Ethereum’s price continues to defend $3,800 despite the cooling investor impetus ahead of the next US non-farm jobs data, and on-chain data analysis reveals a rare bullish signal that could spark the next rally.

Ethereum Price Rally Cools Ahead of US Inflation and Jobs Data

The US Bureau of Labor Statistics is scheduled to publish the next instalment of its monthly Non-Farm Jobs data on Friday May 31. The Non-Farm Jobs is a key macroeconomic indicator that impacts how regulators and investors view the direction of change in inflation and overall economic activity.

Within the current landscape, another decline in Non-Farm jobs could push the Fed on a step towards cutting interest rates, and vice versa.

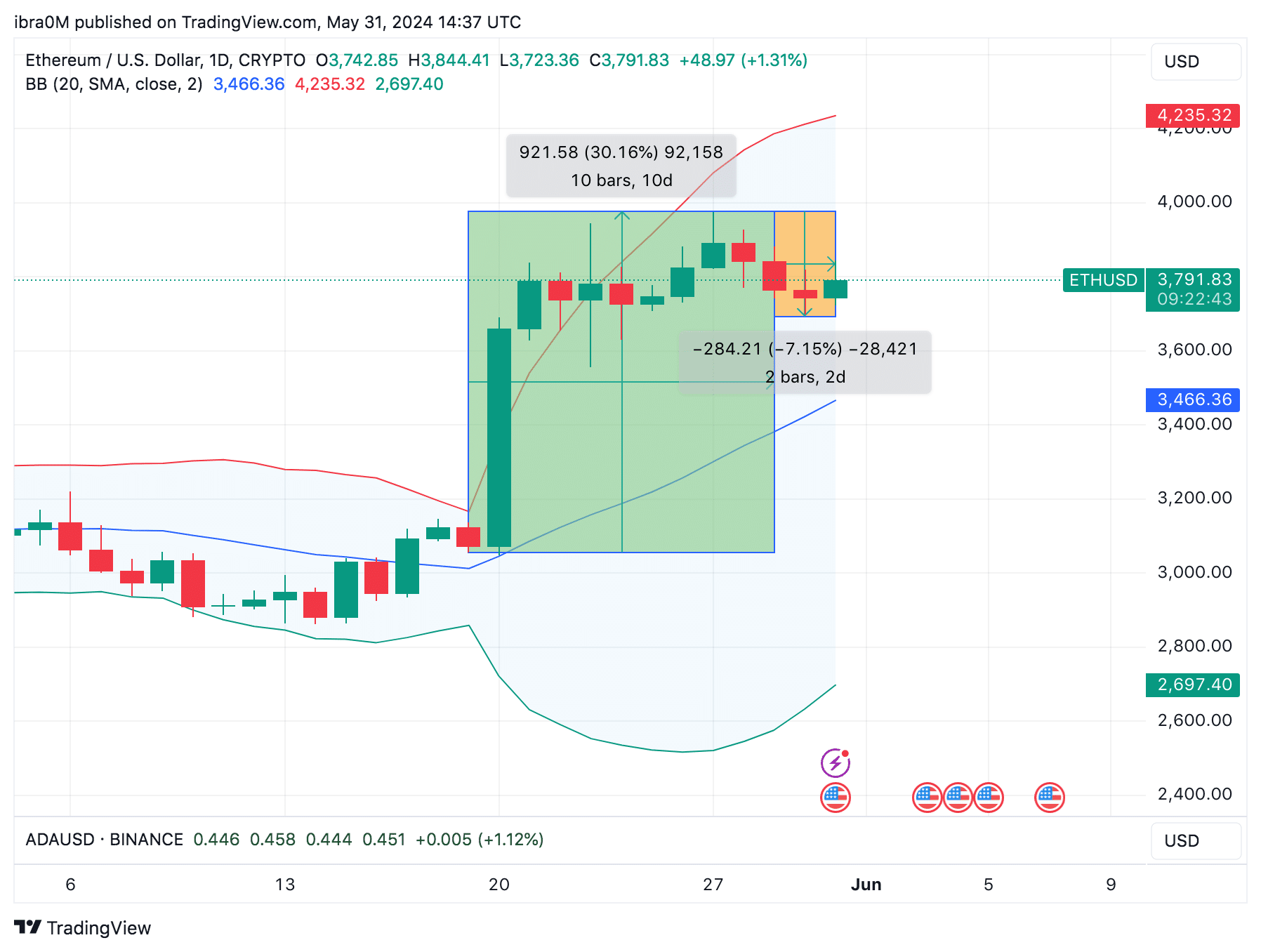

As the report draws closer, strategic crypto investors have cooled their trading activity, tipping the Ethereum markets into a consolidation phase over the last 24-hours, hatling the week-long uptrend from the ETH ETF approval.

