This week could mark a pivotal moment for Bitcoin and the altcoin market, with analysts suggesting a strong possibility of new all-time highs.

This bullish hope comes amid heightened market volatility tied to the U.S. presidential election and the upcoming Federal Reserve interest rate decision.

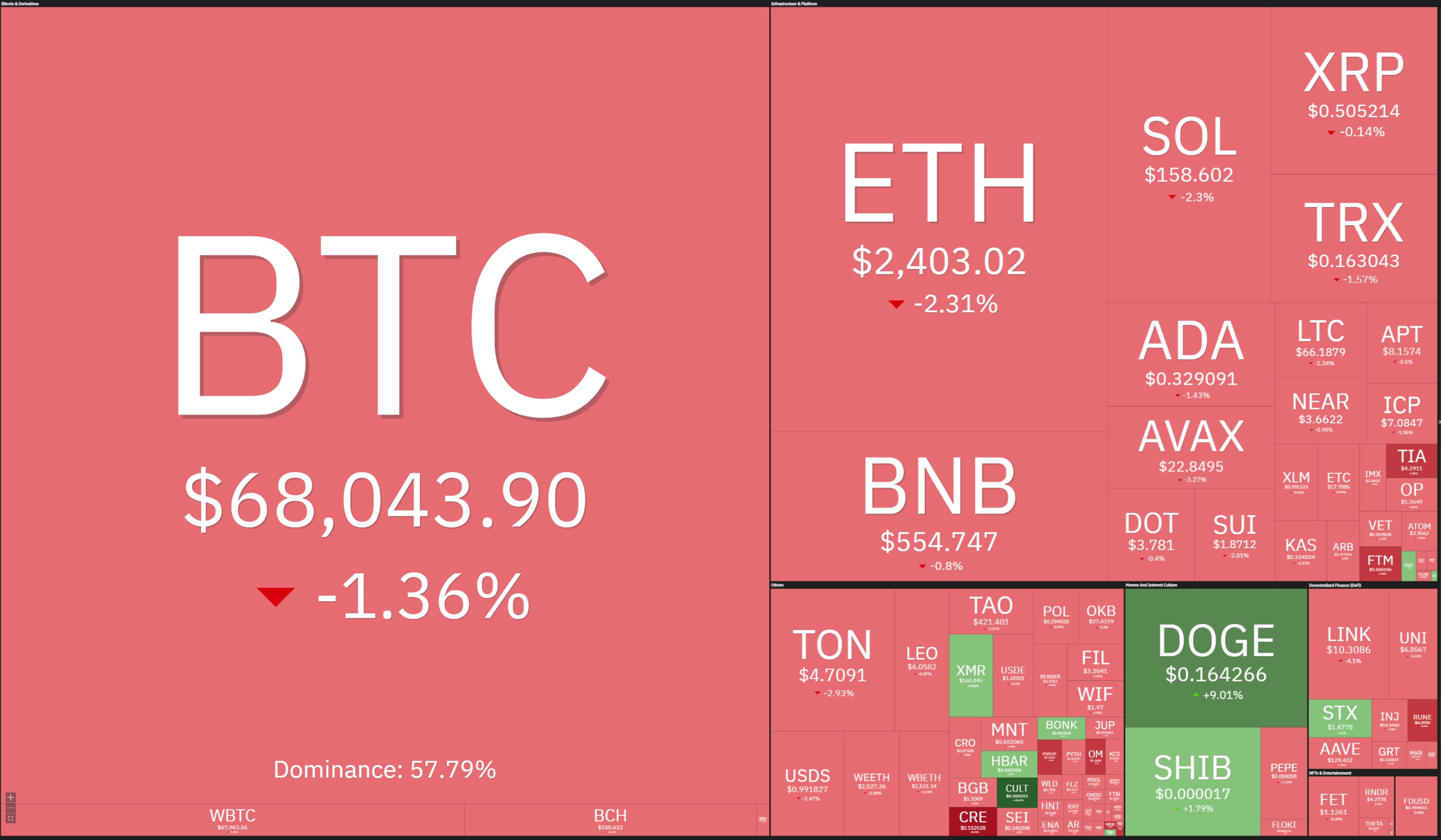

At the time of writing, Bitcoin is trading at $68,649, recovering from last night’s massive drop to $66K.

Bullish Sentiment: Bitcoin’s Path After the Election

Market commentators are split on Bitcoin’s trajectory post-election, but overall sentiment remains largely bullish. Analysts are hopeful that the current volatility could mark the beginning of a sustained upward trend for Bitcoin.

In a post on X, analytics resource Spot On Chain noted that this week’s market conditions are some of the most volatile of the year, driven by the election and the upcoming Federal Open Market Committee (FOMC) meeting.

Despite this uncertainty, Spot On Chain suggested that Bitcoin’s long-term bull rally could be just beginning. It highlighted that historically, major bull runs tend to gain momentum after the U.S. elections.

The firm believes that Bitcoin will likely maintain its upward trajectory regardless of whether Donald Trump or Kamala Harris wins the presidency. Remarkably, Spot On Chain predicted that Bitcoin could hit $100,000 by the end of the year.

Another well-known analyst, Daan Crypto, also anticipates significant price movement for Bitcoin. He forecasted at least a 10% swing in either direction, depending on the election outcome. While Daan noted that this week’s Bitcoin chart does not display an ideal weekly candle, he believes the election will be a key catalyst for price action.

Bearish Concerns: A Potential Post-Election Sell-Off?

However, not all traders expect a smooth path for Bitcoin in the short term. QCP Capital, a trading firm, warned its Telegram subscribers of a potential sell-off after the election. The firm compared the likely outcome to the “sell-the-news” response that followed the Nashville Bitcoin Conference.

QCP noted that market betting odds have shifted, with Trump currently favored to win the presidency, although his chances have decreased slightly over the weekend.

Notably, the odds are 57% for Trump versus 43% for Harris. Nonetheless, the firm believes that no matter the election outcome, a “sell-the-news” reaction could trigger a price pullback in Bitcoin.

The Federal Reserve’s Rate Decision

Adding to this week’s volatility, the Federal Reserve’s upcoming interest rate decision on November 7 has attracted significant attention.

The Fed faces a challenging environment, balancing inflation concerns with recently weaker job data. Currently, markets expect a 0.25% rate cut, which, if implemented, could support risk assets like Bitcoin.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.