Solana reclaims $185 with a 92% surge and rising futures activity. Can the SOL price reach $261 as the falling wedge breakout gains traction?

As the total crypto market cap (excluding Bitcoin) reaches $1.26 trillion, altcoins are gaining momentum. One of the top performers is Solana, currently trading at $183 after an overnight surge of 5.48%.

At present, Solana is facing resistance near a critical supply zone around the $185 mark. However, growing momentum suggests the possibility of a breakout rally toward the $261 resistance level. Could Solana post an additional 42% gain with a breakout above this key level?

Solana Price Analysis Targets $261

On the daily chart, Solana’s bullish reversal has reclaimed the $185 level, last seen on February 17. In 2025, Solana bottomed out at $95.16 and has since surged by 92% over the past 37 days. This sharp trend reversal confirms a falling wedge breakout in the SOL price trend.

The bullish rally has pushed the price above the 200-day EMA at $162 and the 50% Fibonacci retracement level at $165. This has strengthened bullish momentum, leading to a positive crossover of the 50- and 100-day EMA lines. Additionally, the daily RSI is fluctuating in the overbought region, signaling strong underlying bullish sentiment.

Currently, Solana has surpassed the critical $175 zone and is testing the 61.8% Fibonacci level at $184.52. If SOL can break above this overhead resistance, the falling wedge breakout rally may challenge the previous peak near the $261 mark. This indicates a potential upside of 42% as buying pressure continues to build.

On the downside, the 200-day EMA remains a crucial support level at $162, followed by the 50% Fibonacci level near the 38.2% retracement zone at $150.

Solana Bulls Dominate the SOL Futures Market

As Solana approaches a key breakout level, optimism in Solana futures is rising. According to data from CoinGlass, Solana futures open interest stands at $7.49 billion, marking a 12.10% increase in the past 24 hours. In line with the bullish trend, short liquidations have jumped to $14.76 million during the same period, reflecting increased bullish activity in the Solana futures market.

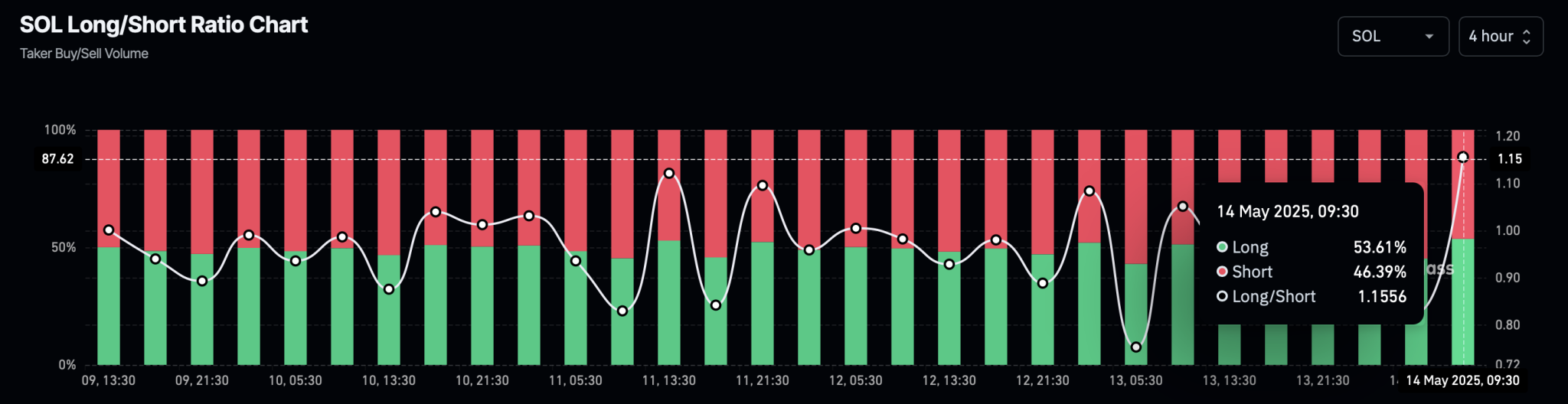

Additionally, CoinGlass data shows a sharp increase in long positions, with longs accounting for 53.61% of taker volume. This has pushed the long-to-short ratio to 1.1556, underscoring bullish dominance in the Solana derivatives market.

As the broader market continues to gain momentum, the rising optimism among Solana derivatives traders points to a potential leverage-driven rally beyond the $185 resistance. This breakout could pave the way for an extended recovery, with SOL prices aiming for the $261 milestone.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.