As the overall crypto market crashed today, WiverRiders, a notable market analyst, has identified a bearish formation in Cardano price structure.

According to the analyst, Cardano currently remains in a bearish trend with no signs of price stabilization, as the token has broken below key levels that previously acted as support.

Bearish Double Top Formation On Cardano

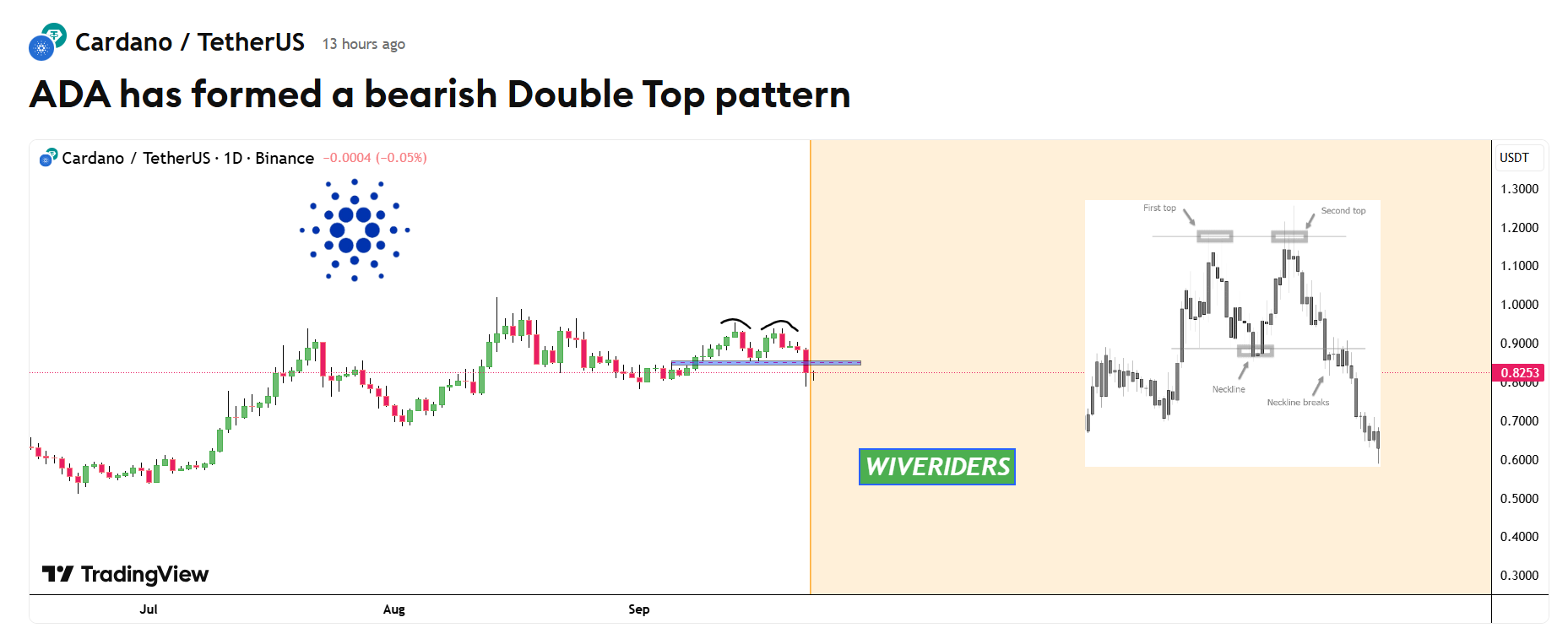

Specifically, the analyst highlighted a bearish Double Top pattern on Cardano’s chart, with both peaks forming around the $0.9300- $0.9600 region, a zone that has now proven to be a significant resistance. The first top formed on September 13 at $0.9546, while the second occurred on September 18 at $0.9358, confirming the bearish setup.

Notably, Cardano has broken the neckline at approximately $0.8500, which signals further downside momentum.

Meanwhile, based on this breakdown, the projected target points toward $0.7682, aligning with the next key support zone.

Conversely, the structure indicates that sellers currently hold the upper hand, pressing ADA toward lower levels if buying pressure does not re-emerge.

However, historical data shows that each time ADA formed this structure, it often collapses further before eventually recovering. For instance, when a double top occurred in May 2025, Cardano dropped to $0.51 by June 22 before recovering to $0.9373 in July.

Another occurred in August and resulted in a drop to $0.78 on Sept. 1. While the latest could lead to steeper declines, Cardano still has hope for a rebound.

Will ADA Extend Losses Toward $0.7682?

Moreover, Cardano had been trading within a rising channel since mid-June, consistently forming higher highs and higher lows.

Nonetheless, on September 22, ADA broke decisively below the channel’s lower boundary, signaling the end of its short-term uptrend and a shift in momentum back to sellers. This breakdown indicates that buyers failed to defend the ascending trendline, allowing bearish pressure to dominate.

Notably, the Directional Movement Index (DMI) reinforces this outlook, with the +DI line crossing beneath the -DI line as the ADX strengthens. Together, the channel breakdown and bearish DMI crossover confirm a downside bias, with ADA now targeting the $0.7682 support level.

Cardano Derivatives Show Weak Participation

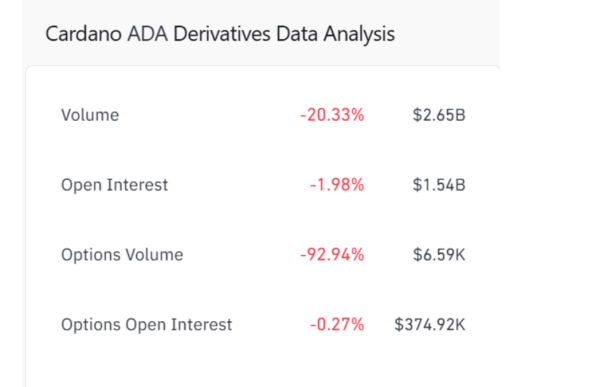

Additionally, Cardano’s derivatives market has also reflected the growing bearish momentum. According to CoinGlass, trading volume declined by more than 20% to settle at $2.65 billion, while open interest slipped by nearly 2% to $1.54 billion, signaling reduced participation from futures traders.

Furthermore, options activity weakened significantly, with options volume dropping by more than 90% and open interest edging 0.27% lower to around $374,000. These declines suggest waning speculative demand and limited hedging activity, aligning with the broader downward trend in ADA’s spot market.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.