While Solana (SOL) has been experiencing a significant bull run over the past few days, recent activities from whales indicate a potential price crash may be imminent.

In the last 24 hours, a Solana whale unstaked 100,000 SOL tokens and transferred the funds to Binance, one of the most liquid crypto exchanges. At the time of the withdrawal, the tokens were valued at approximately $14.9 million.

This latest move to liquidate a substantial portion of the whale’s Solana portfolio follows a transaction three days ago when the same investor unstaked 100,000 SOL tokens and moved the assets to Binance. The timing of these transactions is particularly noteworthy.

Withdrawing Solana Amid 21% Gain

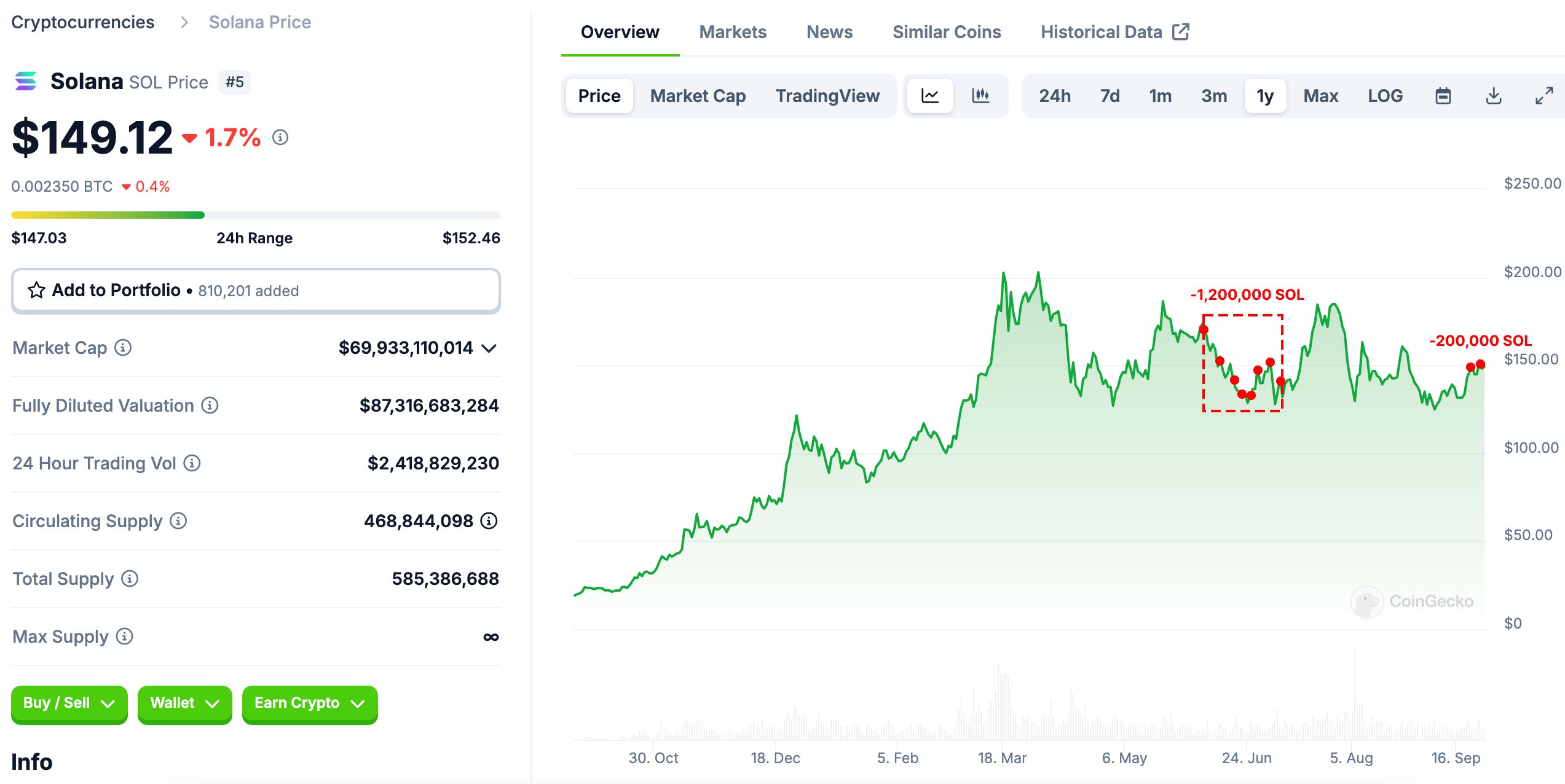

Just last week, on September 18, Solana was valued at $127.25 per token. However, this week, the price has appreciated significantly to $153.55, marking a gain of 20.66% within a week.

Essentially, this investor has moved to liquidate 200,000 SOL tokens worth approximately $30 million this week to capitalize on the recent bull run.

This isn’t the first time this investor has executed such a strategy. Market watcher Lookonchain, which drew attention to the whale’s recent moves, highlighted previous instances where this whale contributed to a 24% crash in Solana’s price.

Previous 1.2M SOL Dump Causing 24% Price Collapse

Specifically, the analysis revealed that between June 7 and July 7, the prominent investor dumped a staggering 1,200,000 SOL tokens through eight rounds of sales. On June 7, SOL was trading as high as $172. The whale’s initial sale of 100,000 SOL contributed to the price dropping to $157 the following day.

The sales continued, and by June 24, after additional sales, Solana’s market value had plummeted to $123.

Although the price appreciated again in the following weeks, reaching $154, the whale sold more SOL tokens. Upon completing this round of sales on July 7, SOL had tanked to $128 by the next day.

This highlights how the whale contributed to significant short-term losses for more steadfast Solana holders. Notably, the 1.2 million SOL tokens cashed out during the 30-day period amounted to $178 million.

With the investor resuming a similar dumping strategy this week, as Solana’s bull run gains momentum, it suggests that the bullish trend may encounter resistance in the coming days if the whale’s liquidation continues.

FTX Selling Pressure

In addition to this particular investor, Solana is facing significant selling pressure from the FTX bankruptcy estate.

Two weeks ago, the estate unstaked $1 billion worth of Solana and transferred it all out. The bankruptcy firm still has an equivalent amount available for sale.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.