Bitcoin’s (BTC) price suffered a fresh new decline in price after its post-fed announcement; the price of Bitcoin dropped from its daily high of $27,500 to $26,500, sparking a fresh sentiment and fear by traders and investors as speculation of $20,000 BTC price resurfaces.

It is not new that a sharp drop in the price of Bitcoin (BTC) and other cryptocurrencies leads to extreme fear and uncertainties of Bitcoin retesting new lows as bears aim to create more doubt and uncertainties for its faithful.

However, the week for Bitcoin and other cryptocurrencies looked promising, with the price of BTC rallying from $25,800 to $27,500 as many traders and investors hope for the price of BTC to close above this region and for good support above $28,500 acting as resistance for BTC price.

The price movement, which was widely celebrated after much range movement by Bitcoin, was short-lived as the price was rejected by bears around $27,500 to a region of $26,500 as the price struggled to hold above this region or retest the lows of $24,800 to $23,500.

Bitcoin’s fear and greed index continues to look promising this week compared to previous months, where the sentiment was fear at around 41 compared to Bitcoin’s present fear and greed index showing 47 neutral, suggesting positive signs for BTC.

The heat map above highlights some positive signs for the general cryptocurrency market, including the talked about weekly top 5 cryptocurrencies (XRP, SOL, LINK, ADA, PEPE), which we will discuss extensively as we head into the new week.

The price of Bitcoin (BTC) rallied from $25,500 on the daily timeframe (1D) to a high of $27,500 with much strength as talks of $28,500 continued to heat up but lasted for a short time as the price of BTC was rejected by bears with what looks like a bearish trap by the bears.

Bitcoin’s price continues to trade below the 50-day and 200-day Exponential Moving Average (50-day and 200-day EMAs) as this region corresponds to the $27,500 acting as resistance for BTC’s price.

The price of BTC needs to reclaim and close above $27,500 to $28,500 to have many hopes of a bullish price rally to a high of even $35,000. If the price fails to reclaim these regions, we could see bears trying to push the price of Bitcoin to a low of $23,800.

Bitcoin’s price movement suggests the price has ranged within a certain price range of $25,500 to $27,500 for over a month now, and a breakout in either direction would be an advantage for traders and investors in the right direction.

Bitcoin’s continuous price struggle has also seen Ethereum’s price not far off from its shadows as the price of Ethereum (ETH) is below its 50-day and 200-day EMAs, corresponding to a price below $1,650.

Ethereum’s law of volatility, volume and unencouraging price action suggests the price looks more ready to retest the region of $1,500 to $1,450 as bulls will be more ready to open a buy order than at present.

Despite a reduced price action from Bitcoin and Ethereum, there has been much speculation making the rounds for these weekly top 5 cryptocurrencies (XRP, SOL, LINK, ADA, PEPE) as we head into a new week as there are chances of many price changes to the upside.

