Bitcoin Cash price reclaimed $390 price level on June 30 to post 17% negative growth performance for June 2024. But having reversed the majority of the losses recorded when it slid to a 100-day low during the crypto market crash on June 24, market data shows bull traders positioning for a positive start to July 2024.

BCH Ends June Strongly Amid Volatile Market Conditions

The global crypto markets experience extreme volatility in June 2024. After a positive start to the month, the overheated jobs data released in the US on June 7 effectively ended hopes of a Fed rate cut in H1 2024, as many risk asset investors had anticipated.

Unsurprisingly, from June 7, Bitcoin Cash (BCH) price was also caught in the crosshairs as the crypto market entered a 3-week tailspin that culminated in a major market crash on June 24. However, recent trends suggest that the June 24 crash may have marked the end of the bearish market phase, sparking hopes of another optimistic start to July 2024 for BCH and other crypto assets.

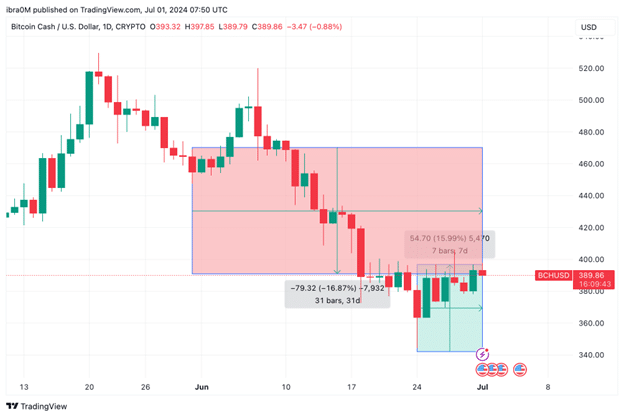

Looking at the BCH price action chart above, the red patch shows how BCH’s price had declined from an open price of $454.75 on June 1 to close the month around the $390 level, booking 17% monthly losses in the process.

On paper a double-digits loss performance seems a hard read, however, zooming the data shows that Bitcoin cash has registered some significant upside since the bearish market phase bottomed out June 24.

As seen below, Bitcoin cash price had slid to $344 during the market crash on June 24, its lowest in over 100-days dating back to March 2, 2024. But since then bull traders and strategic new entrants have swung into action to turn the tide.

In the final week of June, BCH’s price gained 16% as it surged from $344 on June 24 to reclaim the $390 level at the time of writing on July 1.

However, recent trends observed in the Bitcoin Cash derivatives markets suggests that traders are currently positioning for more gains to follow in July 2024.

BCH Bulls Seize Control With 7 Million LONG Positions

Bitcoin Cash price has reclaimed the $390 level at the time of publication on July 1, up 16% within the weekly-time frame. But after double-digit losses in June, more traders are mounting LONG positions on BCH in hopes that the bottom is in for the crypto markets, and that many traders in the stocks markets could reinvest some of their lofty profits in the second half of July into the crypto sector.

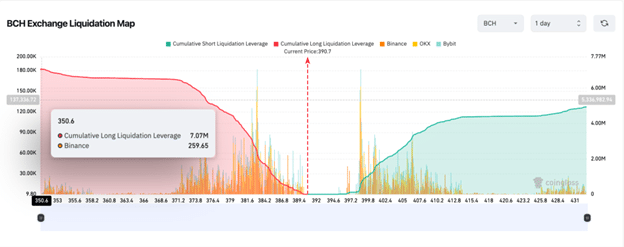

In a clear indication of this, Coinglass’ Liquidations map data, which tracks the total value of active LONG/SHORT contracts listed for cryptocurrencies, shows that bulls are now in the driver’s seat in the BCH markets.

Looking at the chart above, Bitcoin Cash’s active LONG positions have exceeded the $7 million mark as of July 1. Meanwhile, in comparison, the total value of SHORT contracts is still below $5.4 million.

Essentially, this shows that the total value of bullish positions has exceeded the active leveraged short positions by more than $1.6 million. This alignment effectively means that traders are growing increasingly confident in the prospects that BCH price will continue on its current upward trajectory as July 2024 unfolds.

If the bulls continue to support their bullish derivatives LONG contracts, with rapid purchases in the spot markets, there’s a chance that Bitcoin Cash price could reclaim the coveted $400 territory in the days ahead.

BCH Price Forecast: Bull Must Reclaim $400 Territory to Stage July Breakout

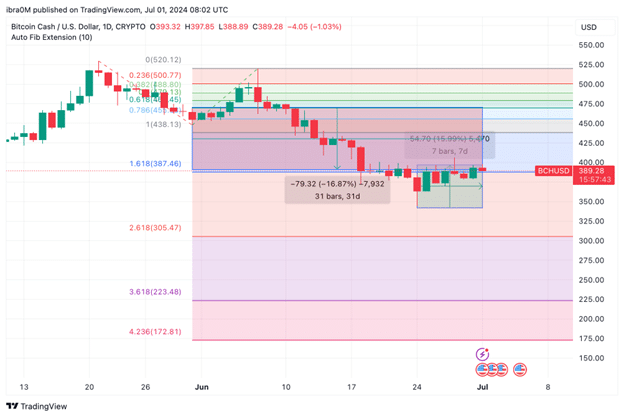

Bitcoin Cash’s price bounced back above $390, having maintained its upward trajectory in the last 7 days of June. More so, the $1.6 million excess LONG positions over SHORTs suggest that the majority of traders are anticipating more upside in July, which could possibly propel BCH price into a parabolic breakout towards the $450 area.

But first, technical indicators suggest the bulls must first scale the psychological resistance looming at the $400 level.

As depicted in the chart, the $400 level aligns closely with the 0.786 Fibonacci retracement level, making it a critical barrier for the bulls to overcome. Once above $400, the next target would be $438.13, followed by $460.45 at the 0.618 Fibonacci retracement level.

Clearing these resistance levels could open the path toward $450 and higher, potentially reaching the $500 area if bullish momentum persists.

However, in the event of further downside, the immediate support for BCH lies at $387.46, marked by the 1.618 Fibonacci extension level.

This level has been tested recently and has held firm, indicating strong buying interest. If BCH dips below this support, the next level to watch would be $305.47 at the 2.618 Fibonacci extension. This level represents a significant support zone that could prevent further declines.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.