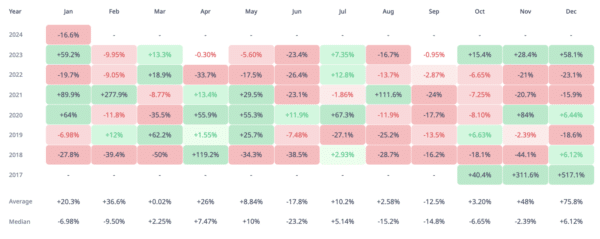

Cardano’s historical record shows an average 36% return in February, even though it is not usually the asset’s best-performing month.

According to this historical data from CryptoRank, Cardano has an average February return of 36%, which makes it the third-best month in history for holding ADA. This means that if the asset follows the same pattern, then it could rise by a similar rate in the coming month.

However, there is a twist. Looking through the lens of time, February is usually not Cardano’s best month. In fact, it is only in two February months of the past six years that the asset has returned a positive performance.

Nonetheless, these returns of 12% in February 2019 and a whopping 277% in February 2021 mean Cardano has an average favorable return for the month under consideration. The other months with a higher average return are November and December.

Bitcoin Halving Year Favors Cardano

Although historical price performance is not a guarantee of future results, it can provide a yardstick for measuring the reaction of participants to certain events and at certain periods of the market cycle.

For example, Bitcoin’s historical rally in a halving year and the year afterward typically leads to a favorable return for other crypto assets.

Based on this indicator, the price of Cardano could perform well in 2024. During the last halving year in 2020, the historical charts above reveal that Cardano (ADA) had seven months of positive returns.

Aside from a single-digit gain in the last month of 2020, the asset posted double-digit returns for its best months. In fact, the 84% return recorded in November of the same year is the fourth highest on record for the asset since then.

At the time of writing, Cardano trades at $0.49, having struggled to get off on the right foot since the start of January. Evidently, time will reveal whether the decline continues, even though history hints that the current consolidation may be a calm before the storm.

Disclaimer: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic’s opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

-Advertisement-