Bitcoin Accumulating Addresses Surges Above 600K, Suggesting an Imminent Price Increase.

Bitcoin investors keep accumulating the world’s top cryptocurrency following its low prices.

With the price of Bitcoin down over 50% from its all-time high (ATH) in November 2021, investors have embarked on an accumulation spree of the top asset class in preparation for an imminent bull run.

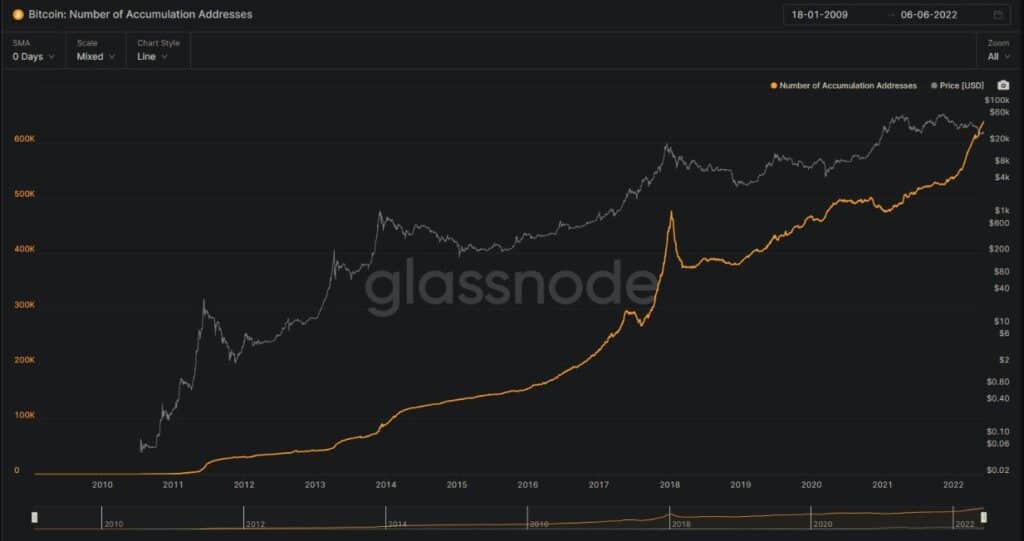

According to data from Glassnode, the number of addresses accumulating the world’s largest cryptocurrency has soared above 600,000 for the first time ever.

The development suggests that Bitcoin investors are taking advantage of the massive price dip recorded in the past week to increase their holding in the cryptocurrency.

The massive accumulation of BTC shows that the number of long-term Bitcoin holders is on the increase, which will help lay the groundwork for cryptocurrency assets to surge. Also, for the first time number of addresses holding bitcoin has surpassed the BTC price on the chart.

It is worth noting that the development was shared by a Bitcoin enthusiast on Twitter, who goes by the username @Blerk52.

“Never before in the history of bitcoin has the number of accumulating addresses crossed up past the price on a chart. Ladies and gentlemen, over the past few days this has happened. This may be the start of the biggest bull run bitcoin has ever seen.”

Most Bitcoin Holders Are In for the Long-Term

Unlike most cryptocurrencies, the vast majority of Bitcoin investors are long-term investors, who have continued to show faith in the asset class, regardless of the market situation.

According to data on the crypto analytic data platform TheBlockCrypto, at least 61% of Bitcoin investors have held the asset class for more than a year, while 33% have held BTC between 1 and 12 months.

Similarly, only a few Bitcoin addresses, representing 6% of holders, have been holding Bitcoin for less than a month. Bitcoin has received interest from most top multinational firms that have continued to declare their commitment to the top asset class.

Some of Bitcoin’s institutional and corporate investors include MicroStrategy, Block Inc., etc.

BTC’s Underperformance This Year

Bitcoin investors are left with no option but to endure a terrible start to the year. BTC, which started the year around $47,000, is down 34.2% as it is changing hands around $30,500 at the time of writing.

Several factors contributed to the bearish state of Bitcoin, including Russia’s ongoing invasion of Ukraine, the Terra tokens crash, as well as the Federal Reserve’s move to increase interest rates in a bid to mitigate surging inflation.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.