more severe correction due to a domino effect.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.