Solana has dropped to $163, breaking below key Fibonacci support. Network activity is slowing, and long liquidations are rising, signaling a continuation of the bearish trend.

With Bitcoin’s price in decline, Solana is struggling to maintain its bullish momentum. The SOL token currently trades at $163 after a pullback of over 2%, pointing to a deeper correction as a bearish pattern unfolds.

Solana Price Analysis

Following a sudden bearish reversal, Solana is down nearly 7% so far this week. This limits its monthly recovery to 11.01%, reversing from its 30-day high of $187.73.

On the daily chart, Solana’s price action highlights a failed attempt to break above the 61.8% Fibonacci retracement level at $184.52. This level, overlapping with the $180 supply zone, has led to the formation of a double-top pattern.

With three consecutive bearish candles on the daily chart, Solana has now broken below the 50% Fibonacci support at $165.71. A daily close below this level would raise the probability of a deeper correction, potentially down to the psychological support near $150.

This $150 support zone coincides with the Supertrend indicator line at $149 and the 38.2% Fibonacci level at $148.82. Supporting this downside risk, the daily RSI has dipped below the midpoint, signaling waning bullish momentum.

Solana Network Slows Down Amid Price Correction

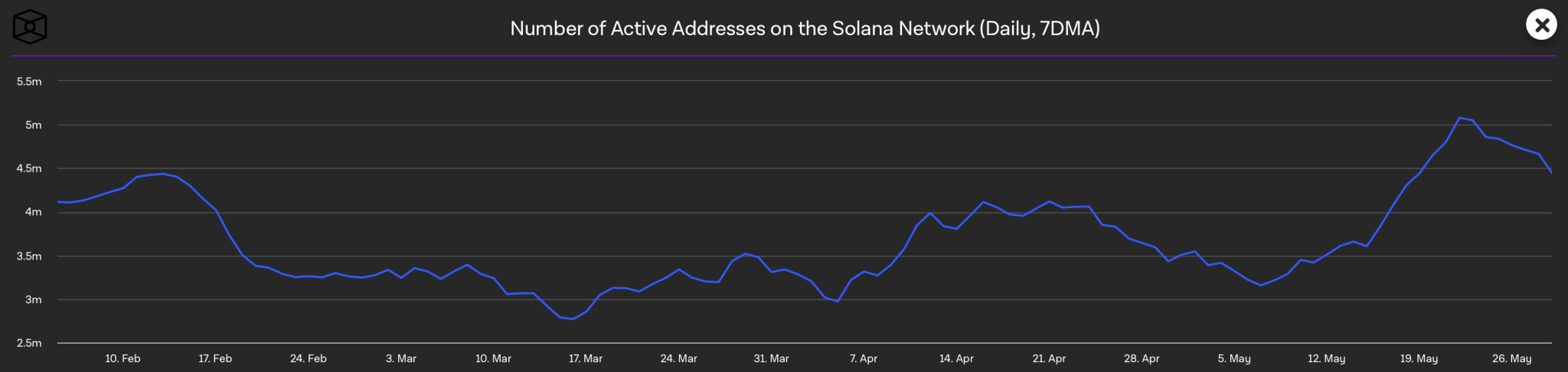

Amid the steep price correction, Solana’s network activity has also declined. According to on-chain data, the number of active addresses on the network has dropped to 4.45 million, down from a 7-day peak of 5.08 million.

As network activity slows, the drop in active addresses may further reinforce the bearish trend.

