A recent analysis shows that XRP price could see a significant uptick if it dominates the cross-border payments sector by 2030.

Ripple is setting its sights on the global payments industry. In a previous video presentation, Pegah Soltani, who leads payments product at Ripple, shared the company’s outlook on the future of cross-border payments.

Ripple Seeks to Dominate the Cross-Border Sector

She pointed out that trillions of dollars already move between countries every year. However, by 2030, that number could climb to $300 trillion.

Nonetheless, even with that kind of growth, Soltani noted that cross-border transactions today still face major problems. Specifically, they’re often slow, expensive, and prone to errors. Ripple wants to fix that by using blockchain and digital assets to make global payments faster and cheaper for businesses and their customers.

She walked through a typical instance. In particular, imagine a company in the UK that wants to send money to the Philippines. They start by asking for an exchange rate quote. Once they approve it, they send the payment. Importantly, XRP acts as a bridge between currencies.

Ripple’s payment service converts the funds into Philippine pesos, and the recipient gets the exact amount, instantly. Soltani also explained that Ripple’s system lets businesses expand into new markets quickly, and payments settle in seconds, not days.

The prospect of XRP Dominating the Cross-Border Scene

The Crypto Basic sought to ascertain what this kind of growth could mean for XRP’s price, so we asked ChatGPT a hypothetical question: what if XRP handled all $300 trillion in annual cross-border payments by 2030? What kind of price could that lead to?

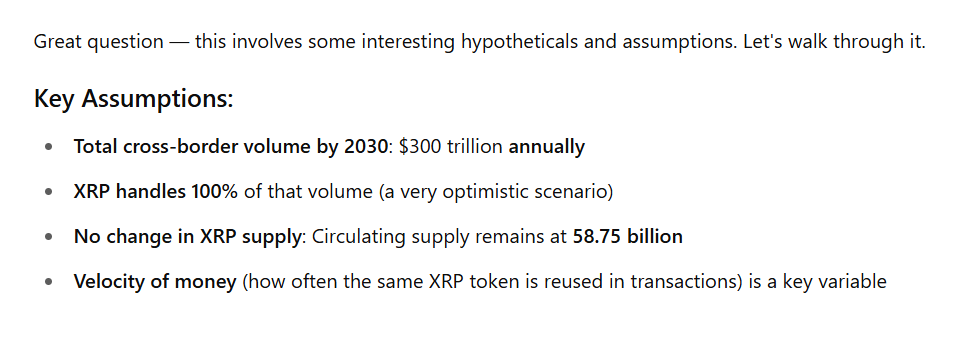

ChatGPT admitted that this is a highly optimistic scenario but first made a few important assumptions. Notably, in this scenario, XRP would have to process 100% of that $300 trillion volume, an incredibly tall feat.

Second, its circulating supply would stay fixed at 58.75 billion tokens. Third, the outcome would depend heavily on how often each XRP token gets reused in transactions, a concept analysts call the “velocity of money.”

XRP Price if It Handles 100% of Projected $300T Volume by 2030

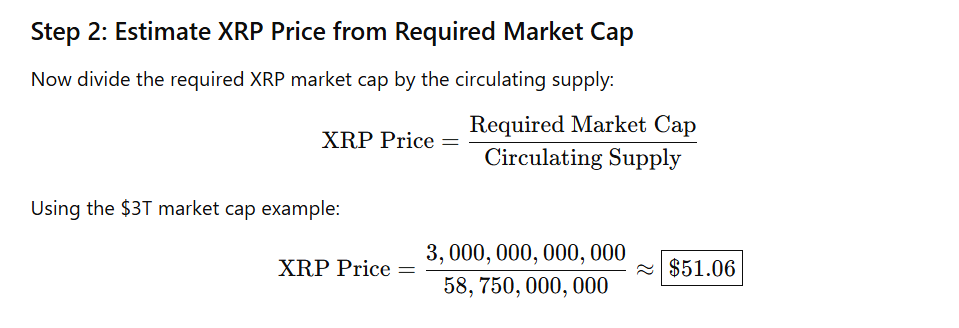

Essentially, to estimate XRP’s potential value, ChatGPT first looked at how much XRP would be necessary to process $300 trillion a year. It used a simple formula: total volume divided by velocity. For instance, if every XRP token was reused 100 times a year, the network would only need $3 trillion worth of XRP to handle the entire $300 trillion.

Next, ChatGPT calculated the token’s potential price. It divided that $3 trillion value by the 58.75 billion tokens in circulation. This resulted in an XRP price of about $51.06. Interestingly, analysts at crypto resource Changelly expect XRP to reach $51 by August 2033.

Notably, ChatGPT then mapped out several other scenarios based on different reuse rates. If the token velocity was just 10, XRP would need to be worth $30 trillion, pushing the price to around $510.64.

Meanwhile, at a reuse rate of 50, the price could reach $102.13. However, a higher velocity of 200 would suggest a $25.53 price, and if tokens were reused 500 times, the price might land near $10.21.

The takeaway is that XRP’s price depends a lot on how often people use it in real-world transactions. While it’s unlikely XRP will handle all global cross-border payments, ChatGPT suggested that even capturing a small share, say, 5% or 10%, could drive up its value if adoption grows with it.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.