A prominent CryptoQuant analyst has identified the point at which Bitcoin long-term holders may start selling their holdings.

According to Axel Adler Jr., a verified analyst at CryptoQuant, these seasoned investors usually begin selling their holdings once their profits cross a major threshold, and this could have an impact on Bitcoin’s future price action.

When Bitcoin Long-Term Holders Could Start Selling

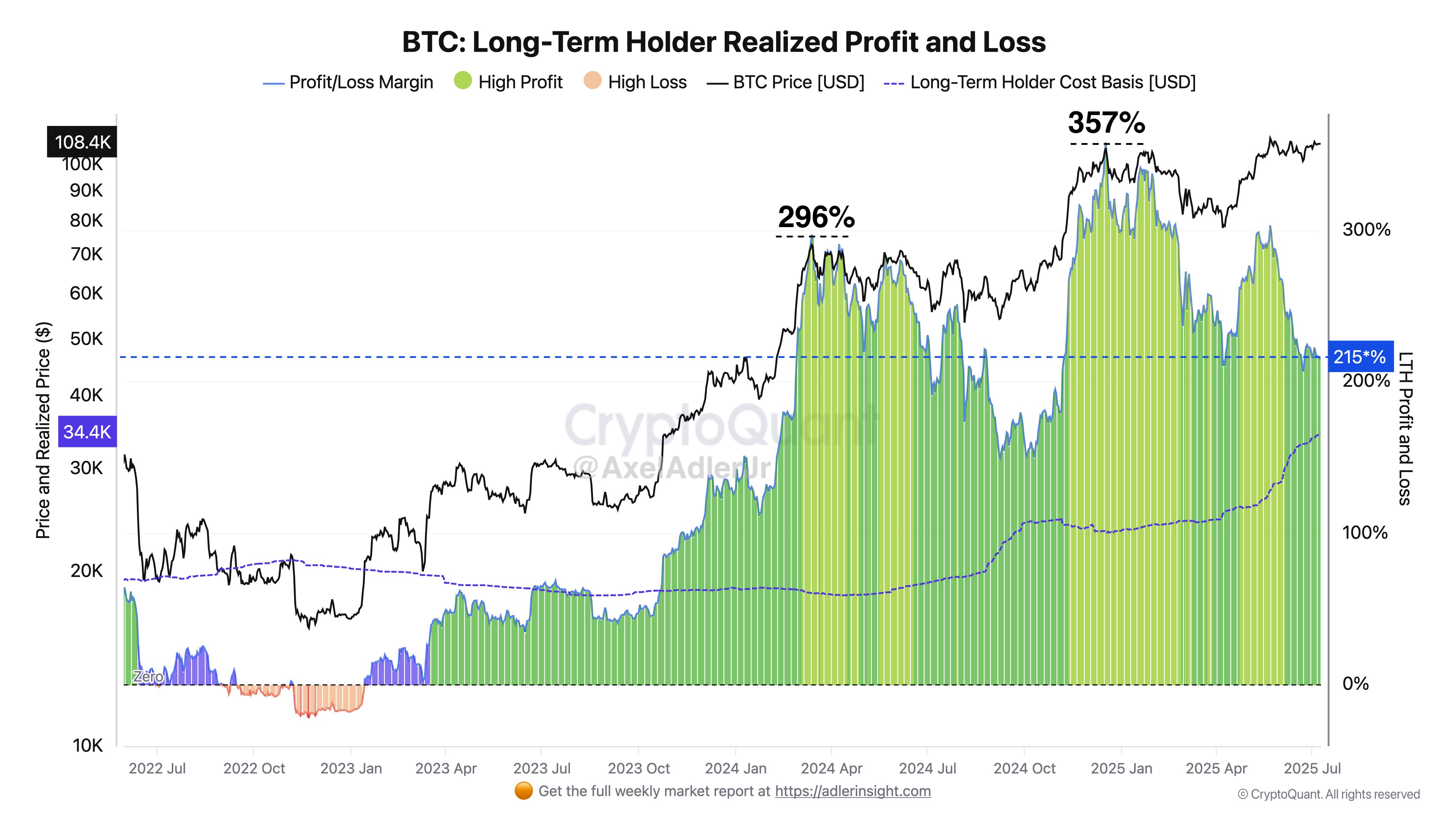

Specifically, Adler pointed out that Bitcoin long-term holders tend to sell when their unrealized profits climb past 300%. Interestingly, this pattern has repeated itself across several Bitcoin bull rallies.

For instance, in mid-March 2024, when Bitcoin reached $72,754, the profit ratio for LTHs hit 296.9%. As that number approached the 300% mark, many of them began selling. Notably, their selling pressure contributed to a drop in price, which pulled their profit margins down again.

Another instance came during the rally between November 2024 and January 2025, fueled by political momentum. During this period, Bitcoin pushed past the $100,000 milestone and hit an all-time high of about $106,000 on Dec. 17, 2024.

At that price level, LTHs were sitting on a 357% profit. The spike triggered another round of heavy selling, which again led to a decline in both Bitcoin’s price and their profit ratio.

Now, despite Bitcoin currently trading at over $109,000, higher than it did back in December 2024, Adler noted that LTHs are now only up about 215% on average. This gap between price and profit ratio comes from a change in their cost basis.

Price at Which Bitcoin Long-Term Holders Could See 300% Profit

For context, in December 2024, LTHs had an average entry price of $23,314. This figure has now climbed to $34,400 because many of them bought more Bitcoin at higher prices. While the current market price is higher, their increased cost basis has reduced their overall returns.