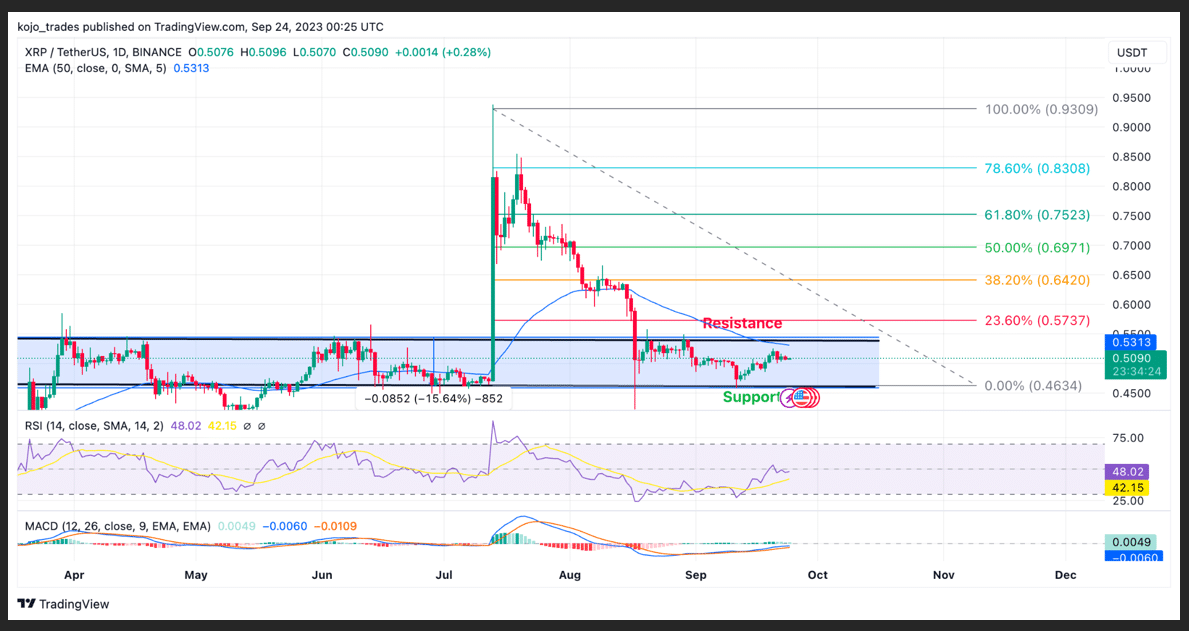

Ripple (XRP) Price Analysis as a Weekly Top 5 Cryptocurrency

Ripple continues to play its game of patience with its investors as the price of XRP/USDT continues its range-bound price movement for over a month as the price of XRP/USDT dropped to its key support of $0.46 before bouncing swiftly to a high of $0.50 as bulls aim to breakout.

Ripple remains one of the weekly top 5 cryptocurrencies talked so much about, with huge community backing over the years despite suffering some shock price decline and uncertainties after the United States Security Exchange Commission (US SEC) court filing.

Ripple has had many advantages this year after winning the legal case in court as the price saw much price action to a high of $0.93 but has since struggled with the bearish price run.

The price of XRP/USDT trades just below the 50-day EMA, acting as resistance for the price of XRP/USDT. If the price of XRP/USDT fails to reclaim its price above $0.55, we could see the price trade below the current point for some time and likely retest the demand zone of $0.46.

A reclaim of XRP/USDT price by bulls above the 23.6% Fibonacci Retracement Value (23.6% FIB Value) would be a good opportunity for bulls to push the price higher to a region of $0.65 to $0.7.

If the price of XRP/USDT reclaims $0.55, we could see many bullish price actions from its daily Moving Average Convergence Divergence (MACD) flipping bullish together with many buy actions on the Relative Strength Index (RSI).

Major XRP/USDT support zone – $0.46

Major XRP/USDT resistance zone – $0.55

MACD trend – Bullish

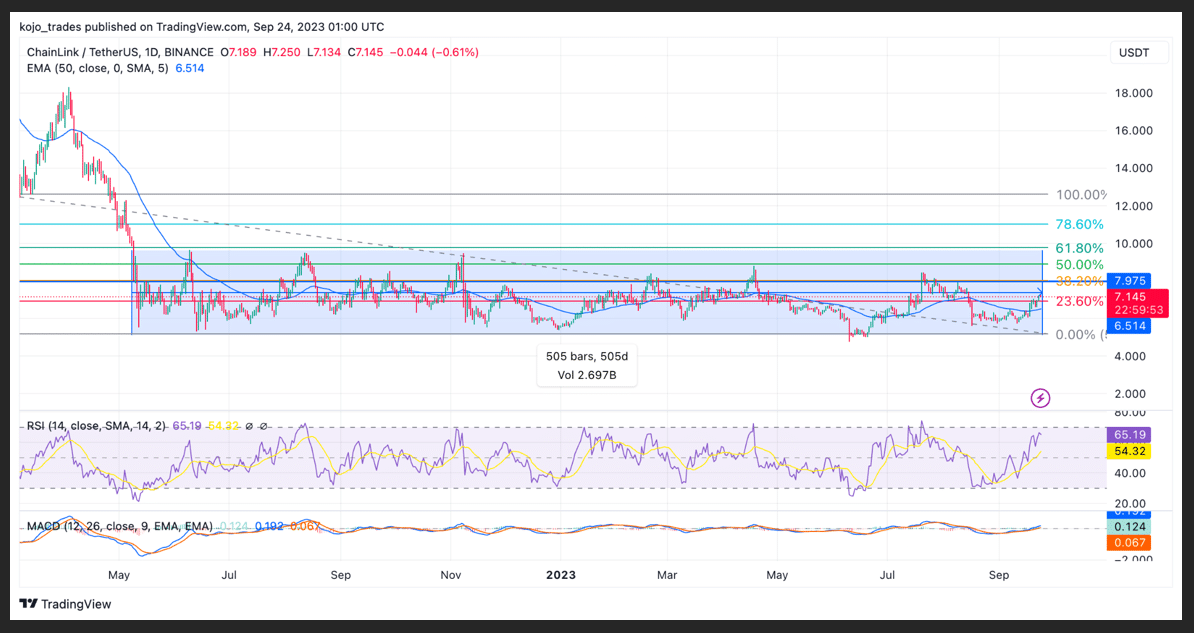

Chainlink (LINK) Resurfaces as Price Eyes $15 From a One Year Price Range

The price of Chainlink (LINK) resurfaces after over 450 days of price ranging between $6 and $9; the price could be set to rally hard in the coming weeks, like the likes of Tellor, as a breakout above $9 could mean LINK marines (bulls) pushing the price to a high of $12 or $15.