As seen above, between May 21 and May 29, Ethereum price had raced into a 30% rally, reaching a new monthly-peak of $3,974. But between May 29 and May 31, ETH price has retraced 7%, reaching a weekly low of $3,698.

This suggests that the ETH post-ETF price rally appears to have entered a recess as crypto investors take on subdued positions ahead of the upcoming US macroeconomics indices data.

However, taking a closer look at the on-chain data, institutional investors on the Ethereum network are still carrying out large volumes of transactions behind the scenes.

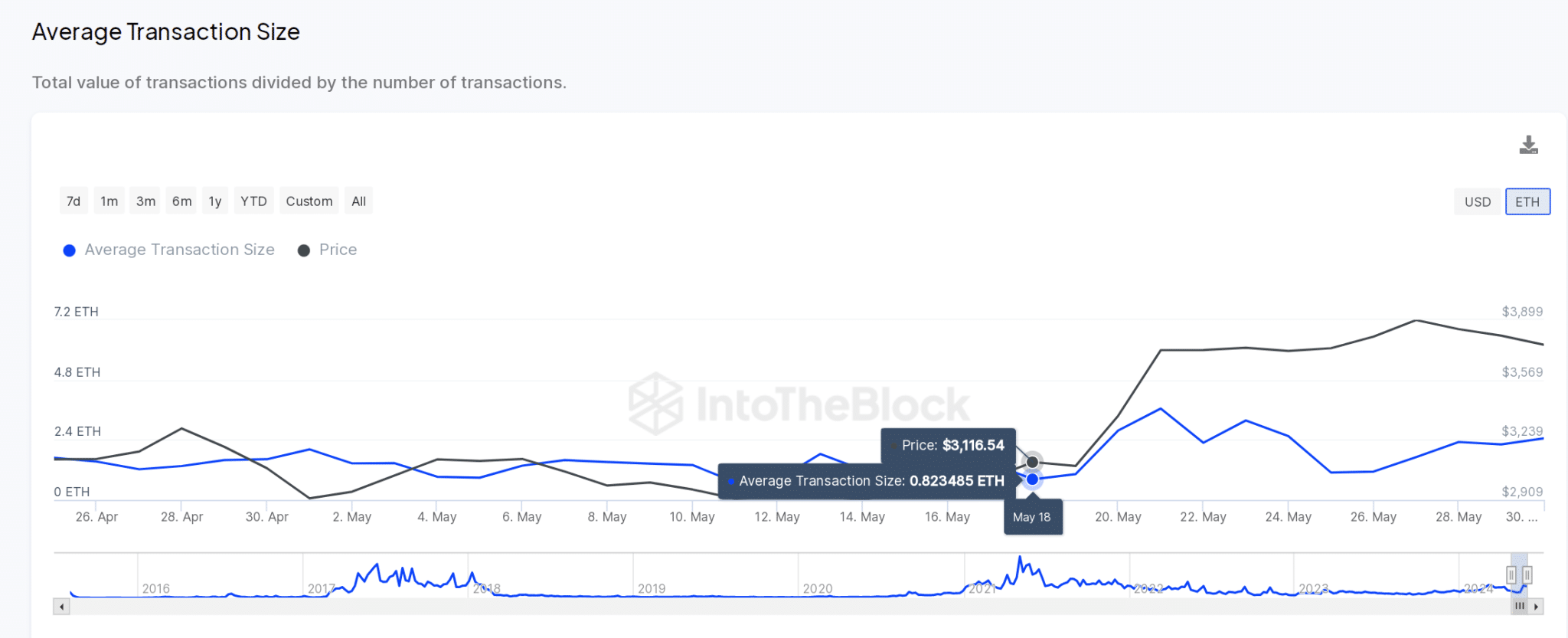

As depicted below, IntoTheBlock’s Average Transaction size provides insights into the rate at which investors are conducting large investments on a blockchain network.

