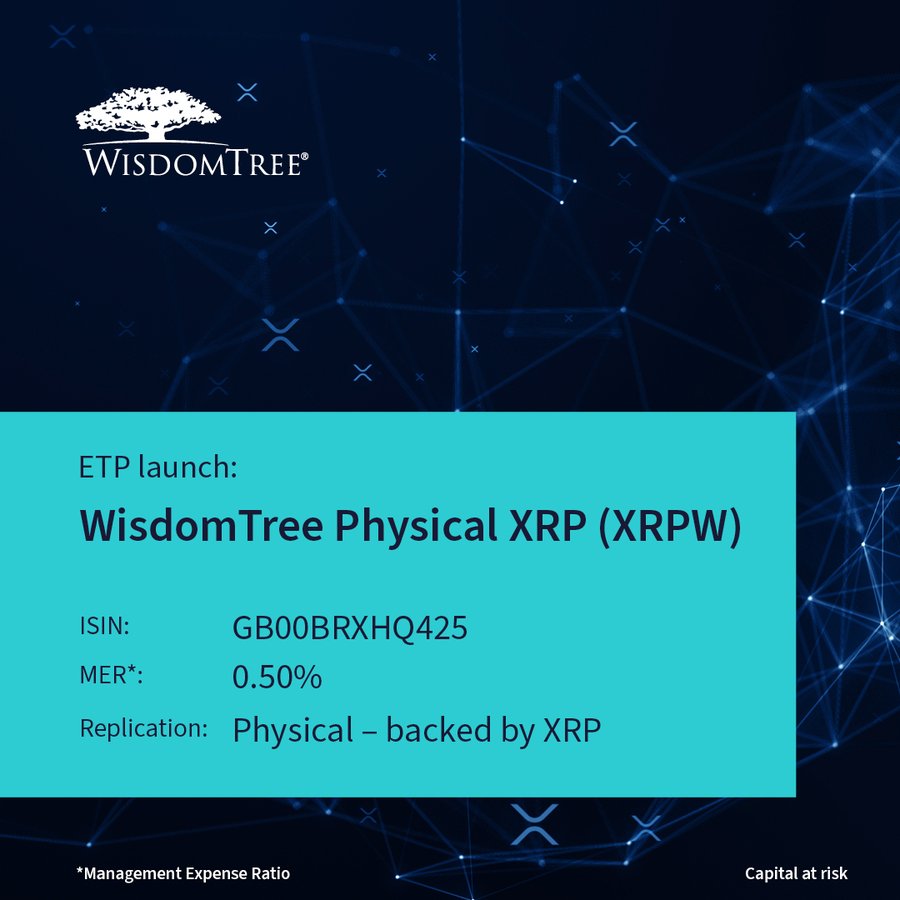

Leading digital asset manager WisdomTree launches a new exchange-traded product (ETP) for XRP across three major European exchanges.

Dubbed the Wisdomtree Physical XRP (XRPW), the product provides investors with secure and physically-backed exposure to the sixth-biggest cryptocurrency by market cap.

The asset management firm launched the product across three European exchanges, including Six Swiss Exchange, Euronext, and Deutsche Börse Xetra. Notably, the XRP ETP is fully backed by the XRPL native token and boasts a management expense ratio of 0.5%.

According to an announcement, the XRP tokens backing the ETP are stored using a dual custody model featuring regulated custodians and cold storage.

WisdomTree Crypto Offerings

The company claimed that XRPW has the most competitive price offering for XRP exposure in Europe. With its launch, XRPW joins a portfolio of nine crypto ETPs WisdomTree offers. Some of the company’s crypto ETPs are tied to assets like Ethereum, Bitcoin, and Solana.

WisdomTree’s crypto ETPs are available in multiple European nations, including Poland, Spain, France, Ireland, Belgium, and Denmark. This large-scale availability increases the likelihood of XRPW launching on more European-based exchanges.

Growing Institutional Interest in XRP

The recent development highlights the growing institutional interest in investment products tied to XRP. Several asset managers have recently shown interest in XRP.

Interestingly, this trend has been observed in the United States, where XRP is embroiled in a lawsuit between the SEC and Ripple. Since last month, at least four asset managers have applied to launch investment products for XRP in the U.S.

In particular, Bitwise submitted two applications, seeking to convert its multi-asset crypto fund containing XRP to an ETP and to launch an ETF exclusively linked to XRP.

Grayscale made a similar move by applying to convert its XRP-related Digital Large Cap Fund (GDLC) to an ETF. This application comes after Grayscale re-introduced the XRP Trust, offering accredited investors direct exposure to XRP. Furthermore, Canary Capital and 21Shares submitted separate filings for XRP ETFs.

Despite the fact that the Ripple lawsuit has moved to appeal, most fund managers, particularly Bitwise, are convinced the SEC will approve their applications.

Also, Gary Gensler’s plans to resign as SEC chairman and the potential appointment of a pro-crypto chairperson further increase the odds for an XRP ETF launch.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.