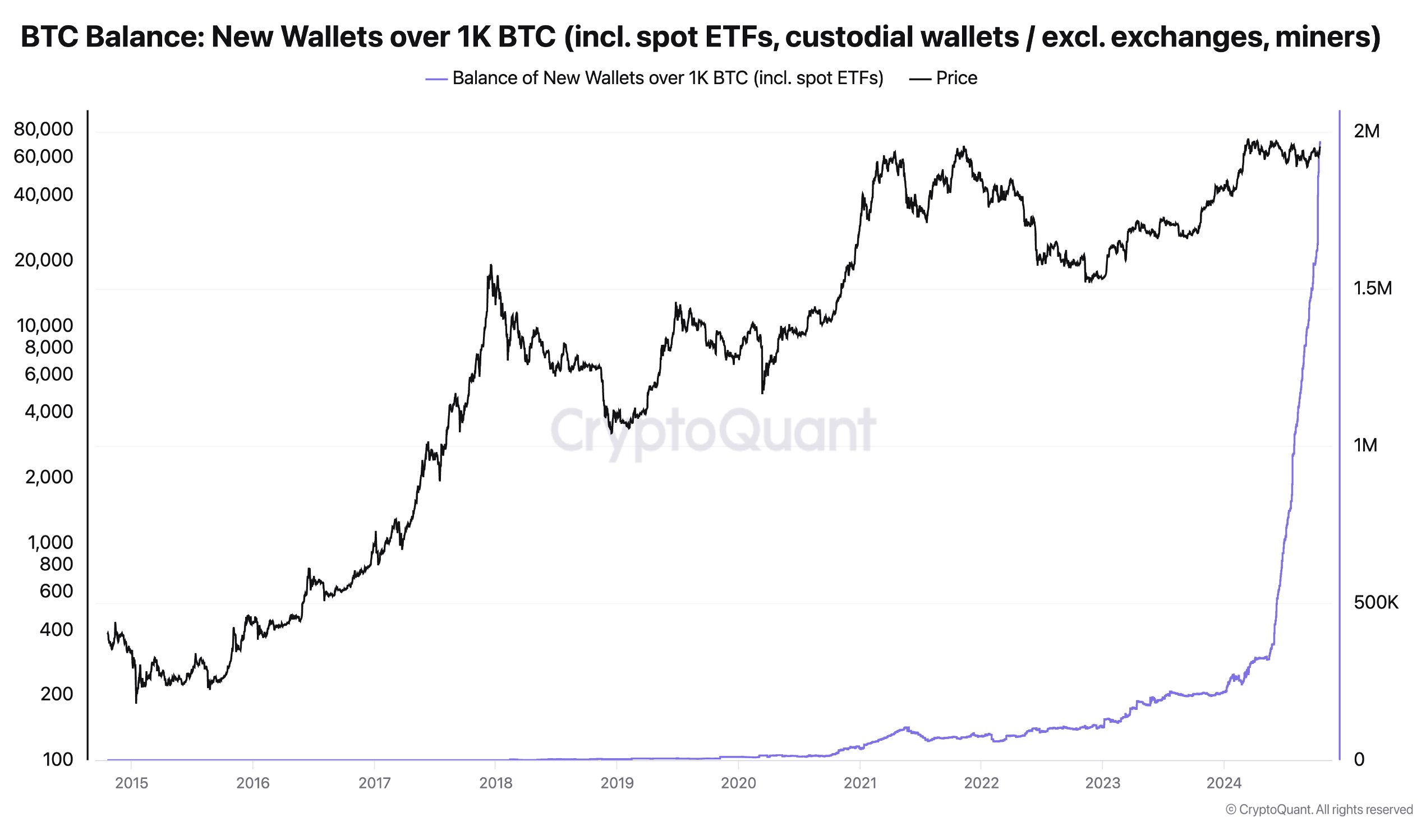

New Bitcoin whale wallets have surged this year, signaling heightened interest in the asset class and maturation of the BTC sphere.

Recent data from CryptoQuant reveals an exponential increase in the balances of new Bitcoin whales. Specifically, the report states that these entities now hold 1.97 million BTC tokens valued at $132 billion. These wallets contain over 1,000 Bitcoin each, with an average coin age of under 155 days.

With the current figures, their BTC balance has surged by 813% year-to-date (YTD), making up 9.3% of Bitcoin’s total supply. Notably, the metric excludes exchange and miner wallets, indicating that investors are likely individuals using self-custodial services.

Ki Young Ju, CEO of CryptoQuant, shared these insights via a post on X. He expressed initial skepticism due to the sheer scale of the numbers. He likened the situation to institutional investors acquiring an additional 8.2% stake in a firm named “Bitcoin” within a year.

Atmosphere Becoming More Mature

Young Ju ultimately noted that Bitcoin is no longer seen as a gambling tool amid the increased accumulation, highlighting the growing maturity of the market atmosphere.

The rise of these wallets has sparked questions within the crypto community. Some users questioned if monitoring these addresses for signs of selling could indicate market tops. In response, Young Ju explained that whale accumulation is more useful for identifying market bottoms rather than tops. In parallel, he suggested that retail investor activity, which highlights overheated markets, is a better indicator for predicting peaks.

Furthermore, another commenter raised the possibility that older whales could be transferring their assets to new addresses for security purposes. Young Ju clarified that while such transfers could happen during wallet upgrades, the transaction input data from 2024 did not show significant changes to support this theory. This reinforced the belief that the surge is due to institutional entries.

Bitcoin Market Profitability

As new whale activity rises, data from blockchain analytics firm IntoTheBlock shows that 95% of Bitcoin addresses are now in profit, suggesting strong bullish momentum. This level of profitability has historically been a precursor to price breakouts, though it could also indicate that the market is becoming overheated.

With 95% of Bitcoin addresses now in profit, market sentiment is booming. Historically, such levels have signaled strong bullish momentum but can also indicate a potential overextension.

Will we see a breakout, or is it a sign that the market is overheating? pic.twitter.com/8q1i9r4tJ8

— IntoTheBlock (@intotheblock) October 17, 2024

IntoTheBlock’s data also revealed that 3% of holders are currently breaking even, while only 2% are experiencing losses as the price remains above their purchase point. The firm questioned whether the market’s current state would lead to further gains or signal a potential overextension.

Historical Patterns and Future Projections

Additionally, amid the whale activity, an analyst has been looking at historical price patterns to forecast future movements. Crypto trader and market analyst Mags recently shared an analysis suggesting that Bitcoin’s price could surpass the $200,000 mark if past trends related to the Relative Strength Index (RSI) and Bitcoin halvings repeat.

Bitcoin’s price reached its all-time high of $69,000 after the 2020 halving but corrected significantly in 2022, dropping to around $15,000. Following the April 2024 halving, the price has steadily recovered, though it has experienced consolidation in recent months.

Mags noted that Bitcoin typically reaches its cycle peak when the RSI surpasses 90, indicating overbought conditions. During past cycles, this has coincided with price surges following halving events. Currently, Bitcoin’s RSI remains in the mid-60s, suggesting that the market has not yet reached its peak for this cycle.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.