Chainlink (LINK) remains a crypto project with huge community backing as it continues to build despite its prolonged bearish run, as the price has failed to replicate its huge potential recently.

The price of LINK/USDT looks prime for a rally as bulls could be set to take hold of the price from the grasp of bears as the price currently trades above the 50-day EMA with much bullish price action from its daily MACD and RSI indicators.

Haven reclaimed its price above the 23.6% FIB Value, which is a good point to kick start its rally; the price of LINK/USDT needs a breakout and close above $9 for a convincing price action from bulls.

LINK/USDT breakout above $9 is key to its anticipated price rally to a high of $12 and possibly $15. If the price of LINK/USDT fails to reclaim above $9, we could see the price remain in a range-bound price movement

Major LINK/USDT support zone – $6

Major LINK/USDT resistance zone – $9

MACD trend – Bullish

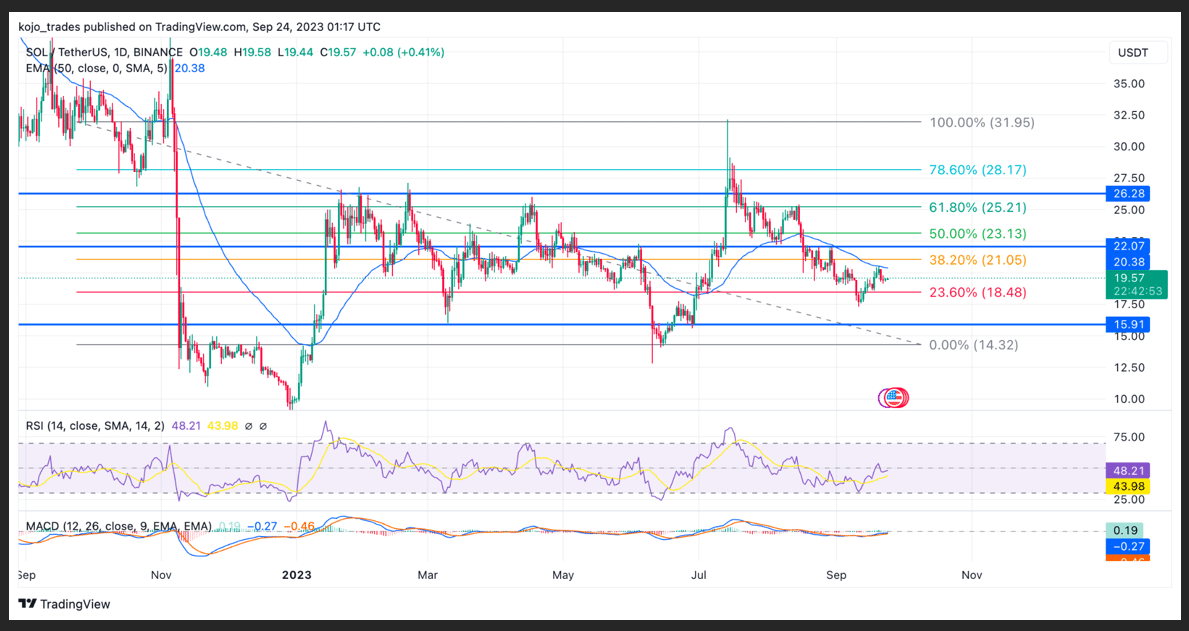

Solana (SOL) Price Analysis as a Weekly Top 5 Cryptocurrency

After the court ordered the sale of FTX assets worth over $3.4B, this saw a very negative effect on the price of SOL/USDT as many investors and traders feared and worried about the price of SOL/USDT dropping to its yearly low of $8.5.

The price of SOL/USDT suffered a shocking decline from a high of $24 to a region of $17.5, acting as strong support for SOL/USDT from the previous price decline as the price of SOL/USDT rallied to a high of $20.5 where the price was faced with resistance to breaking higher.

The price of SOL/USDT currently trades below the 50-day EMA, acting as resistance for the price. The price of $20.5 corresponds with the 50-day EMA acting as resistance for the price of SOL/USDT as the price needs to breakout and close above this region for more bullish movement.

If the price of SOL/USDT breaks and closes above $20.5, corresponding to the 38.2% FIB value, this could be a good opportunity for bulls to push the price to a high of $25 to $26, depending on the volume.