Ethereum Price vs. ETH Average Transaction Size

As seen above, Ethereum average transaction size stood at 1.03 ETH as of May 19. However since the Ethereum ETF approval the figure had continued to increase considerably.

At the time of writing on May 31, Ethereum’s average transaction size has now reached 2.46 ETH, reflecting a 240% increase within the last two weeks.

Typically, a 240% increase in average transaction size is a key bullish signal for a few reasons. Firstly, it signals improved sentiment and bullish conviction, as investors are now willing to perform higher value transactions.

More so, these higher value transactions also indicator a significant growth in market liquidity, which prospective new entrants could find attractive.

Ethereum (ETH) Price Forecast: Is the $4,500 target viable?

Ethereum price is struggling to defend the $3,800 support at the time of writing on May 31. However, if the US. Non-Farm Jobs data yield a positive market reaction, the 240% surge in transactions could set the stage for ETH price to break above $4,500 in June 2024.

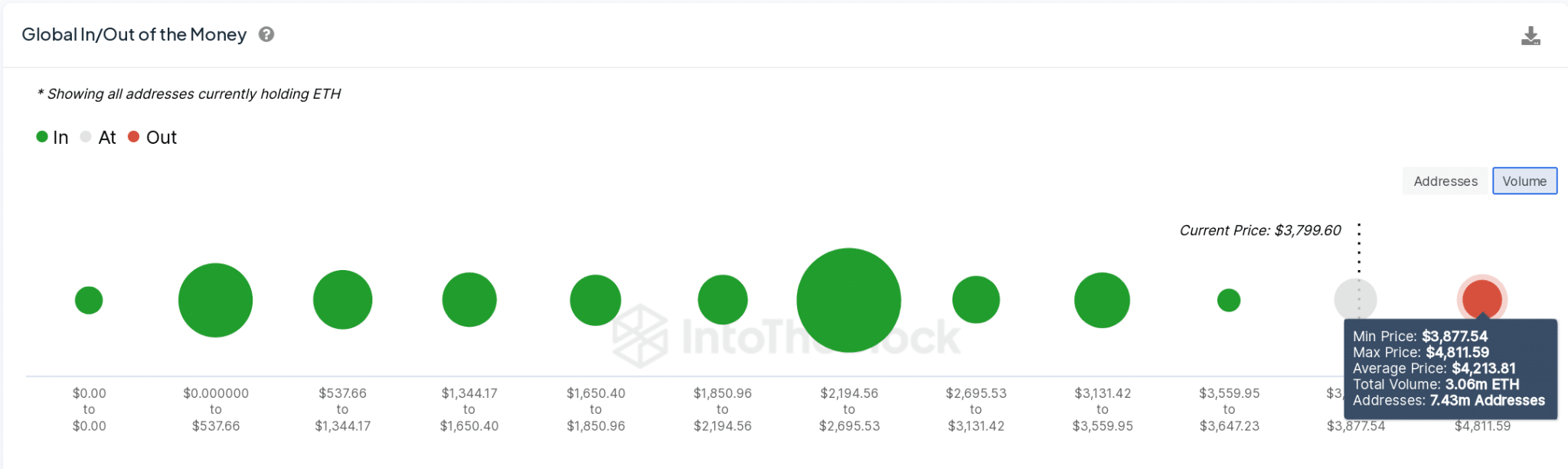

However, looking at the historical buy-in trends, Ethereum price could face a major resistance at the $4,200 during the next phase of the rally.

As seen above, 7.43 million active ETH holders had acquired 3.06 million ETH at the average price of $4,213. ETH price could struggle to break out of that resistance cluster, if they opt to take profits early.

But if Ethereum price can stage a decisive breakout above $4,200, bulls can anticipate new peaks above $4,500.

On the downside, if ETH fails to defend the $3,700 support level, a decline towards $3,560 could be on the cards.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.