Render Token (RNDR) price grazed the $6.50 mark on Monday, July 15, having mirrored the global crypto market uptrend to deliver 13% gains over the weekend; however, on-chain data shows that retail traders are not convinced of further upside.

RNDR Rally Stalls at $6 Resistance

RNDR, the native token of computing power (GPU) rendering protocol, Render Network, has faced intense market volatility over the past month. After mild-rally in June triggered by bullish headwinds from AI giant NVIDIA’s record-breaking stock market performance, major crypto AI tokens like RNDR have been on a downward trajectory.

However, following bullish macroeconomic indices releases by US authorities over the past week, RNDR price has received a significant boost over the last 72 hours of trading.

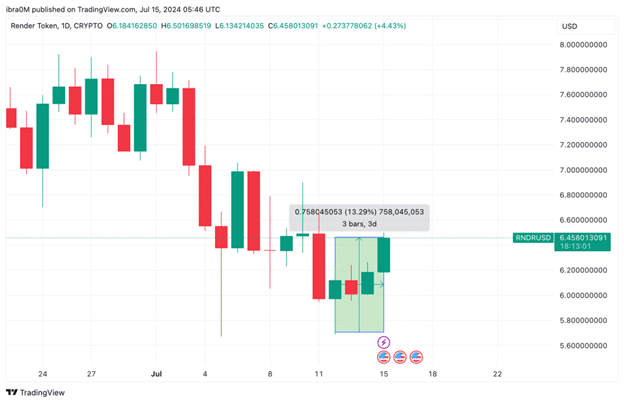

RNDR’s price fell as low as $5.68 amid intense market volatility on July 12. But following the dovish US Consumer Price Index (CPI) data published on Friday, it sparked higher demand across risk assets markets, including the crypto AI tokens sector.

As illustrated above, the Render token price has now increased 13% from the lows recorded on Friday to reclaim the $6.48 level at the time of writing on Monday, July 15. While the short-term price performance has been positive, on-chain metrics suggest that bears could make audacious attempts to trigger a pull-back as the week unfolds.

Short-Term Traders Move to Sell-off RNDR Tokens Worth $42M

However, despite scoring double-digit gains over the weekend, a crucial on-chain data trend suggests that the majority of RNDR short-term traders remain unconvinced of a prolonged price breakout.

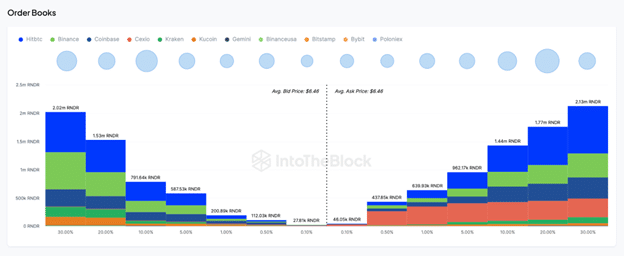

IntoTheBlock’s Exchange Order Books data tracks the number of buy-sell limit orders placed for a specific asset across recognized crypto trading platforms. This provides insights into the present dominant sentiment among traders while also hinting at the direction of potential price swings for the coming days.

The “Ask” side on the right of the chart above illustrates that existing investors have put 6.5 million RNDR tokens up for sale at an average price of $6.48. Meanwhile, the “Bid” side on the left shows buyers have only placed orders to purchase 5.3 million RNDR tokens at the current prices.

With a market oversupply of about 1.2 million RNDR tokens worth approximately $42 million, strategic traders can anticipate some downward volatility in Render token price swings at the start of the week. Unless RNDR can attract fresh demand, sellers may have lower prices marginally to get their orders filled quickly.

RNDR Token Price Forecast: $6.0 Support at Risk

The RNDR token is currently trading at approximately $6.43, showing a modest increase of 3.94% over the past 24 hours. Despite this short-term bullish momentum, the technical indicators suggest potential challenges ahead that could put the $6.0 support level at risk.

The Relative Strength Index (RSI) is currently at 42.19, which is below the neutral 50 level and indicates that the token is still in bearish territory. This suggests that the selling pressure has not yet fully subsided, and there might be further downside risk.

The key support level to watch is $6.0, as indicated by the price action over the past few days. A breach below this level could trigger further selling pressure, potentially driving the price down to the next significant support around the $5.50 mark. Conversely, if RNDR manages to hold above $6.0 and build upward momentum, it could provide a foundation for a bullish reversal in the coming weeks.

The Fibonacci retracement levels on the chart provide critical insights into the potential resistance and support zones. The immediate resistance lies around the 0.618 Fibonacci level at $7.30. Breaking above this level could pave the way for RNDR to test higher resistance levels around $8.0 and beyond. However, failure to break through could cause RNDR to retreat to test the lower support levels.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.