According to recent data, Bitcoin addresses holding 1,000-10,000 BTC added 20,000 BTC ($1.4 billion) during the recent price increase to $70,000.

Bitcoin addresses holding between 1,000 and 10,000 BTC have significantly increased their holdings during the latest price uptick to $70,000, according to recent analysis by IntoTheBlock. Over the past week, these addresses collectively procured 20,000 BTC, equivalent to $1.4 billion, showing a notable trend among large holders.

Bitcoin addresses holding between 1k and 10k $BTC have been the main accumulators during the recent price surge to $70k.

Over the past 7 days, these addresses collectively added 20k BTC ($1.4B) to their balances. pic.twitter.com/LjhZiNnszf

— IntoTheBlock (@intotheblock) May 23, 2024

Trends in Bitcoin Holdings

The chart provided by IntoTheBlock, covering the period from May 14 to May 22, illustrates the balance held by addresses with 1,000 to 10,000 BTC alongside the price of Bitcoin during the same timeframe.

The data reveals that on May 14, the balance held by these addresses was approximately 4.91 million BTC. From May 17 to 19, there was a steady increase to about 4.93 million BTC, which continued to grow. The most significant upsurge occurred on May 21 and 22, ending at 4.97 million BTC.

Simultaneously, the price of Bitcoin showed notable volatility within this period. Starting at $63,789, Bitcoin’s price witnessed fluctuations before recording a gradual rise to $65,483, followed by a significant increase to $68,871 on May 19. The upward trend continued, peaking at $70,565 on May 21.

Accumulation Trends Among Significant Holders

The steady increase in the balance held by these addresses indicates accumulation by large holders. This trend suggests confidence in Bitcoin’s long-term value, potentially reflecting bullish sentiment among significant investors. Despite the fluctuations, the overall trend points to a positive outlook from these key players.

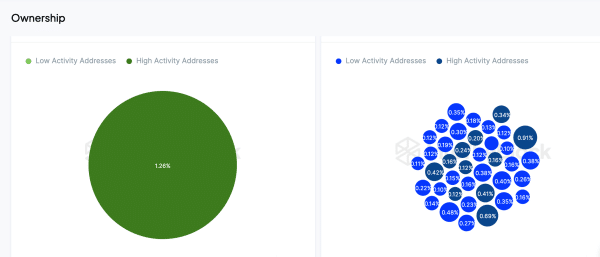

IntoTheBlock’s analysis also categorized ownership into whales and investors. Whale holdings, particularly low activity addresses, accounted for 1.26% of total BTC holdings. These low activity addresses suggest a portion of BTC is held by entities or individuals who do not frequently move their assets. This behavior could stabilize the market by reducing the circulating supply.

Investor holdings showed a wider distribution with a mix of low and high activity addresses. The largest investor segment held 0.91% of BTC.

Majority of Bitcoin Holders Remain Profitable

Meanwhile, a March report revealed that the number of Bitcoin addresses in profit had approached 100% as the price neared its previous all-time high (ATH) above $68,000. The rally since the start of the year erased previous losses, with IntoTheBlock data showing 51.94 million addresses holding Bitcoin at a profit, amounting to 99.63% of total holders.

This trend of profitability continued, with the percentage of profitable addresses reaching 95% as the price touched $57,416 in late February.

Today, the price of Bitcoin is $69,756.52, with a 24-hour trading volume of $30,721,182,878.03. This represents a 0.37% price increase in the last 24 hours and a 4.84% price rise over the past 7 days.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.