Dogecoin holds steady above $0.20, eyeing a 48% surge as bullish patterns emerge. Derivatives data and key EMAs suggest a potential breakout ahead.

As Bitcoin’s price remains above the $109,000 mark, the meme coin market cap has resurfaced above $72 billion. Leading this short-term recovery is Dogecoin, which has gained 4% in the past 24 hours.

With Dogecoin holding firmly above the key psychological level of $0.20, the possibility of an inverted head-and-shoulders pattern breakout remains.

Dogecoin Price Analysis

On the daily chart, Dogecoin formed a bearish engulfing candle on May 23, reflecting an 8.29% pullback. This pullback challenged the breakout potential of the inverted head-and-shoulders pattern, as the price retraced from a long-standing resistance trendline.

Despite this, Dogecoin remains above the 23.60% Fibonacci retracement level at $0.2179, supported by a lower price rejection. A long-tailed doji candle formed on Sunday, and Dogecoin is currently trading at $0.2266, showing an intraday gain of 0.82%.

Furthermore, the price holds above the 200-day EMA, which aligns closely with the 23.60% Fibonacci level. Despite short-term weakness, the underlying bullish sentiment supports the potential for a breakout rally.

The 50-day and 100-day EMA lines are trending toward a bullish crossover. Meanwhile, the RSI remains flat above the midpoint, indicating a potential bullish reversal with room for further growth.

DOGE Price Targets

Based on the Fibonacci levels and the inverted head-and-shoulders pattern, a breakout could propel Dogecoin toward the $0.3830 level, representing a 48% surge.

However, a daily close below the 23.60% Fibonacci level would invalidate this bullish setup. In that scenario, immediate support lies at the 50-day EMA near $0.20, followed by the $0.14 level.

Dogecoin Derivatives Data Supports Bullish Intent

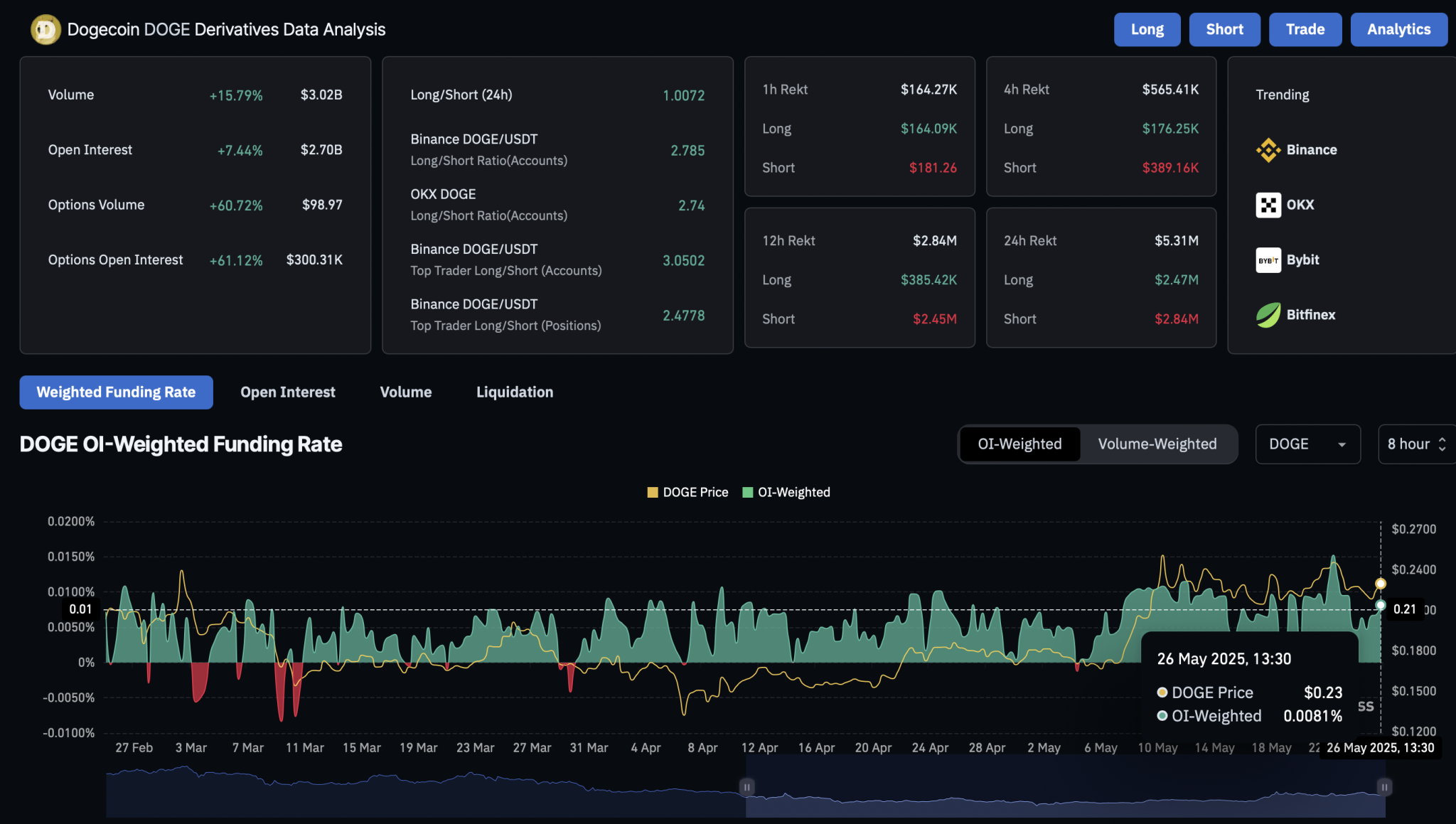

As Dogecoin stands at a crossroads due to the short-term bullish failure, the derivatives market remains optimistic. As per Coinglass data, Dogecoin’s open interest has jumped by 7.44%, with the broader market recovery pushing the total to $2.70 billion. This suggests growing trader activity in Dogecoin, further supported by a rising funding rate of 0.0081%.

This increase in open interest and funding rate reflects a rising bullish sentiment among derivatives traders who anticipate a breakout rally. Notably, options volume has surged by 60%, with open interest in options reaching $300,000.

Over the past 12 hours, Dogecoin’s recovery has triggered $2.4 million in short liquidations, while 24-hour liquidation data remains balanced. Overall, derivatives data maintain a bullish narrative, reinforcing the potential for a breakout.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.