The MACD and RSI for SOL/USDT price on the daily timeframe indicates less activity for Solana as the new week will be a huge factor in the price attempting to break above $20.5.

Major SOL/USDT support zone – $17.5

Major SOL/USDT resistance zone – $21

MACD trend – Bullish

Cardano (ADA) Suffers Fresh Price Decline as Hopes of $1 Dwindles

Cardano (ADA) could be set for a new low as the price has suffered a horrifying price decline, leaving its holders at a loss as the hope of ADA/USDT price retesting $1 in 2024 struggles with reality.

Since its rally to a yearly high of $0.45, the price of ADA/USDT has seen much price decline to a low of $0.245 as the price needs to hold this key region, acting as a demand zone for traders and investors.

If the price of ADA/USDT fails to hold above $0.245, then we could see the price retest a new low of around $0.15 for the price of ADA/USDT, which could be rather worrying for many traders and investors.

Statistics, indicators (MACD, RSI, Volume), and price actions all show bearish price dominance for ADA/USDT, as there seems to be no sign of bulls stepping into the price of ADA/USDT at this region to rescue the price from going lower.

Major ADA/USDT support zone – $0.245

Major ADA/USDT resistance zone – $0.27

MACD trend – Bearish

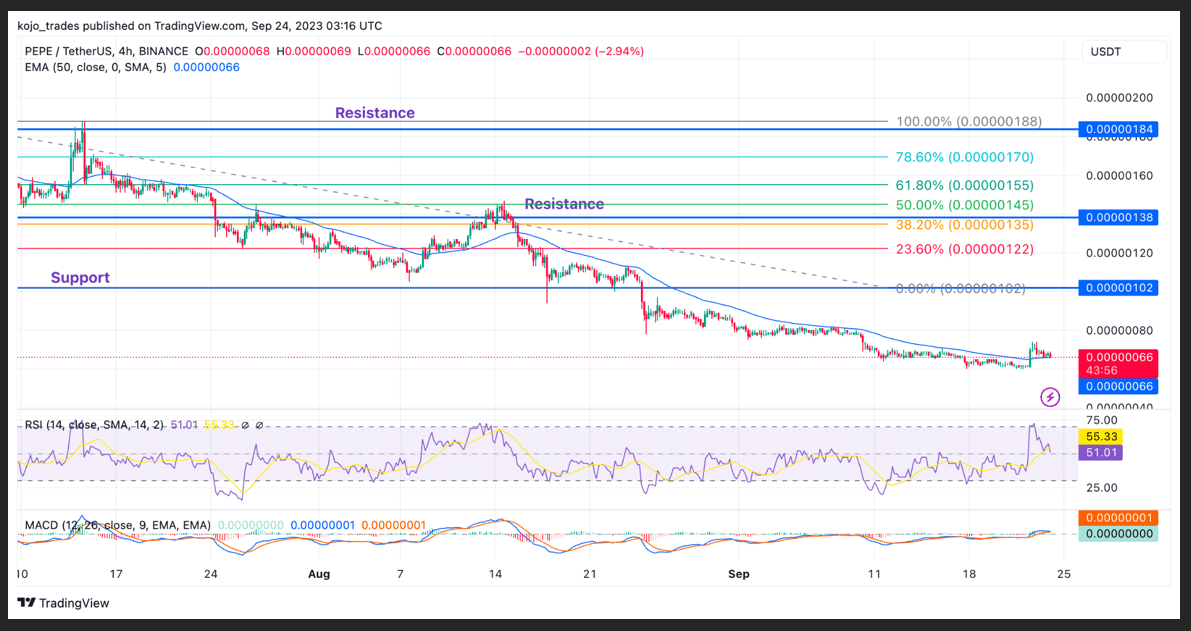

PEPE Memecoin Price Chart Analysis on Daily Timeframe

PEPE has suffered much price decline in the hands of bears as there are no signs of forming strong support or demand zones for traders and investors considering its huge hype and publicity, leading to many millionaires buying into the new memecoin.

Memecoins have become an integral part of trading cryptocurrencies as they possess high potential to produce millionaires quickly, highlighting the opportunities for many PEPE holders and those looking to buy cheap.

After hitting an all-time high of $0.0000040, the price of PEPE/USDT saw its price decline as bears aimed to push the price lower. The price of PEPE/USDT formed support at around $0.00000150 but has seen its price traded below this region, flipping it into resistance.

The price of PEPE currently trades below $0.000000700 as the price looks to form a good support zone to enable buy orders to push the price of PEPE higher. The MACD and RSI for PEPE/USDT indicate much bearish price dominance.

Major PEPE/USDT support zone – $0.000000600

Major PEPE/USDT resistance zone – $0.00000087

MACD trend – Bearish

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.