Notably, for Bitcoin long-term holders to reach a 300% profit at the current cost basis of $34,400, Bitcoin would need to hit $137,600. This price represents a 25% increase from current levels. As a result, if Bitcoin could see another upsurge that might push it toward $137,000 before a roadblock occurs.

According to Adler, until this happens, the market remains in a range where Bitcoin long-term holders may either continue to take profits gradually or prepare for a sharper round of selling once the threshold is met.

Bitcoin Warming up for a Market Shift

Meanwhile, in a parallel report today, Adler said Bitcoin usually sets a new all-time high within 50 days of the previous one, provided the market avoids a correction deeper than 20%.

If there is no deep correction (a decline of more than 20%) during a bull market, a new all-time high typically occurs within 50 days. It's now been 47 days since the last ATH, and we haven’t seen any major pullback.

History doesn’t have to repeat itself but the numbers don’t… pic.twitter.com/BS1R0lhNdZ

— Axel 💎🙌 Adler Jr (@AxelAdlerJr) July 9, 2025

So far, 47 days have passed since the last record high, and Bitcoin hasn’t seen any major pullback. The market analyst believes that if volatility remains low, Bitcoin could break its previous high of around $112,000 within the next seven days.

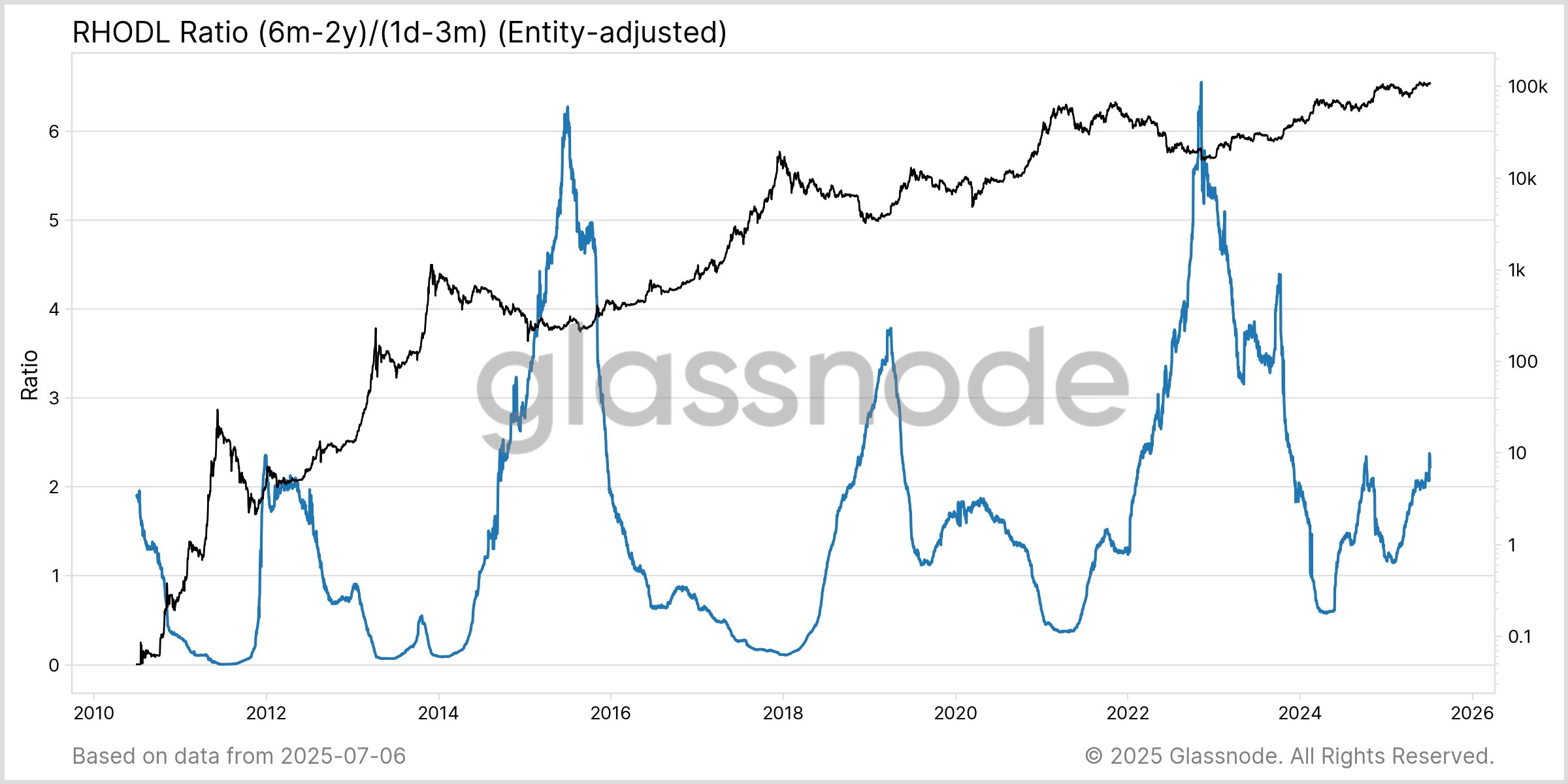

Also, blockchain analytics firm Glassnode noted today that Bitcoin’s RHODL Ratio just reached its highest point in this cycle. This change shows that a growing share of Bitcoin wealth now sits with holders who entered during the current cycle, while activity among short-term holders remains quiet.

Glassnode explained that when the RHODL Ratio moves up and short-term activity stays low, the market often enters a transition phase. These periods usually lead to a drop in speculative momentum. At press time, Bitcoin currently trades for $109,379, up over 1% in the past week.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.