Bearish Sentiment Reshapes Derivatives Market

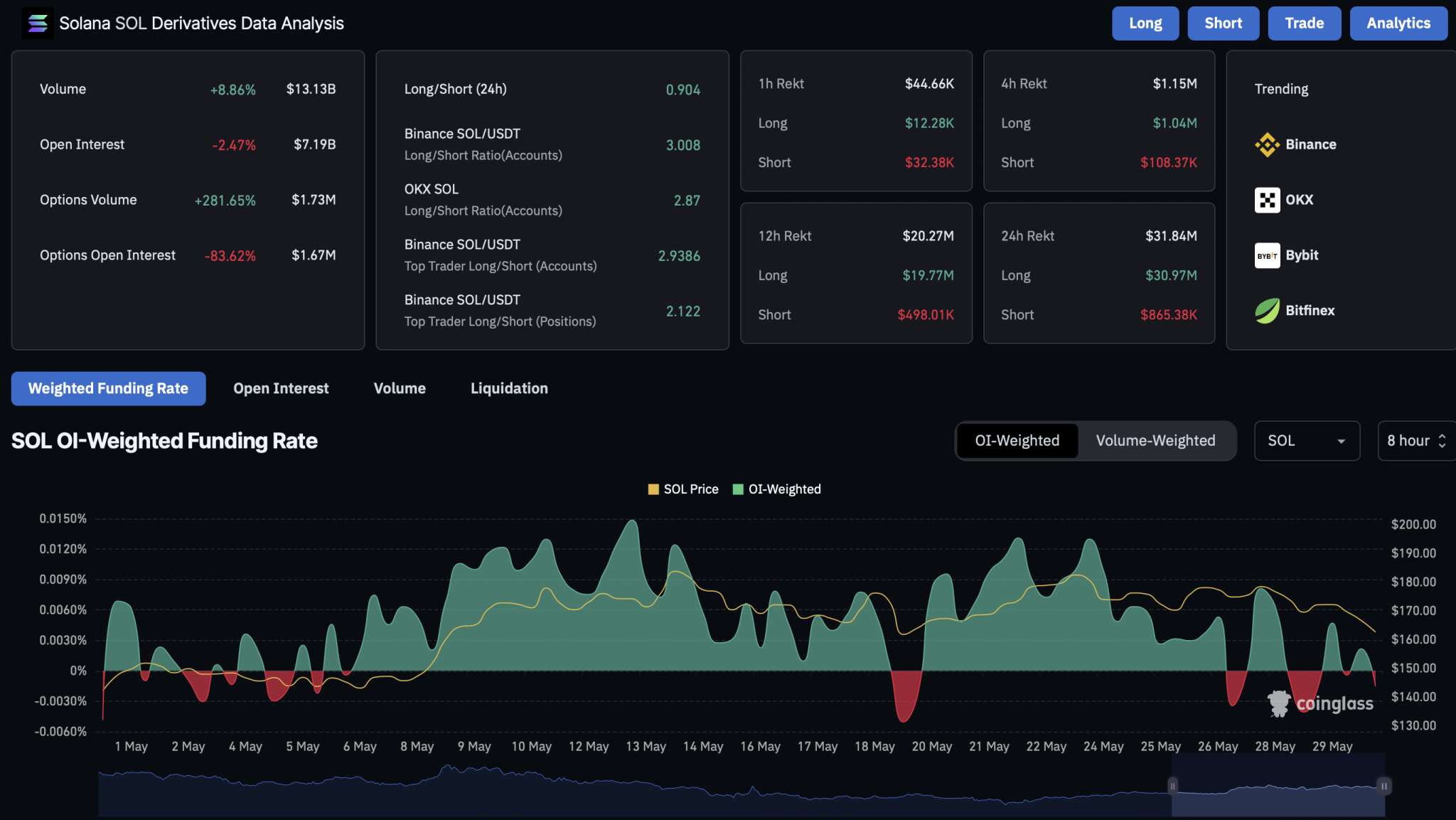

In tandem with the network slowdown, bearish sentiment in the derivatives market continues to grow. Open interest in Solana futures is down 2.47% to $7.19 billion, while the OI-weighted funding rate has turned negative at -0.015%.

Notably, over the past 24 hours, long liquidations have surged to $30.97 million, while short liquidations remain minimal at $865,380.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.