Jan van Eck, CEO of VanEck, has outlined a bold and forward-looking perspective on the Bitcoin and precious metals markets heading into 2025.

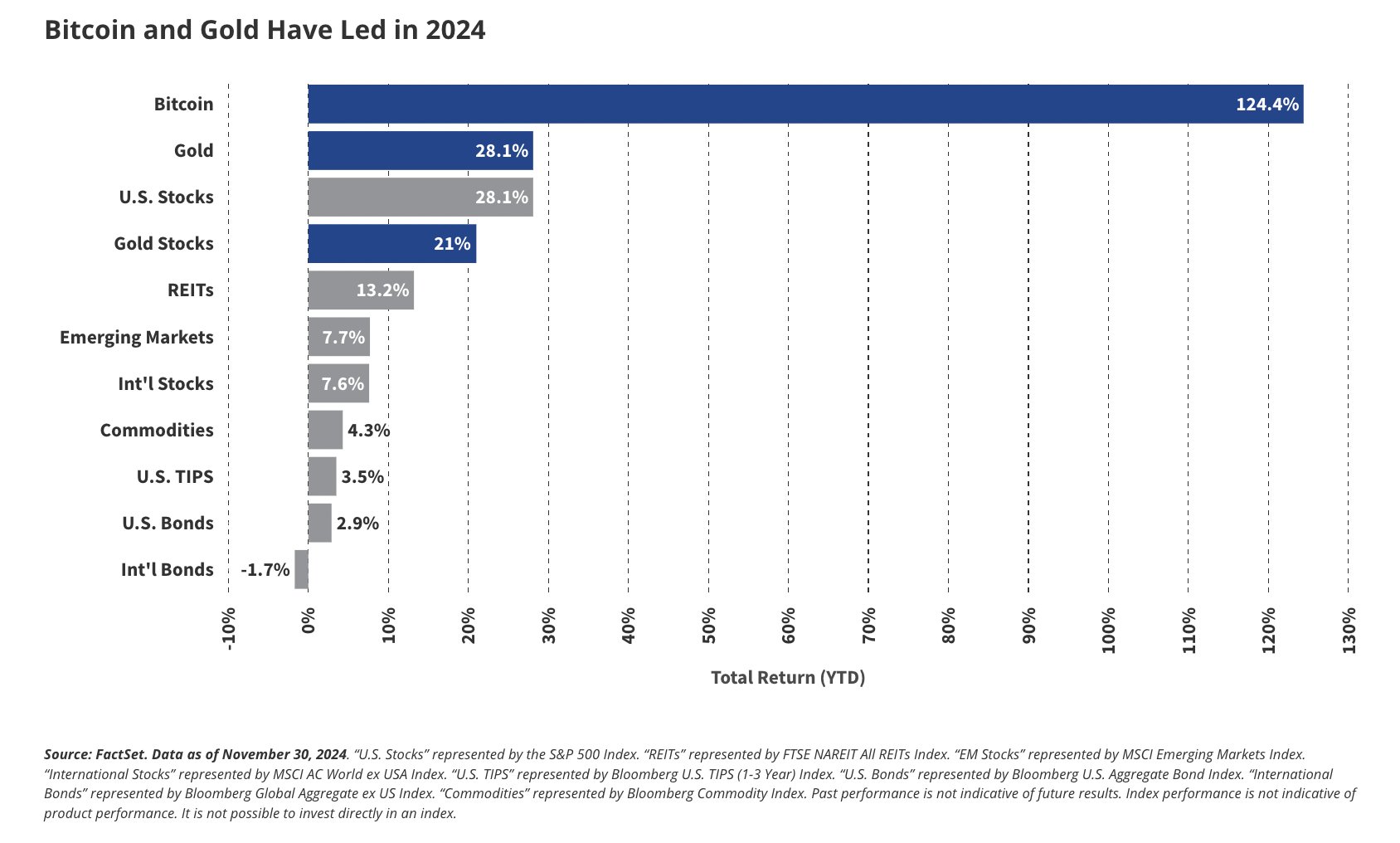

In a recent statement, the CEO highlighted that Bitcoin emerged as the undisputed leader in the 2024 financial market by delivering a staggering 124.4% year-to-date (YTD) return. This figure far outpaces traditional assets like gold and U.S. stocks, which both posted gains of 28.1%.

Meanwhile, Jan van Eck predicts even brighter days ahead for Bitcoin in 2025. He projected the cryptocurrency could climb to $150,000–$170,000.

Bitcoin and Gold Lead the Pack

A performance chart places Bitcoin at the forefront of the market in 2024. Gold followed at a distant 28.1%, buoyed by global central bank purchases and increasing de-dollarization trends.

U.S. stocks kept pace with gold, while gold mining stocks trailed at 21%, and REITs posted 13.2%. Traditional assets like commodities, bonds, and international equities struggled, with most returns below 10%.

Persistent Inflation and Fiscal Reckoning

In his statement, Van Eck stressed that the U.S. economy is at a critical juncture, marked by persistent inflation and unsustainable fiscal spending.

The Federal Reserve’s “higher for longer” interest rate policy reflects the ongoing economic challenges, with inflation, particularly in services and wages, proving more stubborn than initially anticipated.

While van Eck expects some short-term rate cuts, he warns that any sharp easing is unlikely unless the economy faces a severe contraction.

Van Eck’s base case scenario includes a reduction of $500 billion in U.S. government spending by the incoming administration. However, he cautions that these cuts may not be enough to eliminate the deficit.

Inflation risks could increase without further action, leading to higher long-term interest rates and potential market volatility. As a result, Van Eck advises caution in U.S. equities, particularly large-cap stocks, which remain highly valued.

Bitcoin and Gold: Inflation Hedges for the Future

As inflation continues to impact markets, Van Eck highlighted the growing significance of Bitcoin and gold as robust hedges against fiscal uncertainty.

Gold has benefitted from rising global demand, especially due to foreign central bank purchases. On the other hand, Bitcoin is benefiting from its halving event and its role as a decentralized store of value, with its appeal growing as investors seek alternatives to traditional financial systems.

For 2025, Van Eck’s investment strategy recommends reducing exposure to U.S. stocks and diversifying into inflation-hedging assets like Bitcoin and gold. He also advises considering alternatives such as short-duration fixed income and international equities to achieve a more balanced portfolio.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.