Dogecoin is holding near the $0.1869 support level. Will a bounce trigger a breakout rally toward $0.50, or will DOGE fall to $0.14? A trader eyes a potential 2x breakout rally.

As the crypto market sees top altcoins in a weak position, Dogecoin is trading at $0.19. Last week, the largest meme coin fell by nearly 14%, extending its intraday decline to $0.1869. Dogecoin is expected to sustain support at the crucial 23.60% Fibonacci retracement level of $0.1869.

Dogecoin Analysis

On the daily chart, Dogecoin’s price action shows a bullish failure to surpass a long-standing resistance trendline near the 50% Fibonacci level at the psychological mark of $0.25. With a bearish reversal, Dogecoin has breached the 200-day, 100-day, and 50-day EMAs to test the 23.60% Fibonacci level at $0.1869.

With a couple of long-tailed Doge candles appearing over the weekend, the meme coin has managed to stay above the support level. However, the MACD and signal lines have formed a bearish crossover and are approaching the center line, indicating growing bearish momentum.

As the MACD and signal lines continue to decline, the likelihood of a steeper correction in Dogecoin increases. Furthermore, the downward movement in the 50- and 100-day EMAs has delayed the possibility of a bullish crossover that could signal a trend reversal.

A potential cup-and-handle pattern remains in play for Dogecoin if it rebounds from the 23.60% Fibonacci level. To re-test the resistance near the $0.25 supply zone, the meme coin must break above the long-standing resistance trendline. Doing so would increase the probability of a breakout rally, potentially targeting the 78.60% Fibonacci level at $0.3618.

On the other hand, a daily close below $0.1869 would likely extend the decline toward the $0.14 support level.

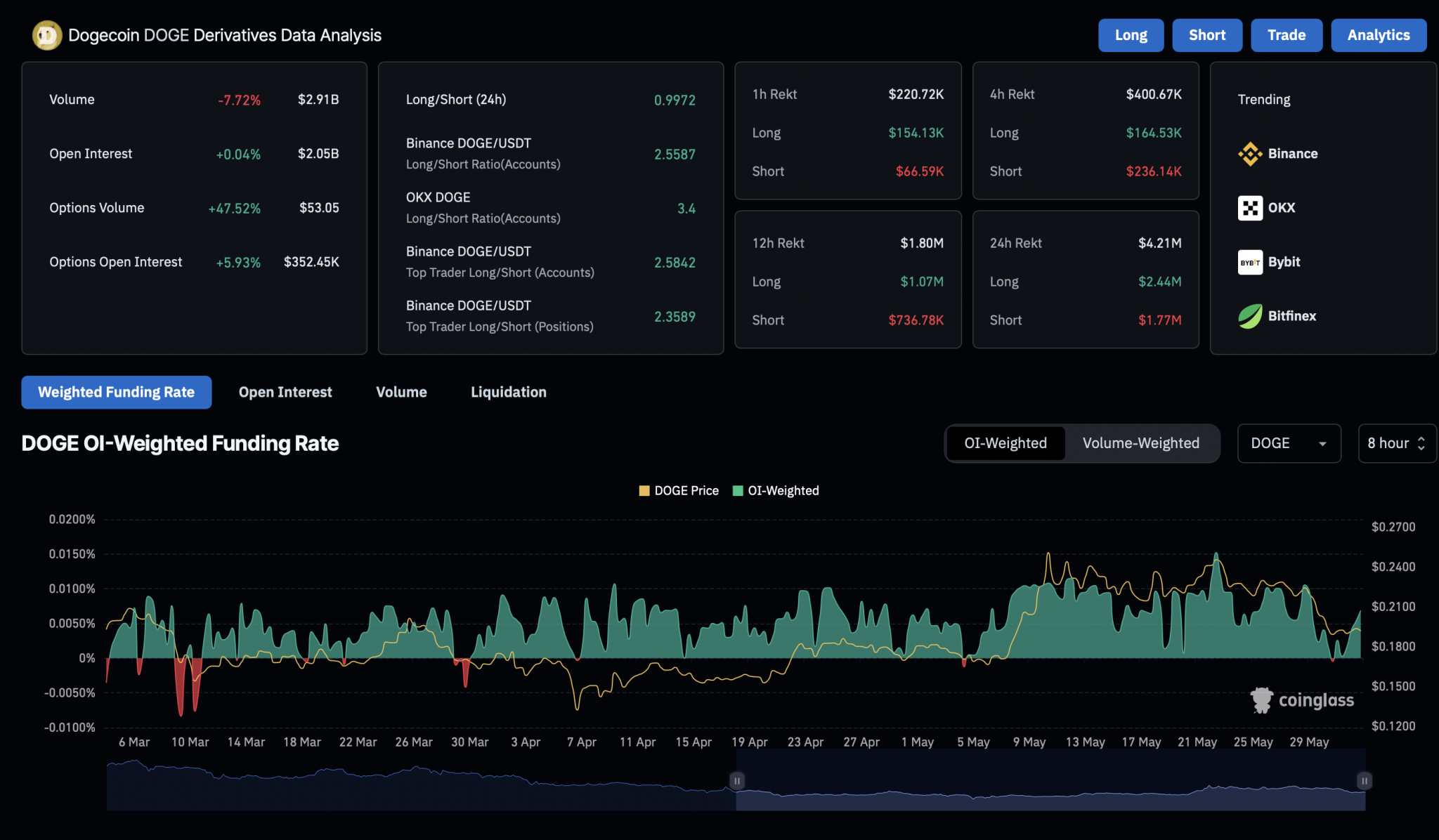

Neutral Grounds in Derivatives Market

Despite Dogecoin’s short-term pullback, the derivatives market remains neutral on the meme coin. DOGE open interest has remained relatively unchanged at $2.05 billion, while the long-to-short ratio at 0.9972 is nearly balanced.

However, liquidation data suggests a slight bearish tilt, with long liquidations rising to $2.44 million, compared to $1.77 million in short liquidations. Despite a larger wipeout of bullish-aligned traders, ongoing trading activity indicates a mildly bullish bias.

This is supported by the funding rate spiking to 0.0069%, reflecting optimism among Dogecoin traders. This increases the likelihood of a leverage-driven recovery that could complete a bullish pattern.

Analyst Predicts 2x rally in DOGE

Adding to the bullish outlook, crypto analyst Tardigrade has highlighted the potential for a new bull run in Dogecoin. The analyst points to a breakout from a base-three pattern within a step-like parabolic curve formation.

At the end of the third base, the analyst predicts Dogecoin could deliver a 2x return, potentially surpassing the $0.50 psychological level.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.