According to historical trends, the ongoing correction in the price of Bitcoin (BTC) might have more surprises ahead.

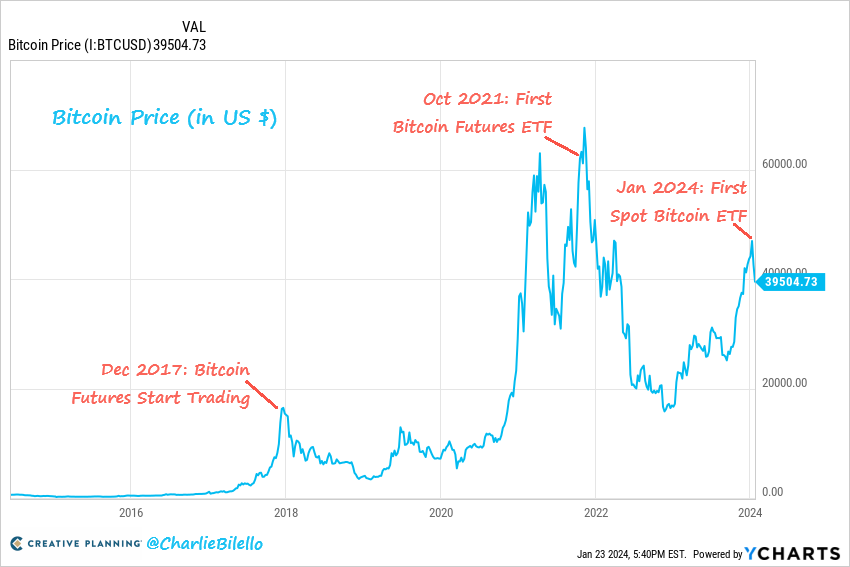

As Charlie Bilello, the Chief Market Strategist at Creative Planning Investor, pointed out, Bitcoin price always faces massive corrections after a big event in its history.

Notably, since the start of the year, Bitcoin has dropped by 5.31%, and at the time of writing, the digital currency is up by 0.4% in the past 24 hours to $40,061.82. The coin’s market cap has jumped by an equal rate to $785,832,653,173, while the trading volume is down by 34.82% to $20,163,194,327.

The Charlie Bilello Observation

According to Bilello, history does not necessarily repeat itself but typically rhymes sometimes. Bilello highlighted the bull run of December 2017, a mega surge that saw Bitcoin jump to a high price above $17,500 at the time. This bull run preceded the start of Bitcoin Futures trading and recorded an 84% correction afterward.

A similar event occurred in October 2021 when Bitcoin charted a rally toward its All-Time High (ATH) of $68,789.63. This rally came before the approval of Bitcoin Futures ETF and bagged a 78% correction afterward.

The similarity in this trend has partially played out with the price of Bitcoin jumping earlier this year in the run-up to the approval of spot Bitcoin ETF products by the US Securities and Exchange Commission (SEC). The second leg of this pattern is a correction, for which the coin has recorded a 20% slump thus far.

Should there be a perfect alignment with its historical trend, Bitcoin may plunge more in the coming weeks.

Bitcoin Price Floor to Watch

With Bitcoin failing to flip the $40,000 price mark into a sustainable support zone, analysts have projected what they believe might be the ultimate bottom for this ongoing market drawdown.

As reported earlier by The Crypto Basic, Ali Martinez, the renowned market analyst, Bitcoin may drop as low as $33,000. He posited strongly that this might be the case if the coin drops below the $38,000 support zone.

Many other analysts share Martinez’s sentiment, however, the consensus is that in the long term, the spot Bitcoin ETF product and the forthcoming halving event will have a positive impact in the price of BTC moving forward.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.