As Bitcoin matures, its growth rate slows, with each new valuation milestone requiring exponentially more capital, according to analytics firm Glassnode.

Bitcoin extended its bullish streak into the third week of May, rising from around $101,000 on May 15 to over $109,000 by May 21. At press time, Bitcoin had established a new all-time high of $109,500, following an intraday gain of 3.6%. The rally builds on last week’s momentum, during which Bitcoin closed at $106,487, its highest weekly close on record.

Slower Capital Inflows with Network Maturity

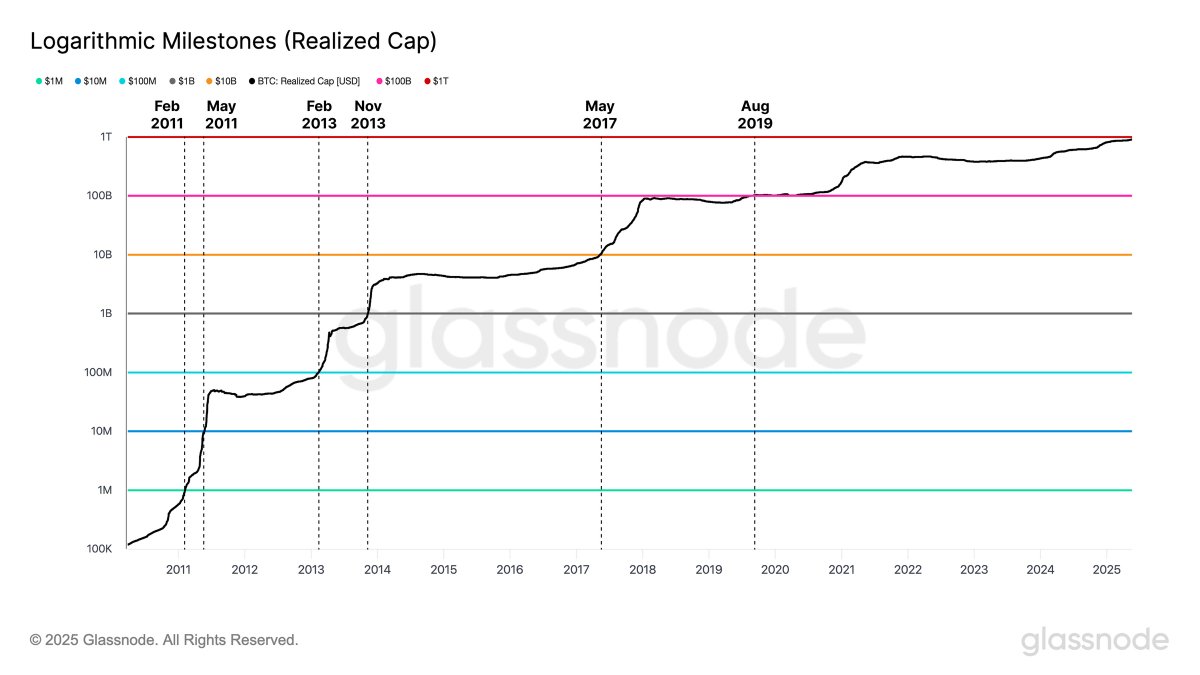

Amid Bitcoin’s continued ascent, analytics firm Glassnode presented data signaling a long-term slowdown in capital inflow relative to earlier growth phases. According to its chart titled “Logarithmic Milestones (Realized Cap),” Bitcoin’s realized capitalization, defined by valuing each coin at the price it last moved on-chain, has increased at a decelerating pace as the asset matures.

From early 2011 to February 2013, realized cap jumped from $1 million to $1 billion, reflecting the rapid accumulation of value during Bitcoin’s early adoption phase.

However, the following years exhibited slower growth. The realized cap reached $10 billion in November 2013 and did not hit $100 billion until May 2017.

Notably, Glassnode’s data shows it has taken nearly six years since then to approach the $1 trillion threshold in 2025. This trend, as highlighted by the flattening curve on the chart, suggests that each subsequent growth milestone requires increasingly more capital inflow.

The implications of this data suggest Bitcoin’s expansion is no longer driven by speculative surges but by broader, more gradual adoption. Glassnode attributes this change to the asset’s maturity, stating that each leap in value as Bitcoin evolves becomes more capital-intensive.

Bitcoin is Still Setting New Records

In spite of the broader slowdown in long-term capital growth, Bitcoin has continued to post new milestones in recent days. The digital asset notched its highest daily closing price in its 15-year trading history on May 20, with market data from Barchart confirming a close at $106,909. This figure surpassed the previous record of $106,487, which had been set just two days earlier.

This record-breaking daily close followed another significant achievement, Bitcoin’s highest-ever weekly close.

As the market maintained its bullish tone, breaking an all-time high, many industry commentators like Arthur Hayes are expecting BTC to reach a $1 million value someday.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.