Crypto investment products involving Bitcoin and other assets have witnessed the first negative weekly flow amid the recent market downturn.

Prominent asset manager CoinShares disclosed the recent development in its latest publication on institutional investments in crypto-based products.

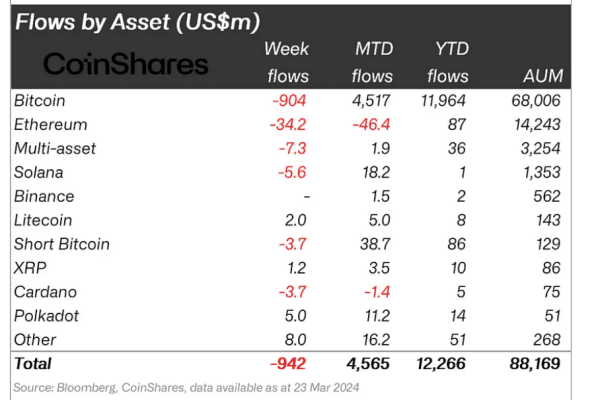

According to the report, last week witnessed a record weekly outflow totaling $942 million across digital asset investment products. This figure marks the first outflow after a remarkable seven-week streak of inflows totaling $12.3 billion.

CoinShares highlighted that despite trading volumes in exchange-traded products (ETPs) remaining high at $28 billion for the week, they were two-thirds lower than the previous week.

Market Correction Caused the Negative Flows

Additionally, the report noted that the recent price correction in the crypto market led to a decrease of $10 billion in total assets under management (AuM). However, AuM still stands above previous cycle highs at $88 billion.

Moreover, analysts at CoinShares suggest that the recent crypto market downturn has resulted in investor hesitancy with crypto investment products. Specifically, they attributed the significantly lower inflows into new ETFs in the U.S. to the market-wide corrections.

According to the data, these U.S. ETFs saw $1.1 billion inflows last week. However, the figure failed to offset the substantial $2 billion outflows from the market, which were largely influenced by Grayscale Investment’s GBTC.

Meanwhile, CoinShares observed that negative sentiment towards crypto-based investment vehicles was not limited to the U.S. market.

Countries such as Switzerland, Sweden, Hong Kong, and Germany experienced outflows of $25 million, $37 million, $35 million, and $4 million, respectively. Yet, Canada and Brazil saw positive flows totaling $8.4 million and $9 million, respectively.

Bitcoin Bled the Most

Additionally, the report highlighted that 96% of the flows were directed toward Bitcoin, which experienced outflows totaling $904 million. Moreover, Bitcoin shorts saw minor outflows amounting to $3.7 million.

Also, Ethereum, Solana, and Cardano faced challenges, witnessing outflows of $34 million, $5.6 million, and $3.7 million over the week.

On the other hand, the remainder of the altcoin space performed well, with net inflows reaching $16 million. Notable performers included investment products of Avalanche, Polkadot, and Litecoin.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.